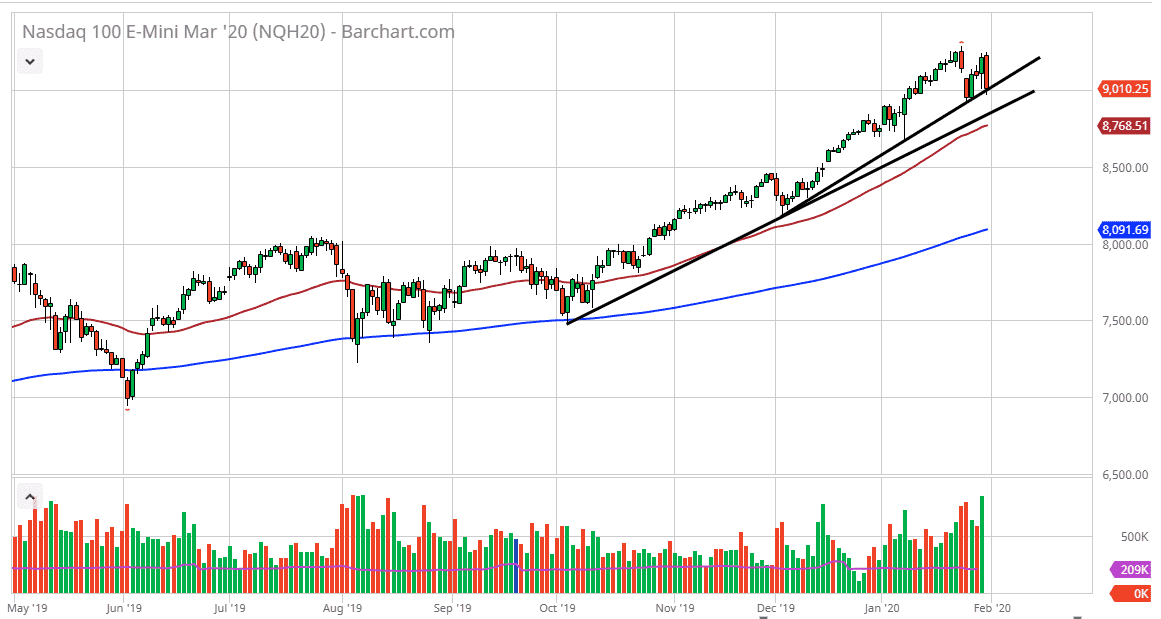

The NASDAQ 100 had a horrible session on Friday, wiping out the recovery from Thursday. However, it is doing a bit better than the S&P 500 as there are a couple of support levels just below that could come into play. In fact, I believe the NASDAQ 100 will probably be the leading indicator for the stock markets, as the NASDAQ 100 has been a bit of a leader anyways.

The inner uptrend line has held so far, and it should be noted that there is also another uptrend line underneath that is supported by the 50 day moving average. With that, I think it’s only a matter of time before the buyers come back, but in the short term I think the fact that we close that the very bottom of the range tells us that we are likely to see more negativity going forward, and perhaps a bit of panic selling as well. Remember, as long as the coronavirus continues to rip through China, it’s likely that technologically sensitive companies are going to continue to suffer. The NASDAQ 100 of course may have done a little bit better due to the fact that there are some tech companies out there that have reported greater earnings but at the end of the day it doesn’t include the reaction in China.

To the downside, if we break down below the 50 day EMA it opens up the door to the 8500 level, an area that would be rather important to pay attention to. To the upside, if we were to wipe out the negativity from Friday it could be a very bullish sign but at this point, I think it would take quite a bit to get through there. Breaking above that level is an opportunity to go towards the 9500 level, but it’s very unlikely to do so quite easily. I anticipate that the weekend news probably won’t be very good either, so we may get yet another catalyst going forward. All things being equal, it’s very likely that the stock markets still have further to pull back. By the time it’s all said and done it’s likely that the markets will offer value and an opportunity to buy based upon dips, but I will need to see a stable daily candlestick before I even attempt to do something like that. At this point, the buyers still run the market but in the short term it looks like the sellers are going to take over.