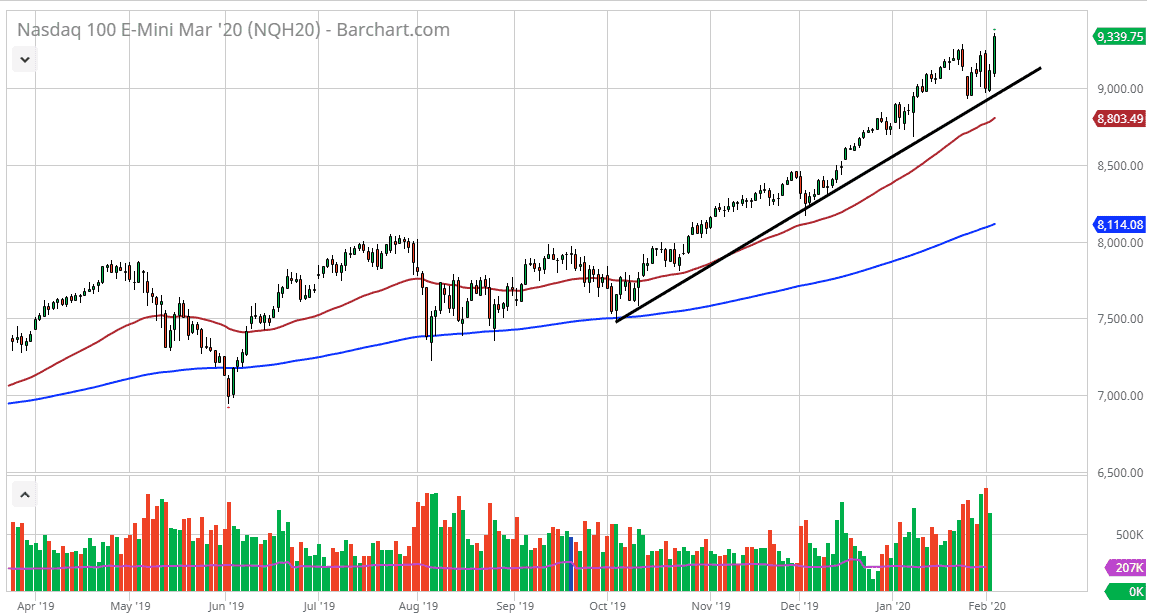

The NASDAQ 100 has exploded to the upside during the trading session on Tuesday, as we have made yet another all-time high. This clearly shows a major “risk on” element to the markets as the NASDAQ 100 has attracted a lot of so-called “hot money.” With that being the case, pullbacks at this point should be thought of as buying opportunities. I also have a trend line drawn on the chart that has been relatively reliable, as it has continued to push the market higher. The 50 day EMA is sitting just below there, so I think that also comes into play when looking for support.

Furthermore, the 9000 level should coincide nicely with the trendline so that would also be supportive as well. The People’s Bank of China has supported their equity markets with massive injections of liquidity, and it seems as if this may be one of the reasons why we are seeing risk appetite come back into the marketplace. Furthermore, there have been blowout earnings for some of the companies involved, mainly Tesla which has shot straight up in the air of the last couple of days, pushing this index quite a bit.

At this point, pullback should continue to offer plenty of buying opportunities so selling is all but an impossibility. In fact, right now I don’t have a scenario in which I am willing to sell unless there some type of absolute panic in the marketplace. Pullbacks, and they will of course come, should be thought of as value just waiting to be snapped up. I believe that the NASDAQ 100 will not only reach towards the 9500 level, but I have a target of closer to 10,000 by the end of the year. That being said, there are a lot of reasons to hope for some type of pullback, not the least of which is that markets can’t go in one direction forever. Looking for those pullbacks and waiting for signs of stability to start buying or even adding to a position will be the best way to trade this market going forward. With the Europeans, Americans, and now the Chinese all offering liquidity for the markets, it’s obvious that they are going to try to inflate the markets even further. Granted, I think this wall end in tears, but in the meantime it certainly looks as if it is bullish.