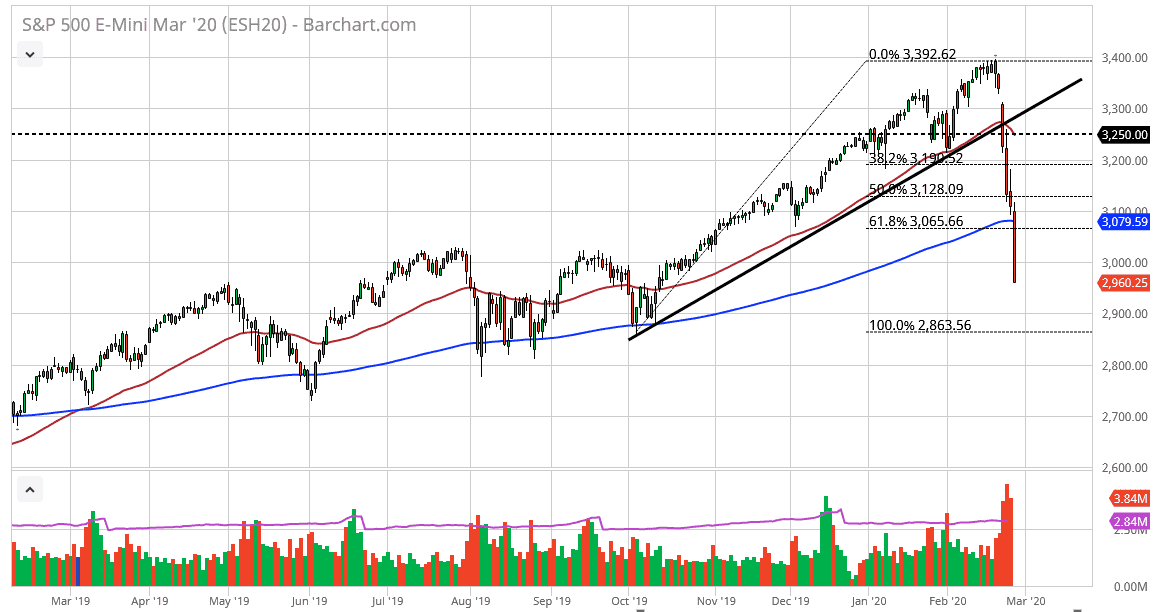

The S&P 500 has gotten absolutely hammered during the trading session on Thursday, and worse yet even close that the very lows. The market as well below the 3000 handle and it makes sense that we would continue to go lower based upon the way we went out. Remember that Asia will be trading the E-mini contract and will probably put bearish pressure on this market as well. The real fight will be closer to the 2900 level, which would wipe out the entirety of the move from October of last year.

If the market does rally from here, I would be very suspicious at the 200 day EMA, and I think we need to find some type of daily candlestick that shows that we are going to turn around, so making the decision at the end of the day is probably the best thing to do. We need to see some type of daily candlestick to give us a bit of help and hope. The candlestick on Thursday just screams that there is going to be follow-through at this point.

The S&P 500 was a bit of a safe haven for a while, but that clearly has gone by the wayside and it looks like we now need to find some type of hope near the 2900 level to turn around a start buying. This is a structural destruction of sorts, and that takes quite a bit of effort to turn things around. Although I think it’s very difficult to short this market right now, I do recognize that we probably have further negativity coming. Short-term traders may be able to take advantage of it but if you tend to pay attention to the longer-term trend, you are probably better off waiting for that sign of stability in order to “buy-and-hold.” It’s hard to tell when Wall Street will have had enough of this selling, but right now we are not quite there and the prudent thing to do is stand by the wayside and wait for the destruction to end before putting a lot of money to work. I will keep you advised as to what I am doing but right now I have no positions on when it comes to the E-mini S&P 500 contract. At this point, things look bleak but they will eventually stop, they always do.