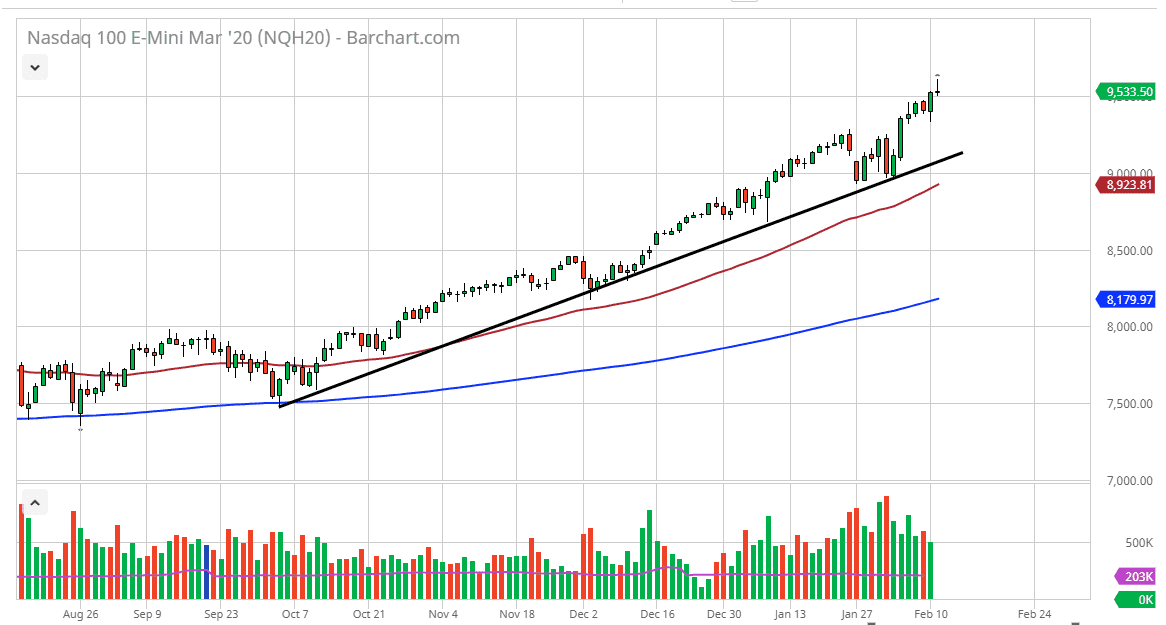

The NASDAQ 100 has initially tried to rally during the trading session on Tuesday, showing signs of exhaustion after initially rallying. The congressional testimony given by Jerome Powell seems to have worked against the value of stocks, but he didn’t say anything that was to poor, just that the market has not gotten the “quantitative easing forever” type of statement that Wall Street wants. At this point, it’s likely that pullbacks will be considered to be value, especially near the 9300 level if we do in fact pull back to that level. The 9500 level could also offer support, but at this point we are a bit overbought so don’t be surprised at all to see this market drop from here.

At this point, it’s likely that even if we break down through the 9300 level, we should find plenty of support at the previous uptrend line. On the other hand, the market was to break above the top of the shooting star during the session on Tuesday, this would show an acceleration of buying, so at this point it would show what would probably be a bit of an impulsive leg higher. I have no interest whatsoever in trying to short this market, it is far too strong and therefore I believe that when you see a market drop, it’s very likely that the value hunters will continue to come out. The 50 day EMA is starting to reach towards the uptrend line, so it’s not until we break down below both of those that I would consider shorting, and even then, I would probably have to think about it for a while. This is a market that is extraordinarily bullish, and as we continue to go through earnings season and perhaps seen China try to recover due to workers going back to work, the NASDAQ 100 should continue to lead the way over the longer term. The NASDAQ 100 tends to be a bit of a leader, and I think that will continue to be the case going forward.