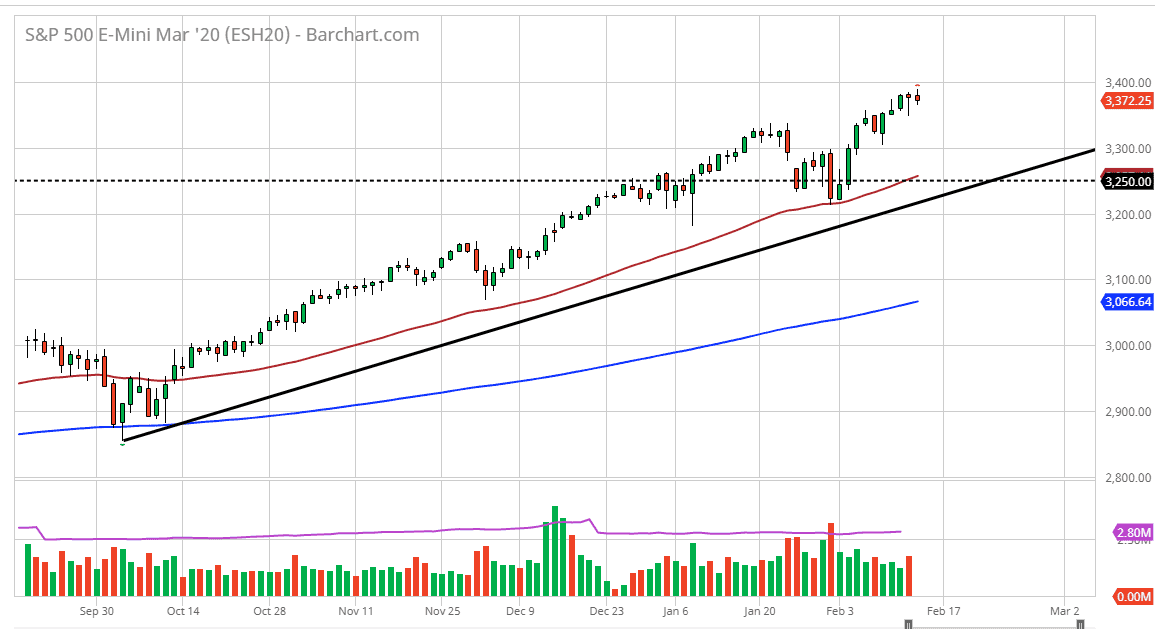

The S&P 500 has initially tried to rally during the trading session on Friday but gave back the gains as I got close to 3400. The large, round, psychologically significant figure of course cause a lot of attention, but I think that the level will eventually get broken. To the downside, I think that the 3350 level is an area where we could find buyers and then most certainly the 3300 level underneath there. The 50 day EMA is starting to reach towards that area, which is also backed up by the uptrend line.

The alternate scenario of course is that the market breaks above the 3500 level, perhaps reaching towards the 3500 level after that. Longer-term, the market does get there but I think a pullback here could also, much like in the NASDAQ 100, offer value and perhaps an ability to build up the momentum to go higher. In fact, I don’t really have a scenario in which I’m looking to sell the S&P 500, at least not in the short term. If the market does break down below the 3200 level, then we have to start thinking about the downside. Keep in mind that the S&P 500 has been used as a proxy to get money out of weaker countries and into the United States, so therefore it’s likely that the market will probably continue to benefit from money flowing out of Asia and the European Union.

Look at pullbacks as an opportunity, it certainly has worked over the last several months and I don’t see anything changing at this point. I would not read too much into the idea of a relatively flat candlestick on Friday, because quite frankly the risk out there is such that the last thing you want to do is put a lot of money on ahead of the weekend, only to see the S&P 500 E-mini contract gap below on you first thing in the morning during Asian trading. If it weren’t for all of the headlines such as the coronavirus and potential global slowing, I suspect that the Friday candlestick would have been grain. Nonetheless, I am positive of the longer-term so I look at pullbacks as an opportunity to “by the S&P 500 on sale”, such as Warren Buffett would say. What’s particularly impressive is that the US dollar and the S&P 500 both have rallied, and I suspect that will continue to be the case.