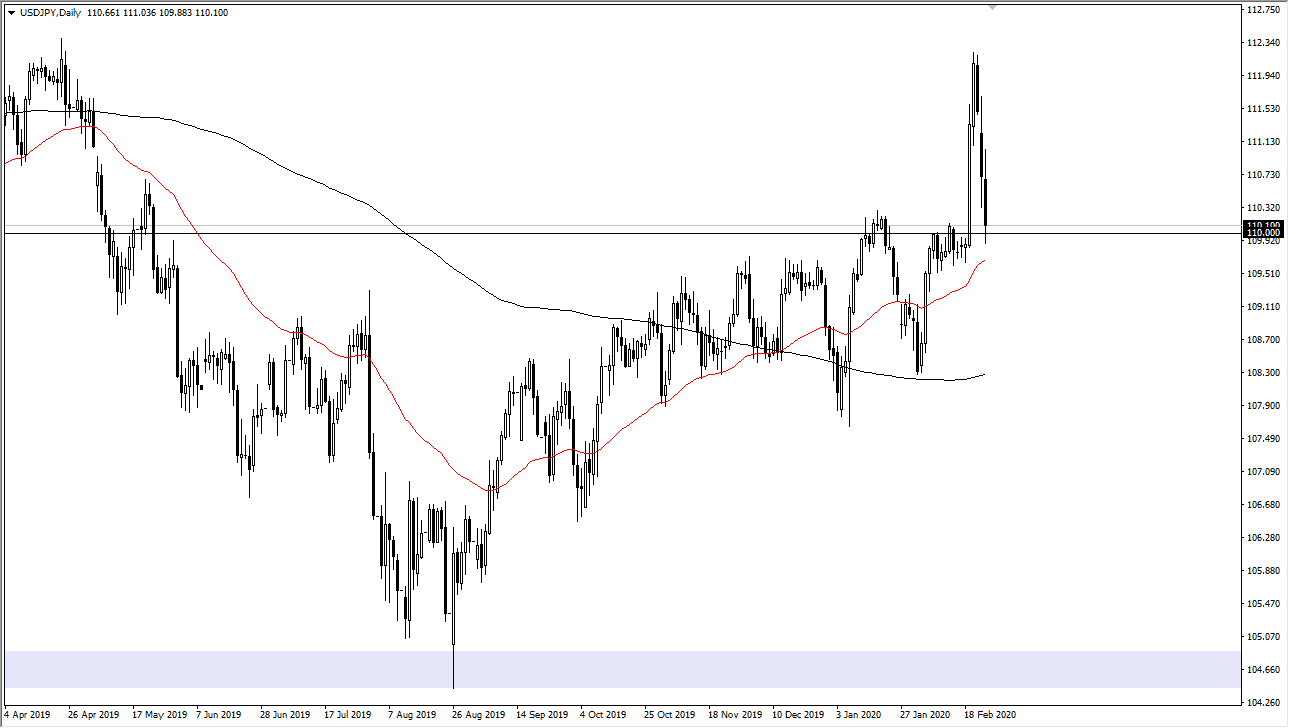

The US dollar got absolutely hammered during the trading session on Tuesday, as we continue to see a lot of trouble when it comes to the coronavirus and risk appetite. At this point in time, the US dollar has gotten crushed due to the fact that perhaps people are starting to worry about the United States suffering at the hands of the virus and of course any type of global slowdown. Furthermore, the ¥110 level of course has come into play, and that could in fact be a potential buying opportunity. If the market does in fact turn around, it’s likely that it will face a bit of noise at the ¥111 level, and then the ¥112.33 level.

I anticipate a lot of volatility, but I also recognize that the ¥110 level is the middle of a larger consolidation area that extends from the ¥115 level on the top and the ¥105 level on the bottom. In other words, it is essentially “free value”, and therefore attracts a lot of attention. That being the case, one should take a look at the area for signs of where we are going next. Ultimately, I do think that we do rally as the US dollar has attracted so much in flow. The US Treasury markets continue to attract a lot of money and this pair is highly sensitive to the differential between the United States and Japan when it comes to 10 year notes.

Beyond that, we are in an uptrend and that is something that you should be paying attention to anyway. I believe that it is only a matter of time before the market finds reasons to go long, and therefore I think that it is probably only a matter of time before we reach to higher levels. Yes, the candlestick was rather brutal but this is a market that has been extraordinarily resilient as money ways away from Asia during the coronavirus infection. All it would take is a bit of negativity coming out of Japan, which we are already starting to see as far as domestic economic numbers are concerned, and therefore the Japanese yen could get hit. Remember, the interest rate differential between the United States and Japan is relatively wide and of course the United States economy is outperforming Japan a by a country mile. Ultimately, I don’t have any interest in shorting, at least not quite yet.