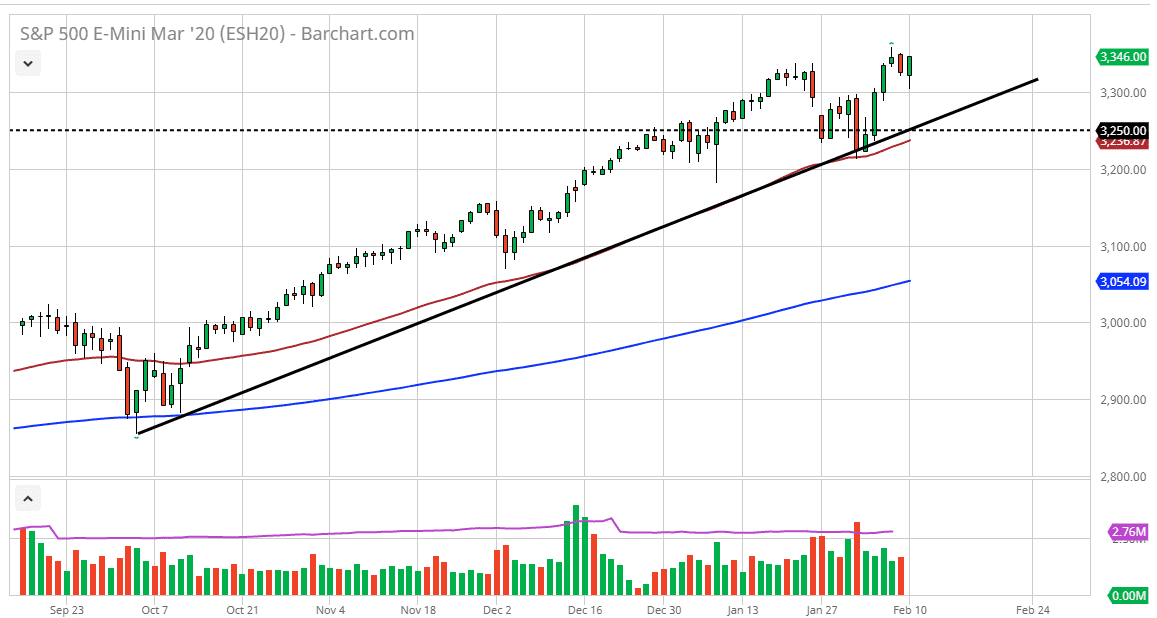

The S&P 500 has initially pulled back during the trading session on Monday, reaching towards the vital 3300 level before buying pick back up again. That being said, this is a phenomenon that we see time and time again, Globex selling with the main traders jumping in and buying.

S&P 500

The S&P 500 has initially pulled back during the trading session on Monday to kick off the week as the Asians continue to be concerned about growth and the coronavirus. However, as sooner the Asians go to bed it seems as if there are buyers willing to get involved. The 3300 level of course is a major round figure, and an area where we had seen selling previously. Now that it had been resistance it should be support, just as the day played out. I believe that we will go looking towards the all-time highs again, but we may need to pullback on short-term charts occasionally in order to make that happen. After all, the world right now is a somewhat scary place.

Nonetheless, we are in the midst of earnings season in the United States oh will cause a certain amount of volatility. Beyond that, the Federal Reserve is willing to step in and support markets however they can so it’s more or less a green light to print money for traders. Continue to look at the market as such and it’s likely that they will simply buy dips going forward. In fact, this has been an extraordinarily resilient rally, and at this point I just don’t see how it changes. If we break down below the 3200 level, then we could start to talk about some major issues but right now that seems to be very unlikely. After all, the massive amount of quantitative easing, although the Federal Reserve doesn’t like to call it that, should continue to throw money into this market. We are in an uptrend, and it’s almost impossible to fight the Fed and of course Wall Street in general. Nonetheless, it does look as if as Globex shows weakness due to fear in Asia, locals continue to pick up value as it appears. It seems to appear quite a bit, and therefore you can look to intraday charts in order to get long. I believe that we are going to go looking towards the 3500 level over the longer term, but it may take a little while to get there.