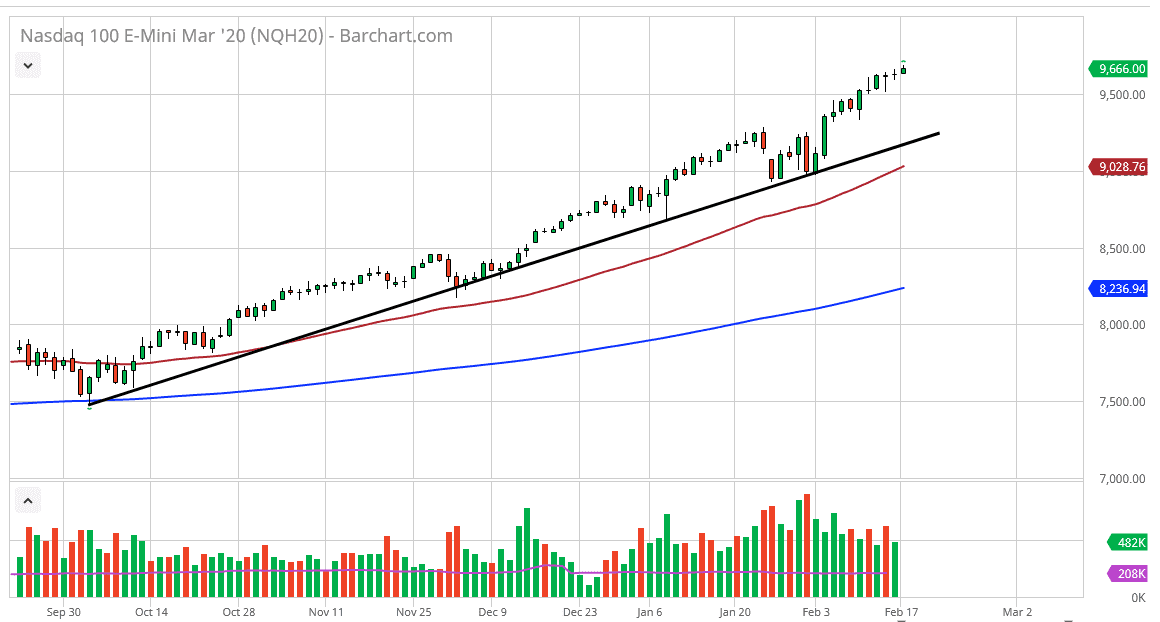

The NASDAQ 100 had a little bit of electronic trading in the E-mini futures market via the Globex sessions, but with Presidents’ Day being celebrated in the United States, the underlying index of course was closed. That being said, you can take a look at the overall chart and see just how the market has been bullish overall. I do believe that continues to be the case, but it is a bit difficult to jump in at this level, as the market has been a bit overbought for some time. Underneath, I believe that the 9500 level is the first area that people will be paying attention to.

Any bounce from the 9500 level will more than likely attract a lot of attention, and therefore it’s likely that we should see plenty of buyers attempting to get involved. However, even if we were to break down below the $9500 level it’s likely that then the uptrend line comes into play as well as the 50 day EMA, so it’s only a matter of time before traders look for value in that area.

To the upside, I believe that the market is going to go looking towards the 9750 level, and then eventually the 10,000 handle. With that being said, it’s very likely that it will be a bit of a fight to get there. Given enough time though I do think that will end up being the way forward.

With all that being the case I have no interest in shorting this market, at least not until we break down below the 50 day EMA and even then, I think it would still only be a medium-term pullback. The markets have been bullish due to the Federal Reserve offering plenty of liquidity, as well as many other central banks. Furthermore, traders are continuing to look at the United States as a bit of safe haven, as the economy in the United States is growing much faster than the rest of the world on the whole. The market is likely to continue seeing a lot of bullish pressure due to foreign inflows and of course all of that money looking for some type of return as interest rates around the world continue to be extraordinarily low. As money gets forced into the stock markets, the NASDAQ 100 will be any different than other indices, meaning that it will be going higher over the longer term