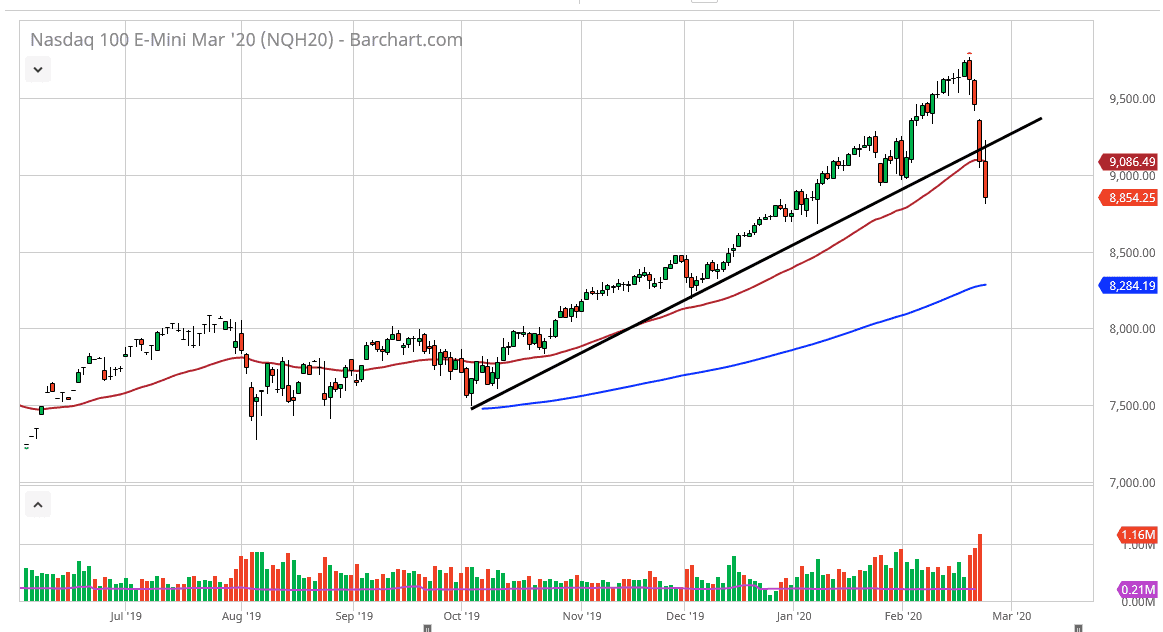

The NASDAQ 100 initially tried to rally during the trading session on Tuesday but then broke down significantly yet again in a repeat of what had happened on Monday. The market broke down below the 9000 handle, and therefore looks very likely that we will continue to see a lot of negativity as there’s not much to keep this market afloat in the short term. Having said that, if the market was to break down below the candlestick for the trading session on Tuesday, then the next area of interest will be closer to the 500 level.

Furthermore, the 200 day EMA underneath will offer support as well, and therefore I think eventually we will find buyers. What’s interesting is that the 8500 level is roughly the 50% Fibonacci retracement level, so that could attract a bit of value hunting as well. Markets have been ignoring the coronavirus in general, but at this point it appears that the markets have finally stood up and taken notice. The market participants will continue to look at this as an extraordinarily negative move, but I think it’s only a matter of time before stabilization comes. The market could continue to see selling in the short term, but I do think that the 200 day EMA is a crucial technical signal the people will be paying attention to. If we were to break down below that level, then the market would be extraordinarily negative, and we could break down drastically towards the 7000 level.

The NASDAQ 100 is especially sensitive to what’s going on, as the semiconductor companies in South Korea are suddenly finding themselves not being able to produce goods. If this continues, it’s very likely that the market will then break down drastically due to the fact that most of the companies on this index do business in both the North American region as well as Asia. At this point, market participants will need to be very cautious, and you don’t need to be the first one into the market but clearly a trend line has been broken so there could be a bit of panic to kick off the session, but don’t be surprised if we get some type of recovery during the day. We are now trading more or less on sentiment than anything else. Technical analysis only does so much in these types of situations.