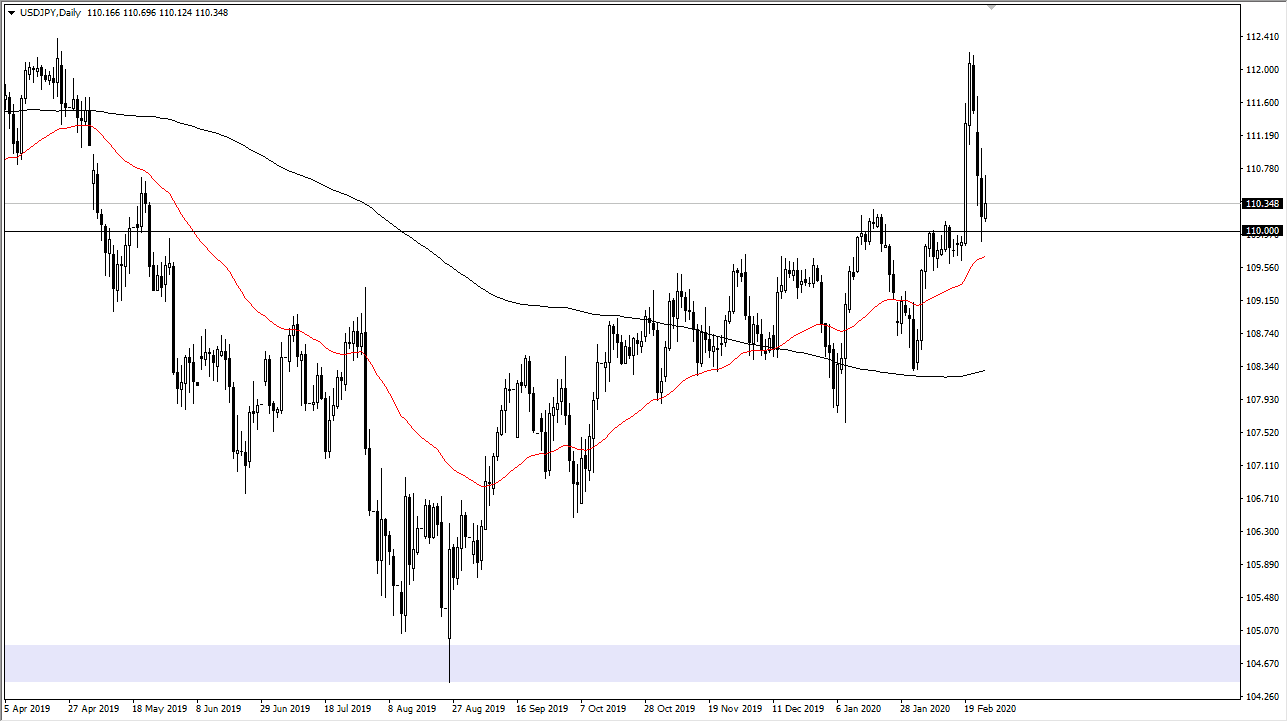

The US dollar bounced a bit during the trading session on Wednesday, as the ¥110 level continues offer a bit of support. It is smack dab in the middle of the range that the market has been in from the longer-term standpoint, with the ¥105 level underneath been massive support, and then also has seen the ¥115 level offer a significant amount of resistance. The fact that the market is hanging around this area should not be a surprise, just as the fact that it has been volatile should not be very surprising either.

Looking at the chart and the candlestick, you can see that there are a lot of questions as to where we go next, but it should be noted that much of the selling of the US dollar happened due to a few random comments suggesting using the word “pandemic” to describe the coronavirus. This was said by the FDA, but it was a random official, so at this point it’s very difficult to make heads nor tails about this other than perhaps algorithms jumped into the fray and reacted to the headline. It’s a bit difficult to understand at this point, but the longer-term fundamental analysis suggests that the Japanese yen could very well be on its back foot for a while.

Losing more than 6% in GDP last month, Japan certainly looks very weak to say the least. Furthermore, coronavirus is starting to make its presence known in that country, so that’s yet another reason to think that the economic pain will continue. At this point, the US dollar is also being lifted due to the fact that the US economy is outperforming many of the other larger ones, so it is driving money into the US dollar. Beyond that, money is running away from Asia as long as the coronavirus continues to be a major issue, and therefore it’s likely that we will continue to see more of the same behavior. That being said, if the market was to break down below the 50 day EMA it could send this market lower but at this point it doesn’t look as likely. In that scenario, the market could very well reach towards the ¥109 level and then even lower than that. It should be noted that the recent breakout was very stringent, so one would have to assume that the uptrend is still very much intact.