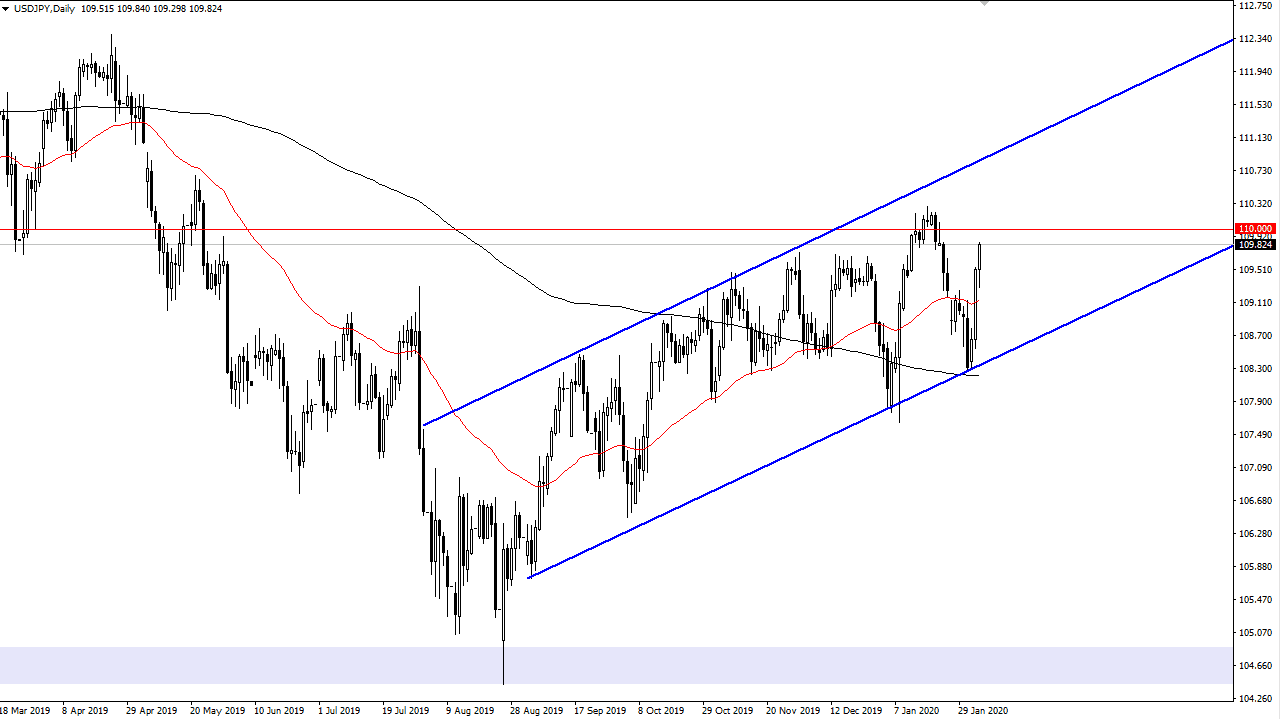

The US dollar has rallied again during trading on Wednesday, as it looks like we are trying to take out the ¥110 level. However, this is an area that should feature quite a significant amount of resistance, so I do think that eventually we will rollover. Having said that, if we do break out to the upside it’s likely that the move will be due to more of a “risk off” type of situation, and the US stock markets have seen a massive bullish pressure over the last few days. Ultimately, I think at this point it’s likely that the market probably goes looking towards the ¥111 level on a breakout, and then eventually the ¥112.30 level after breaking through there.

Short-term pullbacks at this point in time would make some sense though, because we are a bit overextended. The 50 day EMA underneath is typically a place where a lot of traders will look for reactions to price, and that is at roughly ¥109. Furthermore, there is an uptrend and channel that we have been in for some time so the uptrend line underneath should also offer an opportunity for buyers to step in as well. I don’t have any interest in shorting this market, I think that it is only a matter of time before the buyers to overwhelm the sellers. Nonetheless, there are a lot of concerns out there that continue to suggest that the Japanese yen will be sold off aggressively, at least not all at once.

Much of the safe haven status of the Japanese yen is starting to a road though, as perhaps people are looking more towards the US dollar in his most recent scenario of the coronavirus. Japan has been spared of any deaths from that virus, but as soon as it starts reporting those, that could really start to work against the value of the yen. All things being equal though, this is a market that is in an uptrend and channel and that has not changed, so it is most certainly worth paying attention to. If we were to break down below the bottom of the channel, that would change a lot obviously, but right now it doesn’t look like anything that the market is threatening to do in the next 24 hours. I believe that short-term pullback should continue to be buying opportunities but be aware that the Friday session features Non-Farm Payrolls.