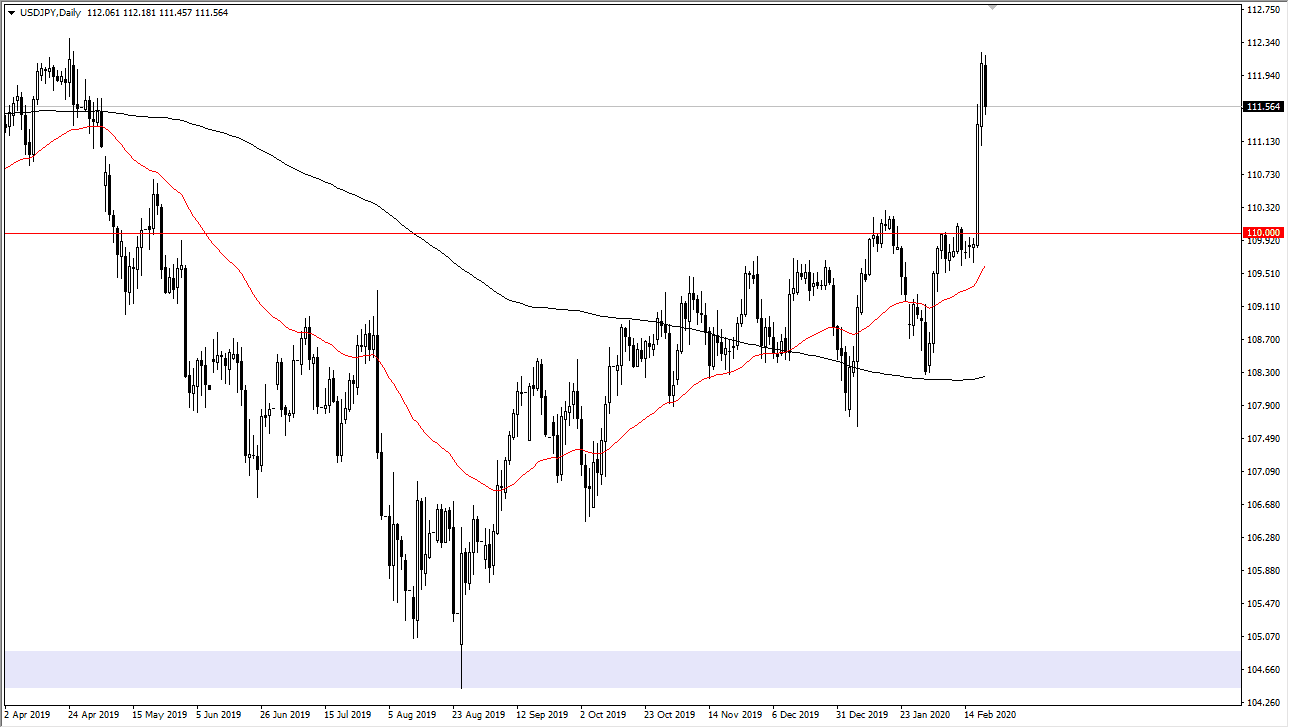

The US dollar has pulled back a bit against the Japanese yen during the trading session on Friday, as we reached the ¥112.30 level. That being said, the market looks very likely to continue seeing a little bit of a pullback in order to build up the necessary momentum. The ¥110 level underneath would be a crucial area to pay attention to, as it was previous resistance. Furthermore, when you look at the longer-term charts, the ¥110 level underneath is considered to be “fair value”, as we had been trading between the ¥105 level and the ¥115 level above.

At this point, the market looks very likely to find plenty of buyers underneath though, as there is a lot of interest in the “fair value level”, and therefore it makes sense the traders would pay attention to that. The 50 day EMA is starting to reach towards that level, so having said that it’s likely that the level will be one worth watching. Keep in mind that the US Manufacturing PMI figures came out a little lighter than anticipated during the trading session, so it makes sense that we had a little bit of a pullback. Furthermore, people are a bit concerned when it comes to the possibility of negative headlines coming out of China over the weekend, perhaps throwing money towards the Japanese yen as a safe haven bit. Working against that theory though is the fact that the Japanese economy is getting ready to head into recession, so that’s of course something worth paying attention to as well. All things being equal, the market is likely to continue to see a lot of attention placed upon the Chinese headlines, and as we were heading into the weekend it’s a bit difficult to carry any type of risk. I suspect that a lot of traders went flat going home, because who knows what comes next.

If the market was to break down below the 50 day EMA, that would be a very negative sign, perhaps opening up the door to the 200 day EMA under there. A breakdown below that level then it opens up the door down to the ¥105 level. Having said that, that’s not my base case but it is an alternative scenario depending on how things play out. I believe that the buyers will continue to push this pair higher, as the US dollar has been so heavily favored against most other currencies.