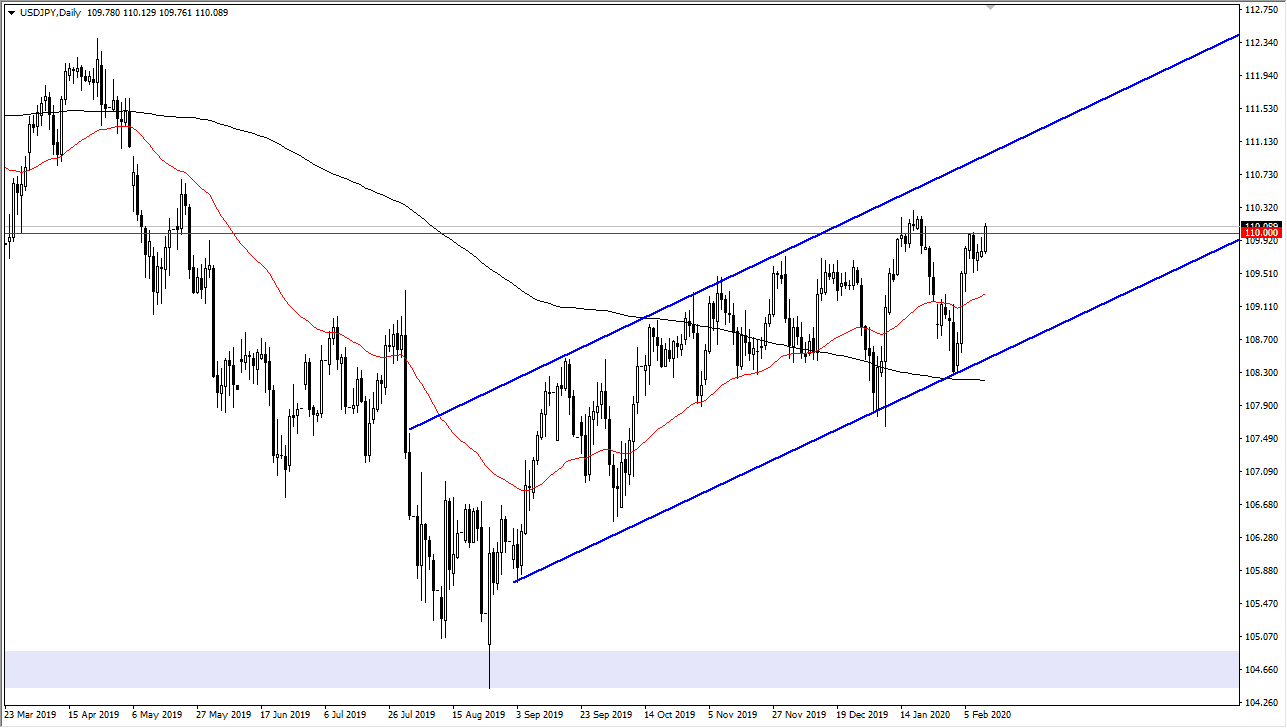

The US dollar has rallied a bit during the trading session on Wednesday, breaking above the ¥110 level. That being said, the area has a significant amount of resistance extending to roughly ¥110.35, and as a result although it looks very bullish, I think at this point you need to make a point to wait for a “fresh, new high” in order to start buying. Keep in mind that this would be a very bullish move and could open up the door to ¥111, and then eventually the ¥112.50 level.

Looking at the longer-term chart, the ¥110 level is essentially the “fair value level” at the longer-term charts, which I believe that the ¥105 level underneath is massive support just as the ¥115 level above is massive resistance. If that’s going to be the case longer-term, then it makes a lot of sense as to why we are struggling in this general vicinity. Ultimately, that means that there are a lot of orders in both directions in this area so it should continue to be very choppy.

All of that taken into account, the Japanese yen is considered to be a safety currency, so if the market continues to rally it is probably a function of people breathing a sigh of relief when it comes to the coronavirus, and of course general risk appetite when it goes around the world. For myself, I am going to be waiting for some type of impulsive break out or break down in order to get involved. The best way I know to play this market is to wait to see if there is a fresh, new high, which would tell me to start buying and aiming for big moves. On the other hand, if the market breaks down below the lows of the last couple of candlesticks, then I think at that point the uptrend line becomes threatened and if that gets broken, we could be looking at a move down to the ¥105 level. Until then, I think you are looking at a lot of difficult trading that will be more or less driven by high-frequency traders and therefore not a level playing field for us mere mortals.