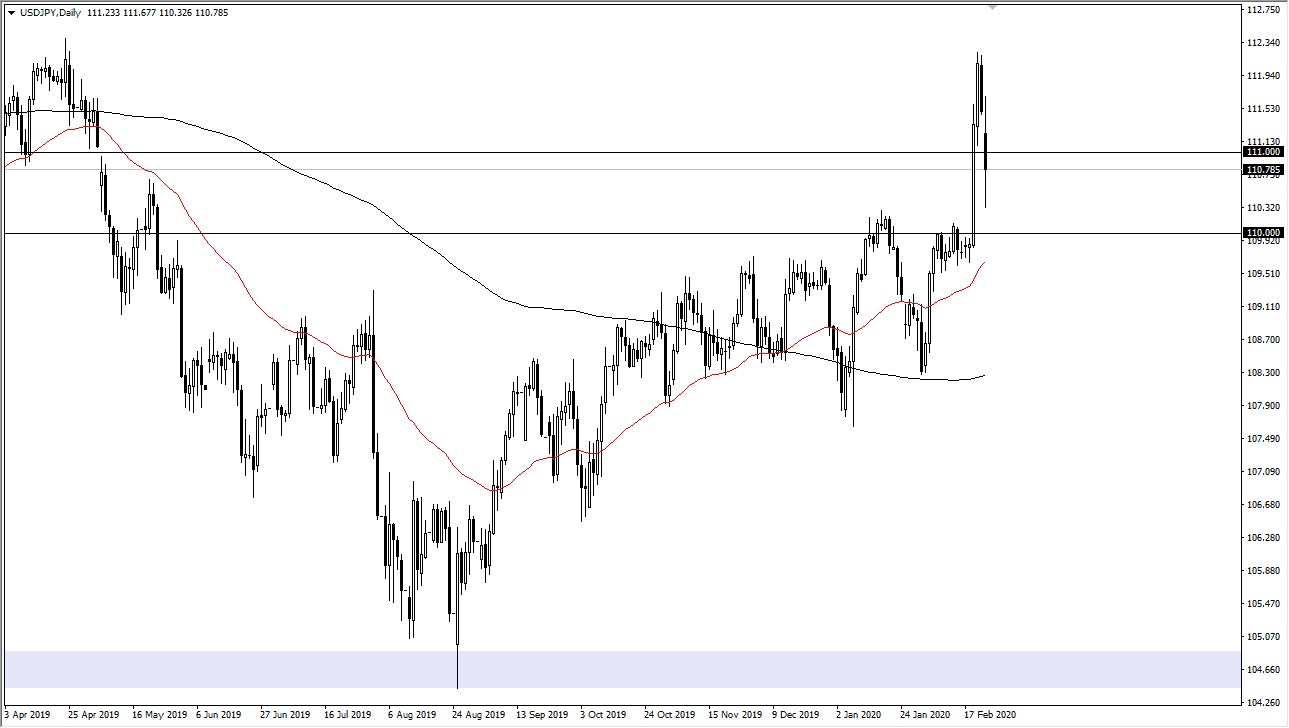

The US dollar initially gapped lower against the Japanese yen to kick off the week on Monday, as fears about the coronavirus continues to be a major driver of markets. That being said though, the market has raced bright back to the upside during the session as perhaps I got a little bit oversold. The US dollar continues to be one of the favored currencies around the world, and later on during the day we started to see resiliency come back into this marketplace. The ¥110 level should be massive support, as it is an area that is essentially “fair value” based upon the longer-term consolidation area that starts at the ¥105 level on the bottom and the ¥115 level on the top. At this point, the market looks very likely to see a lot of back and forth, but as we had broken so significantly above the ¥110 level, it makes sense that we are ready to go higher eventually.

The pullback of course was rather strong, and I don’t think that we are necessarily done selling off, but I would anticipate the ¥110 level on to offer a significant about of support. At this point, the ¥109.50 level being broken to the downside would be what it would take for me to start selling, and although the Japanese yen is essentially considered to be a safety currency, the reality is that the situation is a bit different considering that the coronavirus is raging through Japan right now, so therefore it makes quite a bit of sense that the Japanese yen has taken a hit. Furthermore, the Japanese economy has shown signs of recession, so at this point it’s hard to imagine that the Japanese economy is suddenly going to turn things around.

I believe this point it’s very likely that the US dollar will continue to rally against the Japanese yen considering that the US dollar is considered to be much more desirable as the US economy is one of the few larger ones that is still showing signs of strength in growing. Eventually, the market will go back to its original correlation between risk on/risk off, but in the meantime it’s all about the coronavirus. With that in mind, the headlines will continue to push this market to the upside, but we may get a little bit more further selling between now and then.