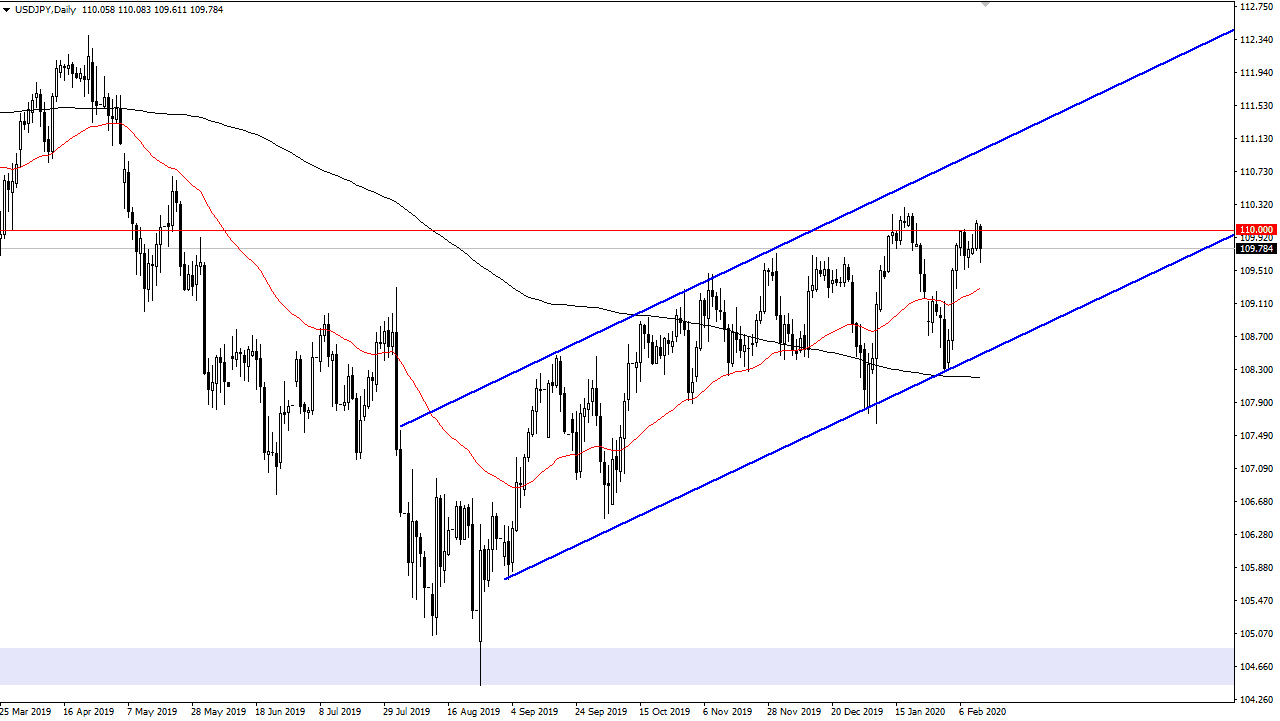

The US dollar continues to struggle against the Japanese yen at the ¥110 level, an area that has caused issues in the past. Ultimately, the market continues to look at this level as an important inflection point, and looking at the longer-term chart, it’s easy to see that the ¥110 level is essentially “fair value” is found for longer-term traders. The ¥105 level has been massive support over the longer term, just as the ¥115 level has been massive resistance. This explains why ¥110 is so difficult to get past, even though we have seen a lot of US dollar strength.

Looking at this chart, we did bounce a little bit towards the end of the day, so it tells me that the market is trying to form some type of support in this area, but I don’t see the impetus for this market to go much higher unless of course we get some type of massive “risk on” type of rally. We would need to break above to a fresh, new high to confirm that, so even just cracking the ¥110 level isn’t going to be enough.

If we do break above the recent high which is roughly ¥110.35, then the market could go looking towards the ¥111 level, but I think it will grind higher, not necessarily race higher. After all, even if we get some type of risk on type of situation, the global growth situation is still rather tenuous, and coronavirus hasn’t completely disappeared, so I think rallies at this point are probably difficult to hang onto. I think at this point the 50 day EMA would probably be support which is closer to the ¥109 level.

If we can break down below there, then it’s very likely that the uptrend line would come into play, which is the bottom of the up trending channel. Breaking below their opens up the door down to the ¥105 level and would probably kick off some type of significant break down. This would probably coincide with a massive shock to the financial system, which isn’t necessarily out of the realm of possibility these days. With this, I am aware of the levels, but recognize that the resiliency of the buyers should not be underestimated. In other words, I would not be surprised if we essentially go nowhere over the next trading session or so.