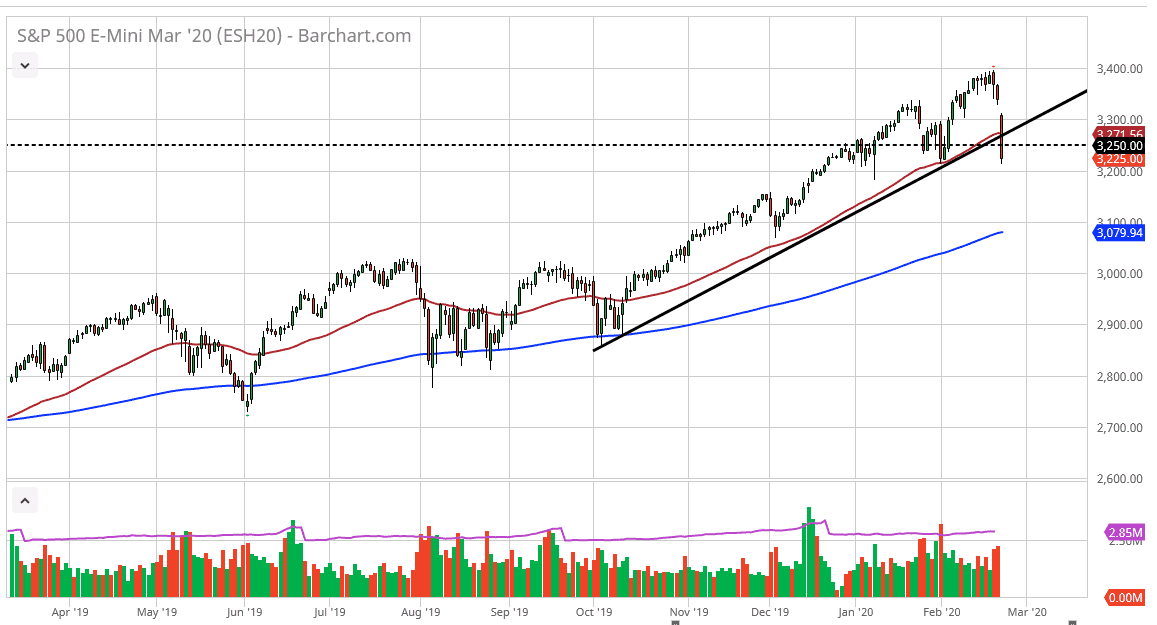

The S&P 500 gapped lower to kick off the trading session on Monday, showing quite a bit of downward pressure. Not only did we gapped lower to kick off the session, but we also have seen a massive slice through the uptrend line, and that of course is very negative in and of itself. The 50 day EMA was also slice through, so that is something to pay attention to.

At this point, people are probably waiting to see if there is some type of rally, but I think that if we fail somewhere between the 50 day EMA and the uptrend line, then you can start to sell this market again. That is one of those things that you have to know what you are looking for in order to trade it, so keep an eye on me here at Daily Forex, as I will let you know based upon tomorrow’s close as to what I may be going next. That being said, a break down below the 3200 level is in fact a very negative but I would not be surprised at all to see this market turn around and try to fill that gap first. If that’s the case, I will want to see what the daily candlestick shape is before doing any future analysis.

We have been in an uptrend for some time, and I do think that eventually the NASDAQ $100 turn around. That being said, I think that maybe we are a little bit overvalued, and I see quite a bit of support in the 3100 region roughly, as the area has previously offered support and of course we have the 200 day EMA grinding towards it. I don’t necessarily think that you should be jumping in and buying the market here, but I wouldn’t necessarily be a seller either. I think the next candlestick or two on the daily chart is going to define where we go next. Things will be volatile, and unfortunately traders will continue to trade based upon the next headline, which of course is almost impossible to predict with something like this. However, you should keep in mind that most of the news involving the coronavirus has been negative, so one would have to assume that all things being equal, we will get more negative news coming down the road. It seems as if expanded cases in South Korea and Italy have been a bit of a tipping point.