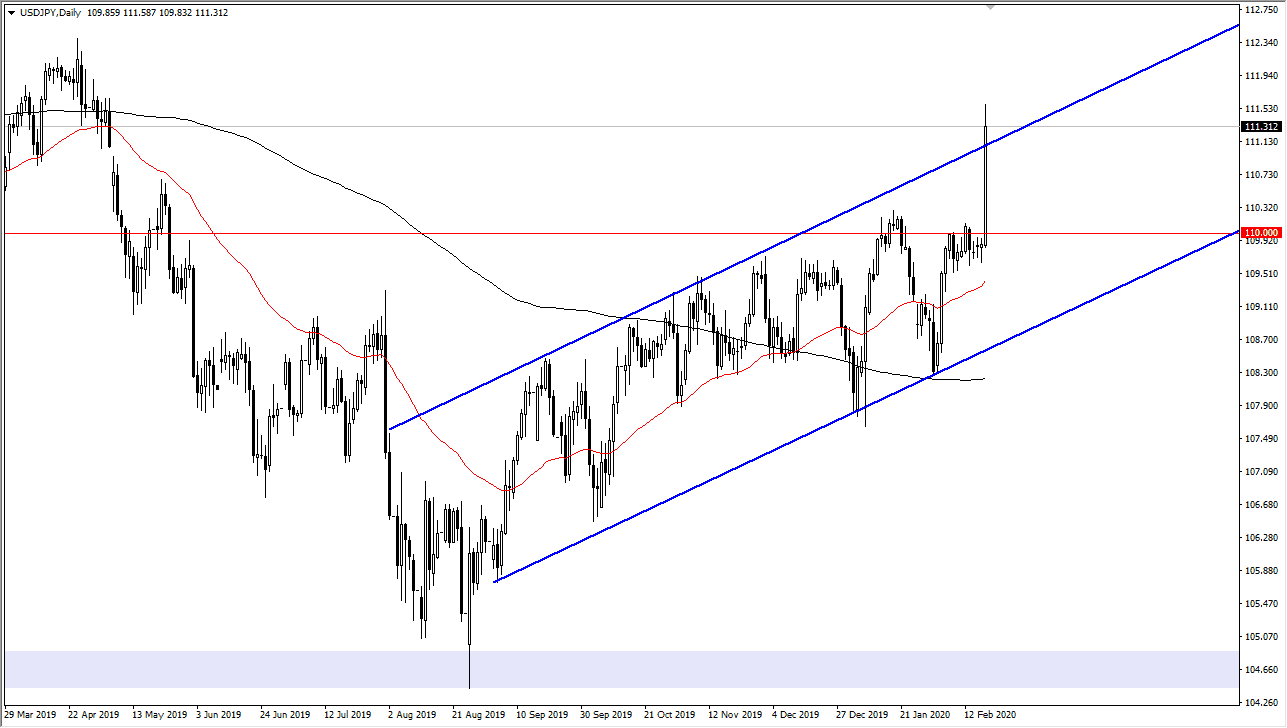

The US dollar exploded to the upside during the trading session against the Japanese yen on Wednesday, clearing the ¥110 level quite handily, and making a fresh, new high. Ultimately, the market has reached the top of the overall up trending channel, and as a result it looks very likely that the market is ready to continue going much higher. We have filled the gap that I had talked about previously at the ¥111 level so don’t be surprised if we get a little bit of a pullback. However, the pullback should be thought of as a buying opportunity, especially if we are to pullback closer to the ¥110 level, although I don’t necessarily think we get that deep to the downside.

The Japanese yen was punished due to the fact that the preliminary Q4 GDP quarter over quarter reading of -1.6% suggests that the annualized GDP in Japan could be as low as -6.3%, its largest drop since 2014. Ultimately, this is a market that is also reacting to the Japanese hiking sales tax again and again, crushing household consumption and stalling what little minor economic expansions the Japanese have fell. Ultimately, the Japanese economy is under a lot of pressure and therefore it makes quite a bit of sense that the Japanese yen gets hammered against something like the US dollar which represents an economy that is growing so rapidly. Having said that, the Japanese yen got sold against almost everything so at this point I think recession is what people are going to be focusing on, as it looks like one is definitely coming to Japan.

To the upside I believe that the 112.33 yen level could be the next target, as it was a major sell off area. At this point though, it’s very possible that we go even further than that. Alternately, if we were to turn around a break down below the ¥109.50 level, then it would change everything. With the impulsive candlestick that we have seen on Wednesday though, it’s almost impossible to imagine that we would completely wipe out that entire move. I believe that short-term pullbacks continue to offer plenty of buying opportunities. Ultimately, the Japanese yen got crushed against almost everything out there and I think it will continue to sell off. With that, and the fact that the United States is growing at over 2%, it makes sense that we continue the uptrend.