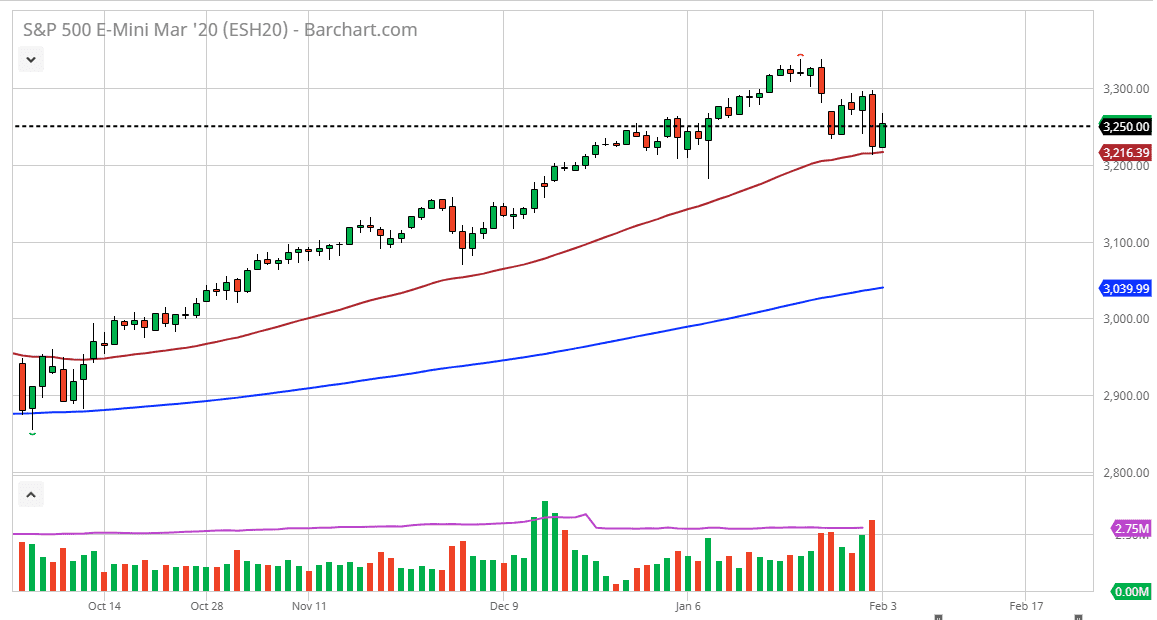

The S&P 500 did rally a bit during the trading session on Monday, but only recovered about half of the losses that the market had seen on Friday. The bounce could be thought of as a technical one more than anything else, as the 50 day EMA of course will have attracted a certain amount of attention. Beyond that, the 3200 level is one area that we have seen action at previously, so a bounce is not a huge surprise. That being said though, it’s not until we wipe out the candlestick from the Friday session that one can be confident of the market going higher. I think that pullbacks will continue, and this pullback should offer plenty of opportunities at the very least down at the 3200 level, but I think we probably go a bit further to the downside than that.

One of the things that help during the trading session with the ISM Manufacturing PMI figures coming out of the United States better than anticipated, and even broke the 50 barrier again. Because of this, it does show that the reaction after the “Phase 1 deal” was signed, but it doesn’t necessarily reflect anything that’s happened after the coronavirus hit, which while not been a major issue in the United States so far, it certainly affects supply chains.

If the market can break down below the 3200 level, then I think we will go looking towards the 3150 level and then eventually the 3100 level. By the time the market were to pull back towards the 3100 level, it’s very likely that the 200 day EMA would come into play. That’s an area that of course attracts a lot of attention over the longer term, and I think it would be difficult to imagine that the market would just simply slice right through it. To the upside though, if we were to break above the 3300 level, it would wipe out the entirety of the Friday session, and that of course would be a very bullish sign. If the market can break out above there, then it’s likely to continue the overall uptrend. It’s not until then that I would trust any rally without some type of significant pullback. The technical analysis does suggest that perhaps we have a little further to fall in the short term but it should offer value.