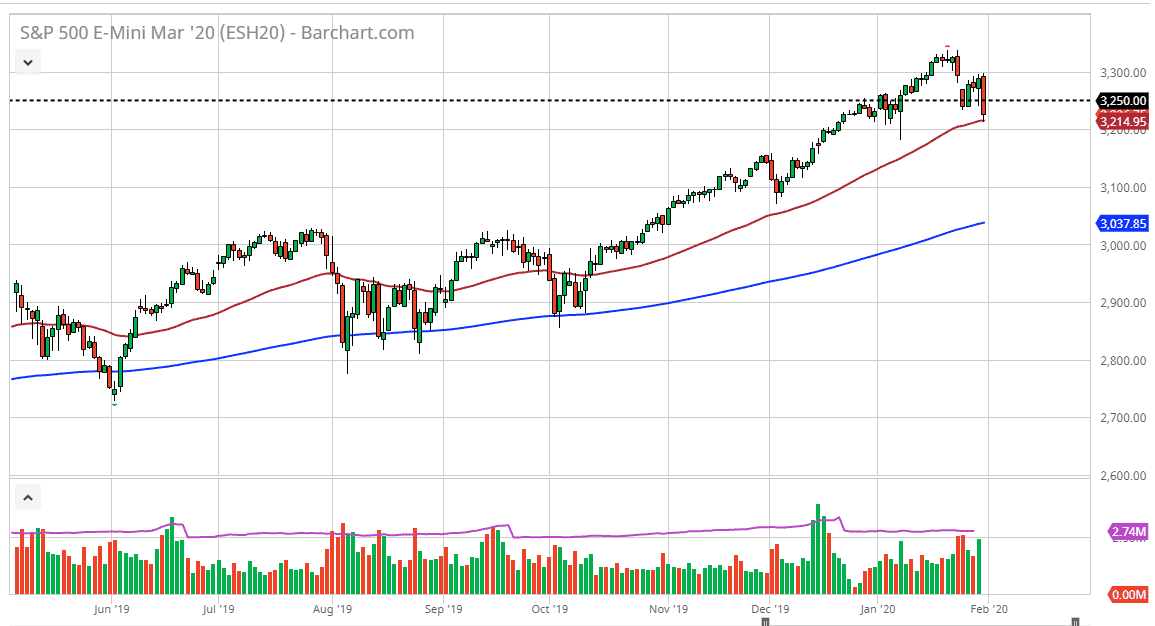

The S&P 500 has broken down significantly during the trading session on Friday, showing the 3300 level as massive resistance due to the fact that we had a massive gap lower on Monday. The fact that we have closed this poorly suggests that there is further to go to the downside, and the 50 day EMA is likely to continue to be support. If the market does break down below the 50 day EMA it’s likely that we continue to go down towards the 3100 level. Ultimately, I also think that the 200 day EMA will catch up somewhere in that area. This is a market that has needed to pull back for some time, and with that being the case it’s likely that the coronavirus was simply an excuse to start selling.

At this point, I believe that the 200 day EMA will eventually bring in buyers, as the market tends to pay quite a bit of attention to that area. However, if the situation with the coronavirus gets worse, we will slice through the 200 day EMA and break down rather significantly. I don’t know that the market is quite ready to give up the trend though, so this pullback is probably going to be more of the 5% variety than anything else. With that in mind, I’m not willing to short this market but what I am willing to do is look for buying opportunities underneath. I will keep you up-to-date as to what I’m doing here at Daily Forex, but right now I am simply sitting on the sidelines and looking for a buying opportunity based upon value. The market had gotten way ahead of itself so I do believe that the next several sessions could cause some creative destruction that we can take advantage of.

That being said, if we do turn around a wipeout the Friday candlestick that would be an extraordinarily bullish sign. However, it’s a bit difficult to imagine a scenario where we simply wipe out the losses. The market closed horribly, and it looks as if there is going to be a significant amount of follow-through coming rather shortly. Short-term traders will probably be sellers, but for myself I think it’s easier to buy at a good price and simply let the market do the work for you. Be cautious, but more importantly, be patient.