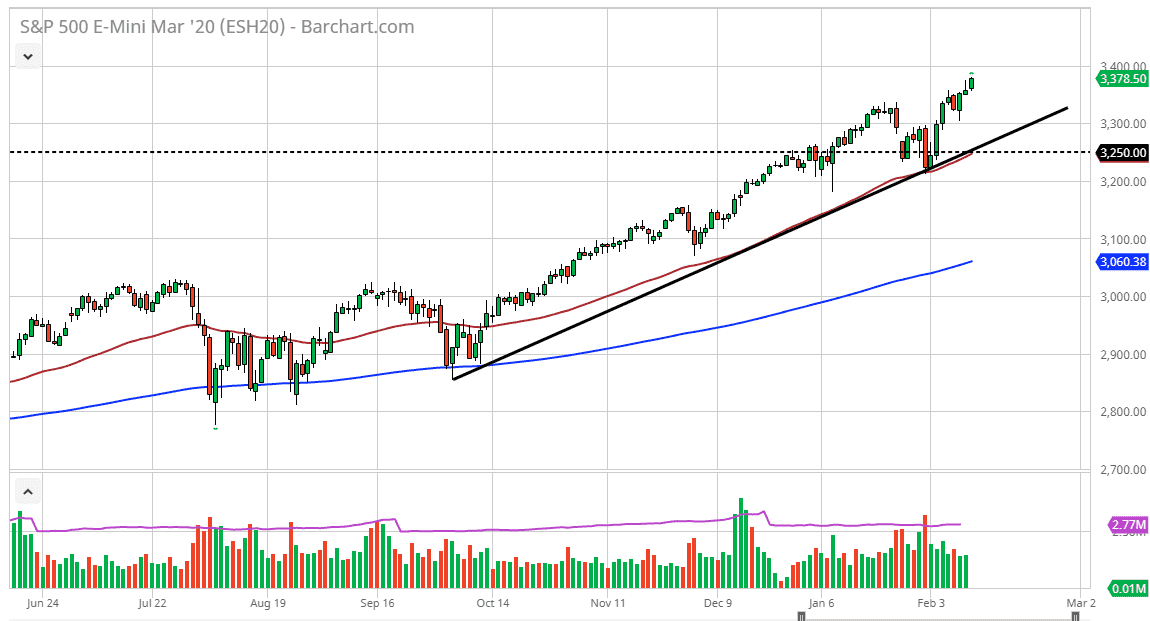

The S&P 500 has rallied again during the trading session on Wednesday, breaking above the top of the shooting star from the previous session. This is obviously a very bullish sign and should continue to push this market towards the 3400 level, and then eventually my longer-term target of 3500. I thought the 3500 level was going to be something to reach for later this year, but it looks very likely that we are going to get there much quicker than expected.

To the downside, any pullback should see plenty of buyers near the 3300 level, and of course the uptrend line. The uptrend line is also padded by the 50 day EMA, both of which should attract quite a bit of buying pressure. Overall, I believe that the market is one that you should be buying on dips, as bond yields don’t offer enough to dissuade people from jumping into the markets. Ultimately, I believe that the market will continue to find buyers on these dips based upon if nothing else, crowd behavior.

Foreigners are buying the stocks in the S&P 500 as a form of safety, as the US economy is one of the few that are growing at a reasonable rate right now. The recent coronavirus outbreak and China has only exacerbated the situation, as there is no way to invest in China without some type of massive fear. Ultimately, if we were to break down below the uptrend line, then the 3200 level should be targeted, and then a break down below there could have the market looking towards the 200 day EMA, which is colored in blue.

Currently, the 200 day EMA is reaching towards the 3100 level, and that for me would be the “floor” in the market. Having said that, I think pullbacks offer plenty of value in shorting this market is all but impossible at this point. If the market breaks above the 3500 level, then we are starting to talk about a longer-term target of 4000, something that seems to be a bit of a stretch at this point, but I could have said the same thing about the 3000 level last year.