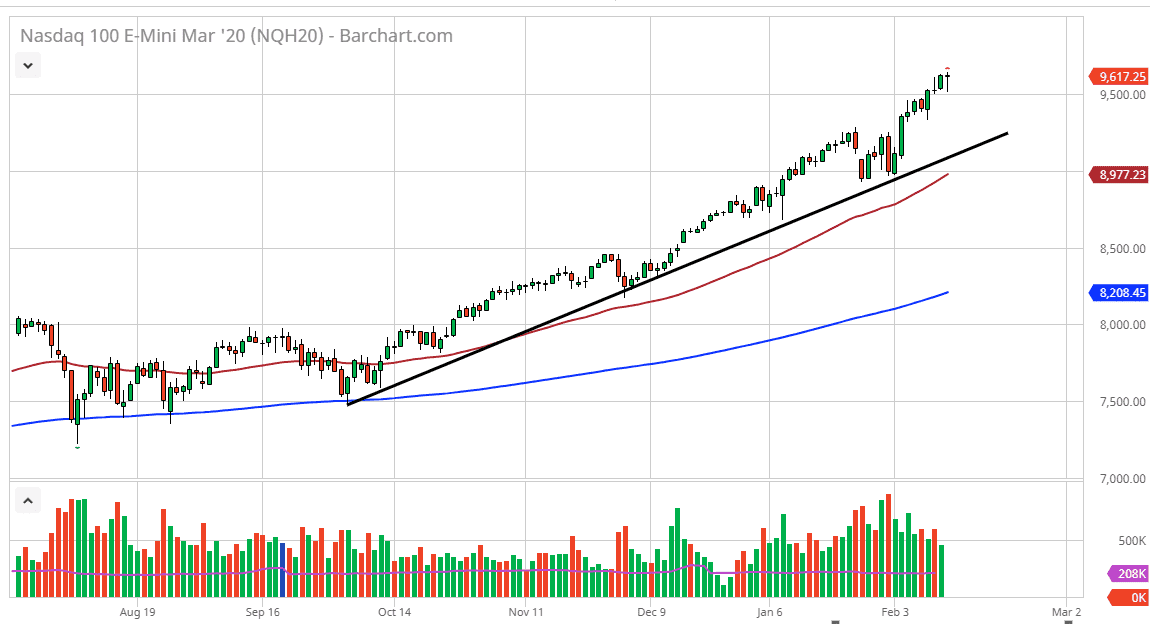

The NASDAQ 100 has initially fallen during the trading session on Thursday but then turned around to form a hammer like candlestick. That is an interesting candlestick as it is at the highs, because a breakdown below the bottom of it would open up the possibility of a “hanging man.” If that’s the case, then the market is likely to go much lower, perhaps reaching towards the 9400 level, and then the uptrend line. I don’t think we break down below there unless of course we get some type of massive “risk off” scenario in the United States on some type of Black Swan event.

Looking at this chart, if we were to break the top of the candlestick, it would be a very bullish sign as it would show an opportunity to go much higher and it would show that the 9500 level to be a potential floor going forward as well. A lot of money continues to flow into the NASDAQ 100 and as a result it continues to be one of the strongest performing index that I cover. That being the case, it makes quite a bit of sense that value hunters will continue to jump on these dips, and that’s why I think the so-called “hanging man” won’t be the case going forward.

To the upside, the obvious target would be 9750, and then of course the 10,000 level which is insane to say out loud. However, I thought perhaps we were looking at 10,000 over the next several months, but at this rate we could get a bit of a “blow off top” that allows the market to go reaching towards there. Money is flowing out of most other countries, and therein lies one of the major drivers, people are trying to find returns wherever they can as yields are almost nonexistent. If you are patient enough, you may get an opportunity to pick up a bit of value early next week, and there is the possibility of some short covering at the end of the day on Friday, so keep in mind that the market could pull back quite a bit. At this point, look for value on short-term charts and take advantage of it, it seems to be the way to go as anytime you have tried to sell the market you have lost money. Just as some of your Asian friends who have been sellers night after night.