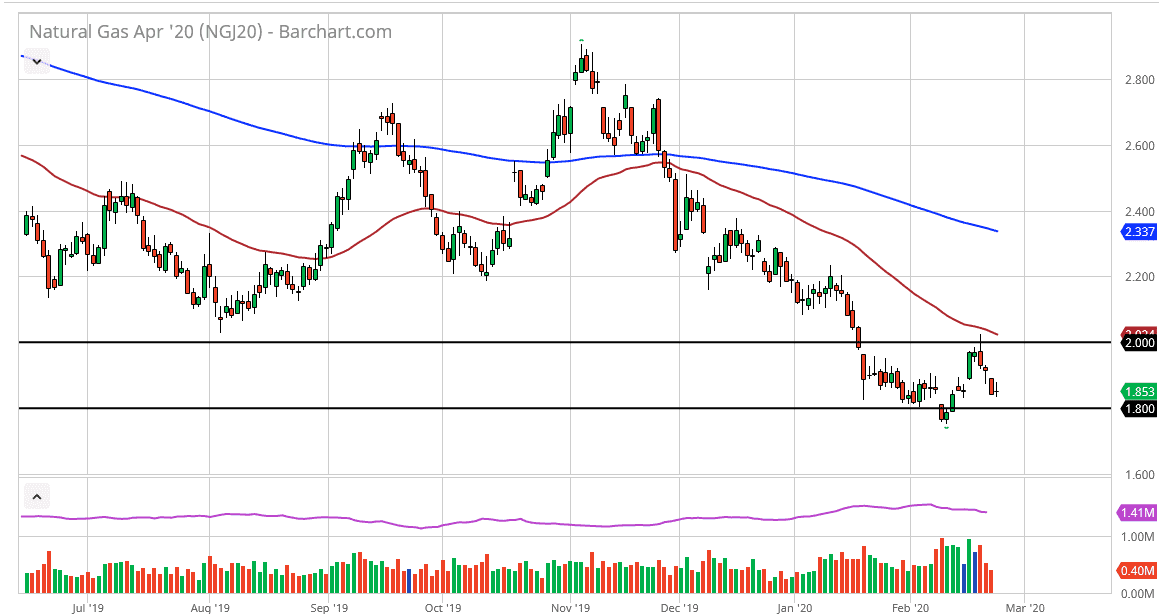

The natural gas markets have done very little during the trading session on Tuesday, as we continue to see volatility in other markets. The natural gas markets are sitting just above a significant support level in the form of the $1.80 level, so it does make sense that perhaps we could see a bit of stringent support. That however could give way, as the $1.80 level has been sold off and below previously. A move below there could open up the markets to reach down towards $1.60 level, an area that has been important from a longer-term standpoint anyway, so it would make sense that we would retest that area.

Looking at this chart, the 50 day EMA above is sitting just above the $2.00 level, an area that is a large, round, psychologically significant figure, and an area that has been important more than once. Rallies at this point will be sold off near that level, and even if we did break above there it’s likely that the $2.20 level would be the next major resistance barrier. Remember, supply and demand is mainly what is driving this market, and there is far too much supply at this point.

Beyond that, temperatures in the United States are starting to rise again, as we come out of the winter. If that’s going to be the case, the market is very likely to continue to suffer, because the demand will start to drop at the worst possible time. This is a market that can’t get out of its own way so clearly you can’t be a buyer of natural gas. Simply waiting for short-term rallies to sell is the only way to play this market. However, down the road we will get a whole slew of bankruptcies in North America that could help has it will drive down the overall flood of natural gas coming into the marketplace. Right now, there is no circumstance in which you should be buying this market. Ultimately, longer term we might have a trade to the upside, but we are so far away from that right now it’s not even worth worrying about. If the market was to break down below the $1.60 level, that would be an extraordinarily bearish scenario, albeit I think that breaking down below there would be very unlikely as the world already knows that oversupply is an issue.