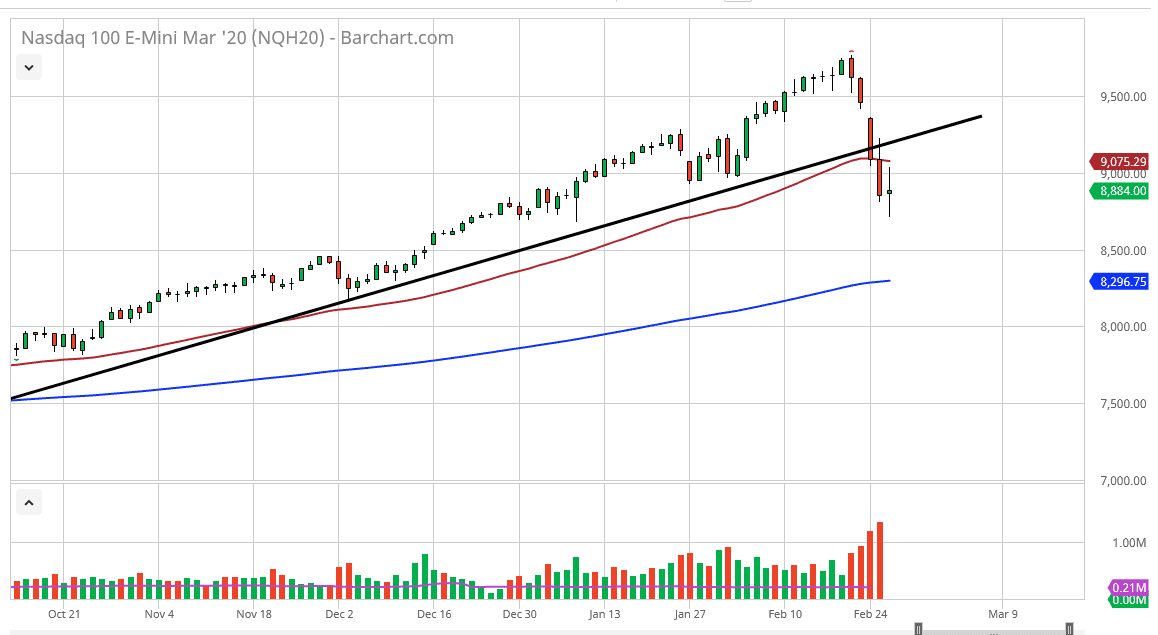

The NASDAQ 100 has been all over the place during a very volatile session on Wednesday, as the markets don’t really know what to do. At this point, the market has tried to break above the 50 day EMA but then rolled right back over, only to bounce again. The candlestick is showing a bit of a neutral shape now, and therefore if the market is getting ready to make a decision. The question now is whether or not we break down significantly, and that would be shown by the break of the bottom of the candlestick, or do we turn around and recover, which of course would be shown by a break above the top of the candlestick.

If we do get that break to the upside, the 50 day EMA offers a bit of resistance, just as the previous uptrend line does. If we can clear the previous uptrend line, then it’s likely that the market could go towards the gap from the beginning of the week. Granted, this is going to come down to sentiment of the day, as we continue to worry about coronavirus and its effect on the global supply chain. The NASDAQ 100 of course is especially sensitive to the situation as somebody technology companies do business in both Asia and the United States.

Underneath, the 200 day EMA is sitting at the 8300 level, which is an area that should attract a certain amount of attention, just as the 8500 level would on a breakdown. We have gotten a bit oversold, but it should be noted that we even tried to rally quite a bit during the trading session on Wednesday, but some random official from the FDA use the word “pandemic” and the machines went crazy. Because of this, waiting for a break above the neutral candlestick is probably the best thing you can do, because at least at that point you would have the market telling you which direction it wants to go. That being said, we are getting dangerously close to an area where the buyers need to come in and pick this up, otherwise we will see a pretty significant break down of this index. If the market were to break the 200 day EMA, that will have the machines going crazy to short this thing too much lower levels. That being said, waiting for a break of the candlestick is probably the easiest way to trade this.