The S&P 500 rallied a bit during the trading session on Tuesday but gave back quite a bit of the gains as Jerome Powell testified in front of Congress. I believe it’s basically because Wall Street didn’t hear him guaranteeing more liquidity, therefore the main driver of the stock market is now in question. Don’t kid yourself, although earnings do matter for specific companies, in a passive investing environment, what truly matters is whether or not earnings, but Federal Reserve quantitative easing or liquefying of the markets. As long as money is cheap, stock market traders will continue to start buying.

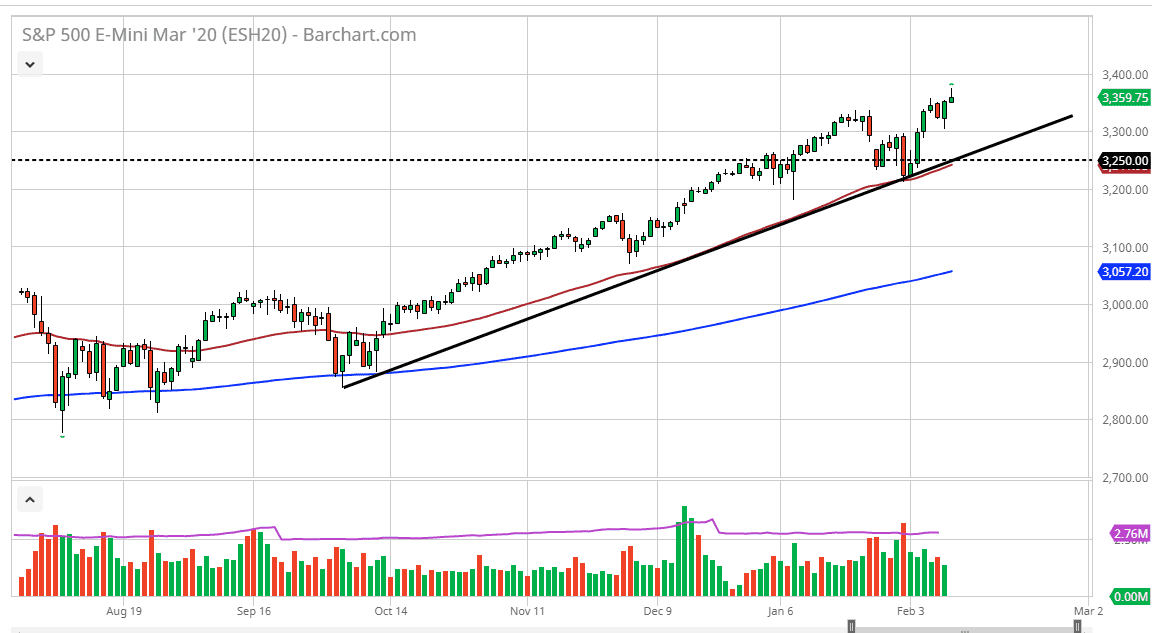

Pullbacks at this point should offer plenty of support, especially near the 3300 level, but then again at the uptrend line underneath which continues to see a lot of interest. The 50 day EMA is granting right along the uptrend line, so ultimately, it’s likely that the markets will continue to find that area massively supportive as well. If we were to break down below that level then the 3200 level would be targeted, and then perhaps down to the 3100 level. At the 3100 level, it’s likely that the market will find a bit of support in the form of the 200 day EMA, but we have a long way to go before that happens.

On the other side of the equation, if the market was to break above the top of the shooting star from the trading session on Tuesday, it would suggest that we are getting ready to see a significant impulsive move to the upside, so having said that every time the market pulls back I’m looking for buying opportunities and prefer that over a breakout to the upside, but also recognize that it is a buying signal in and of itself. I have no interest in shorting this market, at least not until we break down significantly through that uptrend line, which is not something that I’m expecting to see anytime soon. The 3500 level is still my longer-term target, but I think it’s going to take some time to get there as the market continues to deal with a lot of headlines coming out of China and the like.