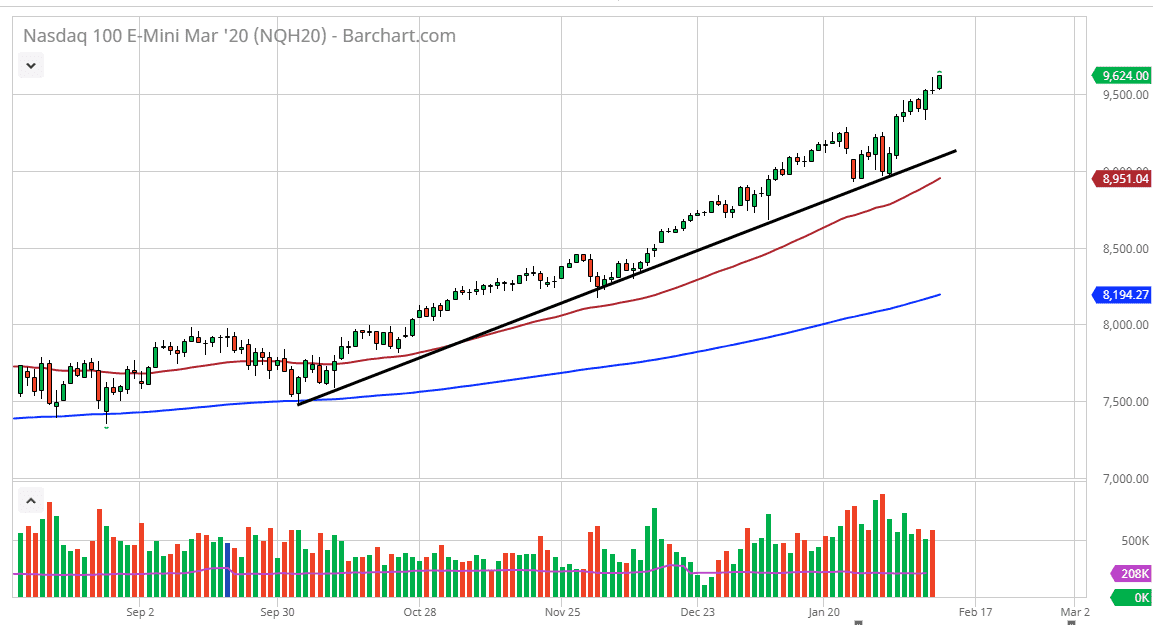

The NASDAQ 100 has broken above the top of a shooting star from the previous session, which is a very bullish sign. The 9500 level underneath continues offer plenty of support, so short-term pullbacks will initially be bought in that area, and then possibly at the 9400 level again. The NASDAQ 100 continues to lead the way overall, as it is full of tech companies that might be breathing a bit of a sigh of relief due to the fact that the reported new coronavirus infections are starting to slow down a bit. Having said that, not everybody believes that story but at the end of the day that’s what we have to work with.

Furthermore, the United States is the only place to put money to work for the most part, and with the Federal Reserve more than likely going to continue to loosen monetary policy in one direction or the other, stocks make quite a bit of sense. The bond yields are paltry, and foreigners buying the bonds in America continue to drive yields down anyway. In other words, money is jumping into the stock market as it’s the only way to get any type of return for most people.

If we do break down from here the uptrend line should continue to offer plenty of support, just as the 50 day EMA underneath should continue to offer support. I have no interest in shorting this market, and I look at every pullback as a potential buying opportunity to take advantage of “cheap” set ups. Looking at this futures market, it’s obvious that traders continue to see this as a market that should grow. The 10,000 level is my longer-term target, and at this rate we may get there much quicker than anticipated. Central banks around the world continue to liquefy the markets, and therefore it’s likely to continue to make stocks go higher. If China can get the virus outbreak under control, that helps this index in particular, considering that the large companies on this index do so much work between both countries. Follow the trend, but look for value as it should appear eventually.