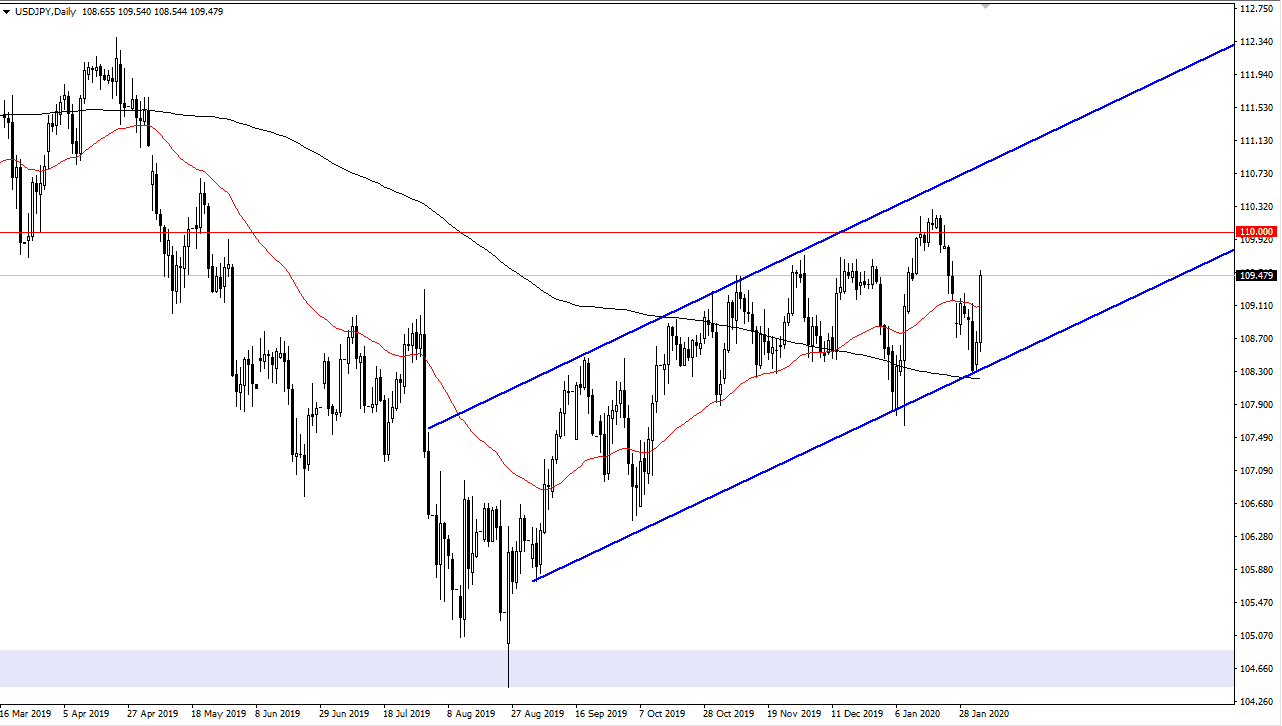

The US dollar has rallied again during the trading session on Tuesday, breaking well above the 50 day EMA in what has been a major “risk on” type of situation as far as the global markets are concerned. The USD/JPY pair is highly sensitive to global risk appetite, so therefore it’s not a huge surprise that this pair had seen a significant move. This pair has been relatively quiet, but with the action on Tuesday it had wiped out the last week or so of negativity. Furthermore, it looks as if it is hell-bent on trying to get to the ¥110 level, which is the “fair value” level between the support and resistance from the longer-term monthly charts.

You can also make out an obvious up trending channel that the market has bounced from, so this is a simple continuation of what we have seen previously. If the market can finally break above the ¥110 level, at least on a daily close, then it’s likely that it may go looking towards ¥111 level, and then perhaps the ¥112.30 level after that. Ultimately, this market remains a “buy on the dips” type of scenario in the short term, but it should be noted that the market has been very erratic lately.

Furthermore, you do have to keep in mind that there are a lot of concerns coming out of Asia, which tends to drive money into the Japanese yen. If that’s the case, then this pair will probably fall. If it was to turn around and breakdown below the 200 day EMA, this pair could go looking towards the ¥105 level based upon longer-term historical charts. The pair does have a significant correlation to the S&P 500 which had a very strong session on Tuesday, so keep that in mind as well. It looks as if equity traders are coming in to pick up risk appetite again, and therefore the Japanese yen will probably continue to be sold against not only the US dollar, but multiple other currencies as well. Having said all of that, if we get some type of shock headline coming out of Asia, especially when it comes to the coronavirus, it’s very possible this whole thing could unwind rather quickly as is typical with yen related trading pairs. I am cautiously optimistic but looking for value before putting money to work at this point. Buying pullbacks is the best way I know.