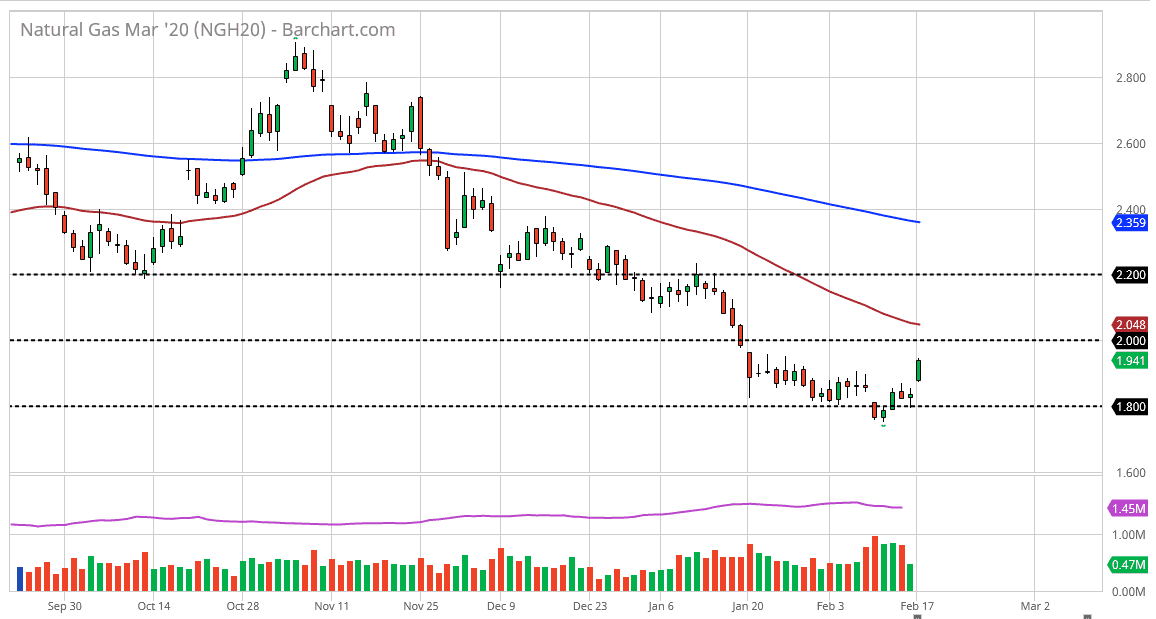

Natural gas markets have gapped to kick off the week on Monday, reaching well above the $1.90 level. That is a very bullish sign, but ultimately this is a market that is in a major downtrend and this will not have changed regardless of the massive move higher. At this point, the $2.00 level will offer a significant amount of psychological resistance, just as the 50 day EMA is approaching that level. At this point, it is more than likely going to continue to be a market that has sold every time it rallies, because quite frankly the natural gas markets are extraordinarily oversupplied.

There are reports that the temperatures in the United States are going to fall, which of course does drive up the demand for natural gas, but this will be a short-term phenomenon. The market is simply reacting as it typically does but given enough time temperatures will warm back up and natural gas markets will continue to fall. The markets continue to focus on the fact that the suppliers in the United States continue to flood the market, but there is a slew of bankruptcies coming, because there has been an oversupply in the market for quite some time.

That being said, the market has plenty of resistance built in at the $2.00 level but also the two point to zero dollars level after that. We are getting relatively close to warmer temperatures in the United States, so even though we are going to get a short-term pop in prices, it should offer an opportunity to sell this market yet again. That being said I will be looking for some type of daily candlestick that show signs of exhaustion to take advantage of as these relief rallies can be quite brutal. To simply step in and sell this market is tempting fate, but I do think that the overall downtrend makes quite a bit of sense. That being said, later on we will see natural gas markets rally due to the fact that the suppliers and drillers will be going bankrupt. This is exactly what the market needs, but in the short term it’s can it take some time to get there. In the meantime, simply fading rallies is about the only thing you can do. Ultimately, the rally and natural gas due to bankruptcies will be a story for later this year.