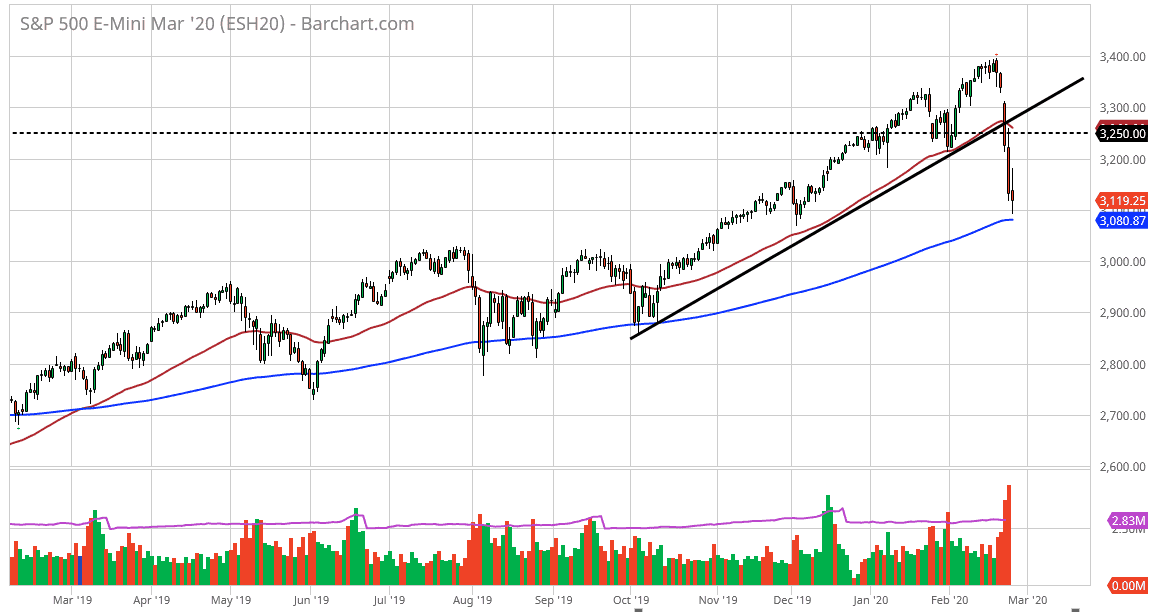

The S&P 500 has been all over the place during a very volatile session on Wednesday, initially tried to rally but given back those gains as computers traded the word “pandemic” coming out of a random FDA officials mouth during the day. The 200 day EMA is likely to offer support, and in fact it looked as if we were getting a trend change again during most of the day until that algorithmic selling started.

If we were to break down below the bottom of the candlestick and by extension the 200 day EMA, then it’s likely that the market probably goes down to the 3000 level which of course is a large, round, psychologically significant figure. Breaking below there then opens up the “trapdoor” to much lower levels. Alternately, if we can break above the top of the candlestick for the trading session on Wednesday that would be a very bullish sign and have this market looking for the 50 day EMA at the 3250 level. At this point, it’s probably best to either wait for the breakout or maybe the next daily candlestick. I will be very cautious about dipping my toe back into the water, but at this point I think it is very possible that by the end of the week we get some type of recovery. All we need to see is some type of shift in sentiment, which seems to flip on a word or two of these days.

The gap above has not been filled yet, so it is possible that we at the very least try to do that. We need good news, and then value hunters will probably come back into this market. If the United States starts to be seen as a safe haven again, that could lead more flows into the S&P 500. At this point, I think the one thing you can probably count on is a lot of volatility, but I believe it’s only a matter of time before the market takes some type of direction, and after the bloodbath that we have seen over the last several days, I do think that there is the possibility of a “rip your face off rally” coming. However, you don’t want to be the first person to get into the market in order to take advantage of that. You want to see the market prove itself going forward.