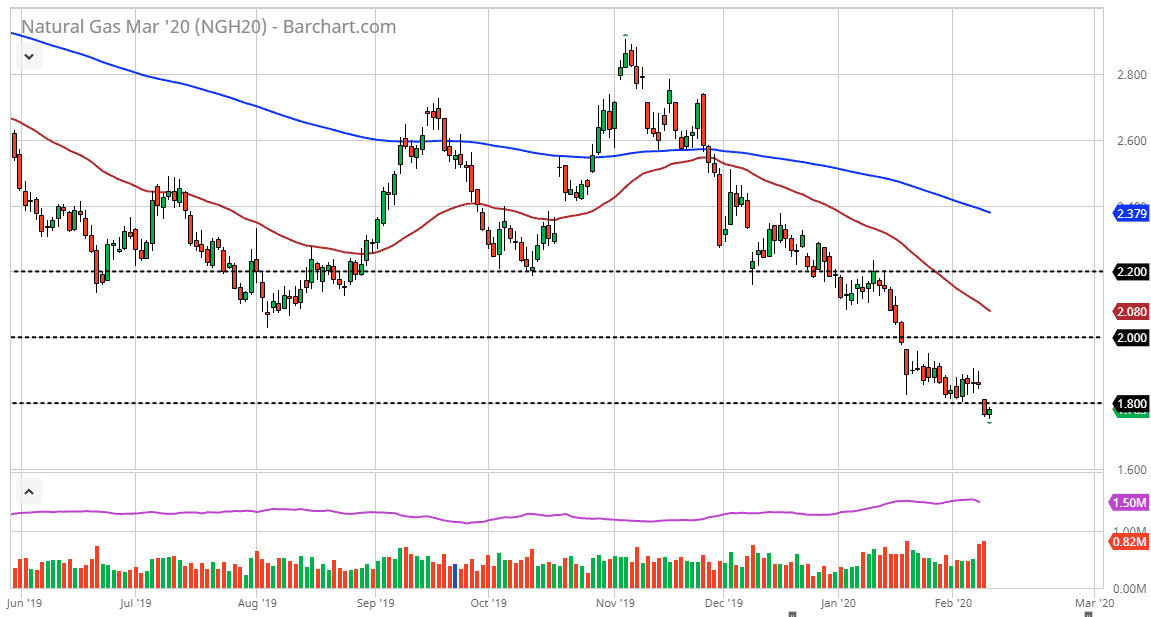

Natural gas markets drifted a bit lower to kick off the trading session on Tuesday, but then turned around to rally a bit. Ultimately, there is a gap that sits above this market still need to be filled, so it’s possible that the market goes looking towards the $1.86 level before finding sellers again. Furthermore, there are plenty of sellers beyond that level as well, especially at the $1.90 level, and then the $2.00 level. The 50 day EMA is starting to race towards the $2.00 level as well, and ultimately, it’s only a matter of time before exhaustion comes back into this market.

The fundamentals continue to work against natural gas, as it is extraordinarily oversupplied at the moment, and there’s no sense in trying to fight this overall trend. Furthermore, whether reports for the end of February suggest that it is still going to be warm, and therefore demand in the United States will continue to drive. Beyond that, the Chinese economy is certainly slowing down as well, as one would have to think that demand for natural gas products is dropping over there also. Quite frankly, the last thing that the natural gas market needed was warmer temperatures to drive down demand even further in what is an oversupplied market to begin with. Going forward, there will be bankruptcies, and those bankruptcies should help, but it’s going to take quite some time for that to happen.

To the downside, the $1.60 level underneath could be a target, as this market does tend to move in $0.20 increments, as it is a very technical market. Furthermore, the $1.60 level is an area where we have seen a massive bounce in the past, so that of course will attract a certain amount of attention. The easiest way to deal with this market though is to simply sell it every time it rallies and struggles, showing signs of exhaustion. I have no interest in buying natural gas, as the temperatures are only going to start rising in the United States going forward. Quite frankly, natural gas looks horrible.