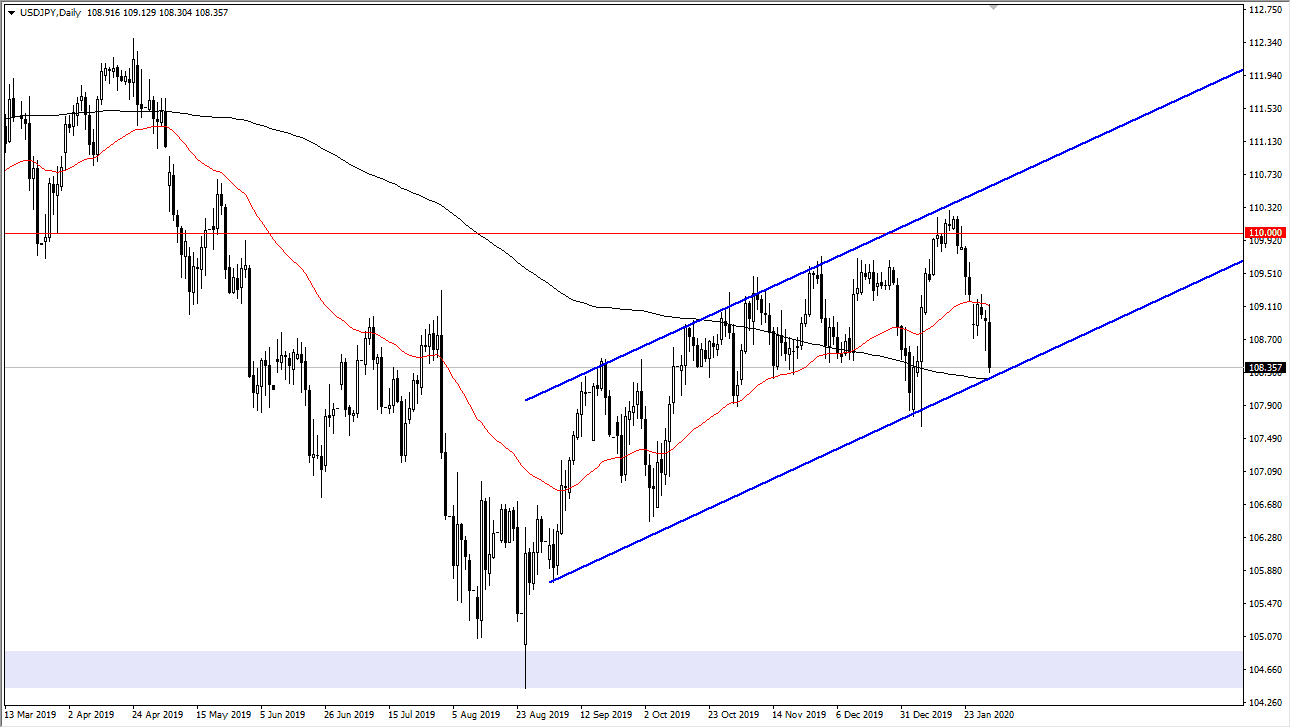

The US dollar has broken down significantly during the trading session on Friday as stock markets got hit on the way out the door. The market initially trying to break above the 50 day EMA was a good sign, but clearly, we have broken down towards the massive support level based upon not only the 200 day EMA, but also the uptrend line from the ascending channel that we have been in for some time now. That being said, this is a very negative turn of events so if we were to break down below the 200 day EMA on a daily close, then it opens up the possibility of a much lower move in the USD/JPY pair.

It should be noted that the market on the weekly chart shows a clear gap lower, and attempt to fill that gap, and then a breakdown. Because of this, there is a very negative sign and it’s likely that if we break down below the 200 day EMA, it will kick off a much more significant pullback. When you look at the weekly chart, the ¥110 level is obvious “fair value”, as it is in the middle of the range from ¥105 on the bottom to the ¥115 level on the top.

I believe that the Monday session could be crucial, because it will show you as to where the market is going to end up. At the end of the day on Monday, I will have a decision as to which direction we are going, and I do think that more than likely we will probably see some type of break down based upon what is going on. Remember, the Japanese yen is a safety currency, and people are concerned about the coronavirus right now and quite possibly some type of zombie apocalypse. Granted, that might be a narrative on how out-of-control the media is, but you can’t separate the fact that the sentiment for the market most certainly is very negative. With that, people are worried about Chinese factories closing down, which of course wears down global growth. However, if we recover it’s likely that we should see plenty of support in this region, and the market could turn around and retake the 50 day EMA. If it does that, then I believe that the market will continue to attack the “fair value area” above.