The NASDAQ 100 has been all over the place during trading on Tuesday, but the one thing that it continues to show is that people are willing to jump in and take advantage of value. After all, the market seems to rally every time it sells off, as there is so much demand for US assets. Quite frankly, the rest the world is struggling so it makes sense that money continues to flow towards American companies. After all, the US economy doing better than the rest of the world means that there should continue to be better returns from those assets.

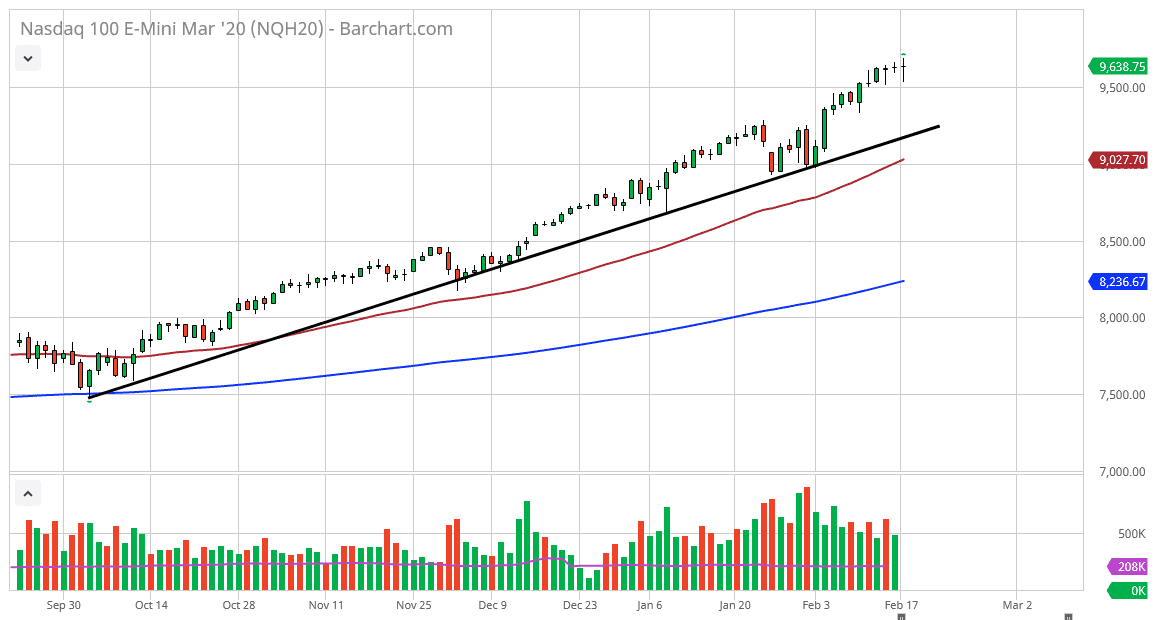

The 9500 level is an area that seems to be offering support, especially as you can see the NASDAQ 100 E-mini contract has seen buyers at that level over the last five trading sessions. Even if we break down below the 9500 level it’s very likely that the uptrend line underneath should continue to offer plenty of support as well. Furthermore, the 50 day EMA is just below. I do like the idea of buying this market based upon value as we have been in such an extreme uptrend for months. If the market was to break down below the 9000 handle, then I think the market probably goes looking towards 8500 level. However, that seems to be very unlikely to happen anytime soon. The 200 day EMA is starting to get close to that area, so if we were to break down below that level it would essentially and the trend. Currently, it appears that the market will continue to find plenty of value hunters, and therefore I like buying dips. I have no interest in shorting anytime soon and it’s likely that eventually the coronavirus impact will start to abate. If it does, then the markets will continue to rally based upon that as well.

Keep in mind that the NASDAQ 100 is highly sensitive to cross Pacific transactions, as most technological companies on that index do work in both the United States and China. With that, it’s very likely that we will continue to see this market act positively to any signs of hope coming out of the pandemic. With the Federal Reserve looking to pick up the stock markets every time they fall, it makes sense that the NASDAQ 100 will rally right along with the S&P 500 over the longer term.