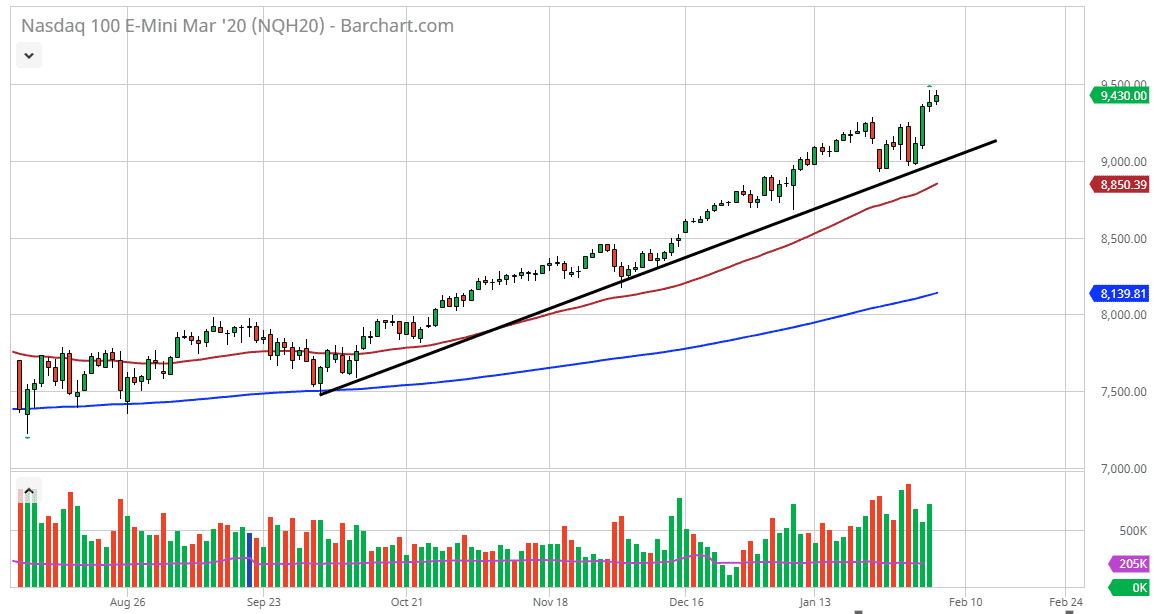

The NASDAQ 100 has rallied a bit during the trading session on Thursday, reaching towards the top of the shooting star from the previous session on Wednesday. If the market were to break above the top of the candlestick, it’s very likely that the market should continue to go much higher as 9500 of course is a psychologically significant figure. That being said, the market more than likely will find buyers underneath, and therefore I think it’s not until we break down through the uptrend line that you can get short of this market, and even then I would be concerned about the 50 day EMA underneath which is massive support as well. Longer-term, every time this market pulls back there have been buyers and I think that continues to be the case.

The NASDAQ 100 has led the way for the rest of the indices in the United States, so this of course bodes well for all of them. I believe that the jobs number should solidify the idea that the US is where you want to have your money, and therefore it’s all only a matter of time before dips are thought of as value that you can take advantage of. I think that the longer-term target is probably closer to 10,000, but that of course is a longer-term call, something that we will probably see later this year. That being said, breaking above the top of the shooting star from the previous session is a sign that significant resistance has been breached and the floodgates could open to the upside.

I think at this point it’s only a matter of time before the buyers return, not only due to the strength of the US economy itself, but the fact that the Federal Reserve will continue to loosen monetary policy going forward, and there is also the possibility that the coronavirus get some rain then, and that should also help the NASDAQ 100 as it is full of technological company to go back and forth between the United States and China. I have no interest in shorting this market anytime soon as it has been so reliably bullish.