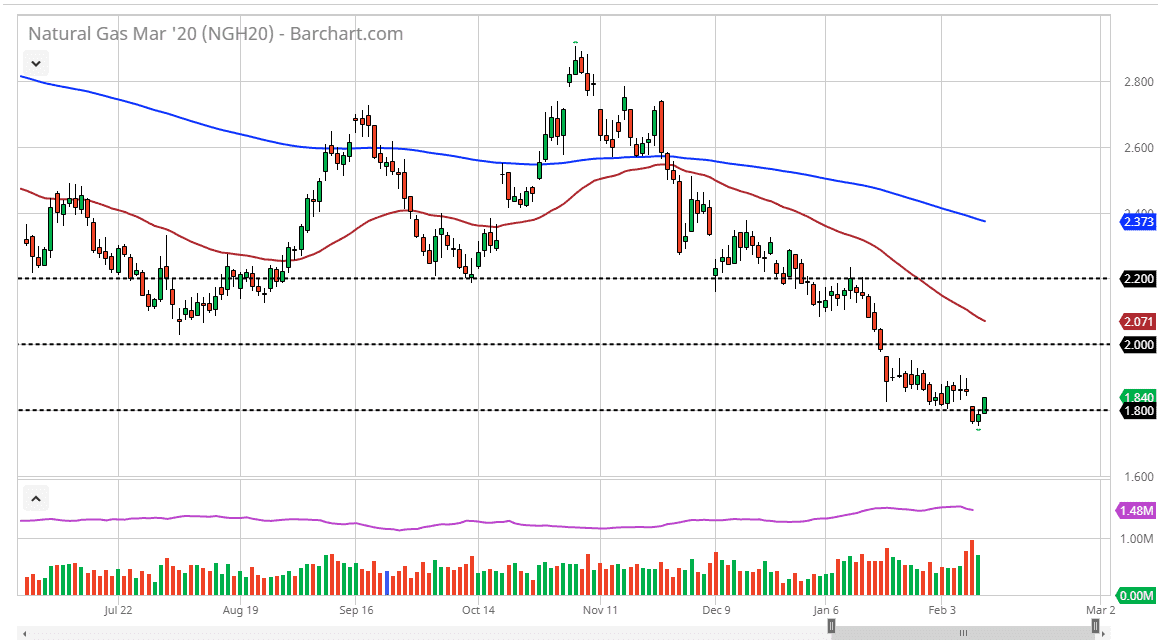

Natural Gas markets rallied significantly during the trading session on Wednesday, breaking well above the $1.80 level. However, there is the top of the gap that has yet to be filled at the $1.86 level and I believe it’s an area where we will find more selling pressure. Even if we break above there, the trend is most certainly to the downside so it’s almost impossible to imagine buying this market right now. At this point, if the market was to clear the $1.86 level, I would start looking at the $1.90 level as a place to start selling as well.

Even breaking above that level only opens up a selling opportunity closer to the $2.00 level, which is a large, round, psychologically significant figure as well. That’s an area that will attract a lot of attention not only due to large institutional trade flow, but also options that will be focused on that area as well. If we were to break above that level, then it would be a very bullish sign but right now there isn’t enough demand out there to overtake the supply, and even though we will eventually see a huge wave of bankruptcies that drives the price higher due to less supply, that is quite some time away, and needless to say as we leave the wintertime in the United States and Europe, demand for natural gas is going to fall as well.

Having said all of that, the market is at an extraordinarily low level, so I don’t necessarily think that we are going to get any major meltdown anytime soon. I simply look for signs of exhaustion that I can sell into, perhaps aiming for the lows again, and on a break of the lows I think that sets up a move down to the $1.60 level which is extreme lows that have shown a significant amount of support at that area as the market bounced from that level last time it was that low. That being said, I still believe that it is easier to simply short rallies as they occur, as writing out the longer-term downtrend won’t be as profitable as it once was.