The NASDAQ 100 has rallied quite nicely during the trading session on Monday as traders came back to work but having said that it’s likely that we continue to struggle in general. The NASDAQ 100 of course is sensitive to the entire situation between the United States and China, so at this point it’s likely that the trade negotiations will course be an issue, but furthermore it’s likely that the coronavirus has a bigger influence on this market than anything else.

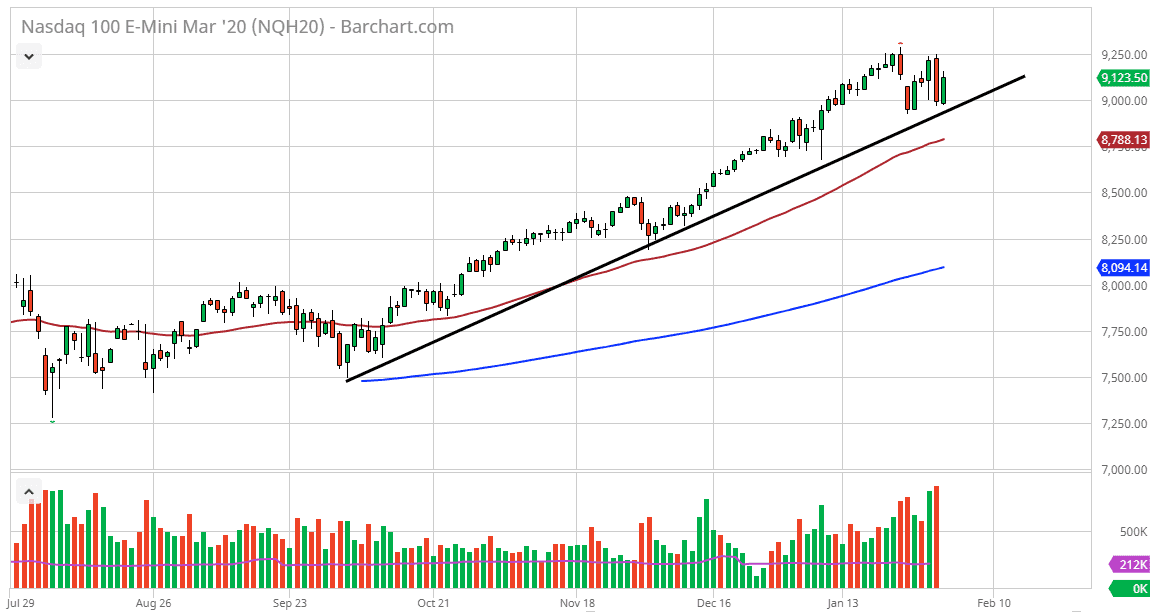

Underneath there is a significant trendline that should continue to keep this market somewhat lifted, but even if we break down below this trendline it’s likely that the 50 day EMA could come into play and offer support as well. Furthermore, the 8750 level is also an area where we could see buyers.

I don’t have any interest in trying to short this market, because even if we do pull back significantly it’s likely that there should be plenty of value hunters out there given enough time. Furthermore, the NASDAQ 100 does tend to lead the rest of the stock market and as a result the US indices may be following this market in general. I still believe that the NASDAQ 100 will eventually go looking towards 10,000, but we have a long way to go before we get there.

To the downside, if we were to break down below the 8750 level, then the market will go looking towards 8500 level. Quite frankly, any type of major sell off would be welcome right now, and I think that will only offer plenty of value the people are going to be taking advantage of. The NASDAQ 100 does tend to react quicker than most of the other stock markets though, so if it starts to rally and breakout above the recent highs at the 9250 level, then it should continue to bring the S&P 500 and Dow Jones Industrial Average right along with it. All things being equal, I think this is a “buy on the dips” type of market but I would like to see more value brought into play before getting involved. However, if we were to break above and make a fresh, new high, then you have to get long at that point. Ultimately, this is a market that can’t be sold, but it’s only a matter of time before you get the opportunity to buy it.