The greenback initially pulled back a bit during the trading session on Monday, but then turned around to reach towards the ¥110 level again. This is an area that has been significant resistance for some time, and of course has attracted a lot of attention. Ultimately, the market is very likely to go looking towards pullbacks as a potential buying opportunity, with the greenback being one of the strongest currencies at the moment. Keep in mind that this pair is highly sensitive to risk appetite, so that being the case it’s likely that the market will continue to pay attention to the coronavirus issues and stock markets around the world. Nonetheless, the most influential stock market for the USD/JPY pair tends to be the S&P 500, which has been attracting a lot of inflow in a bit of safety from other places like Asia and Europe.

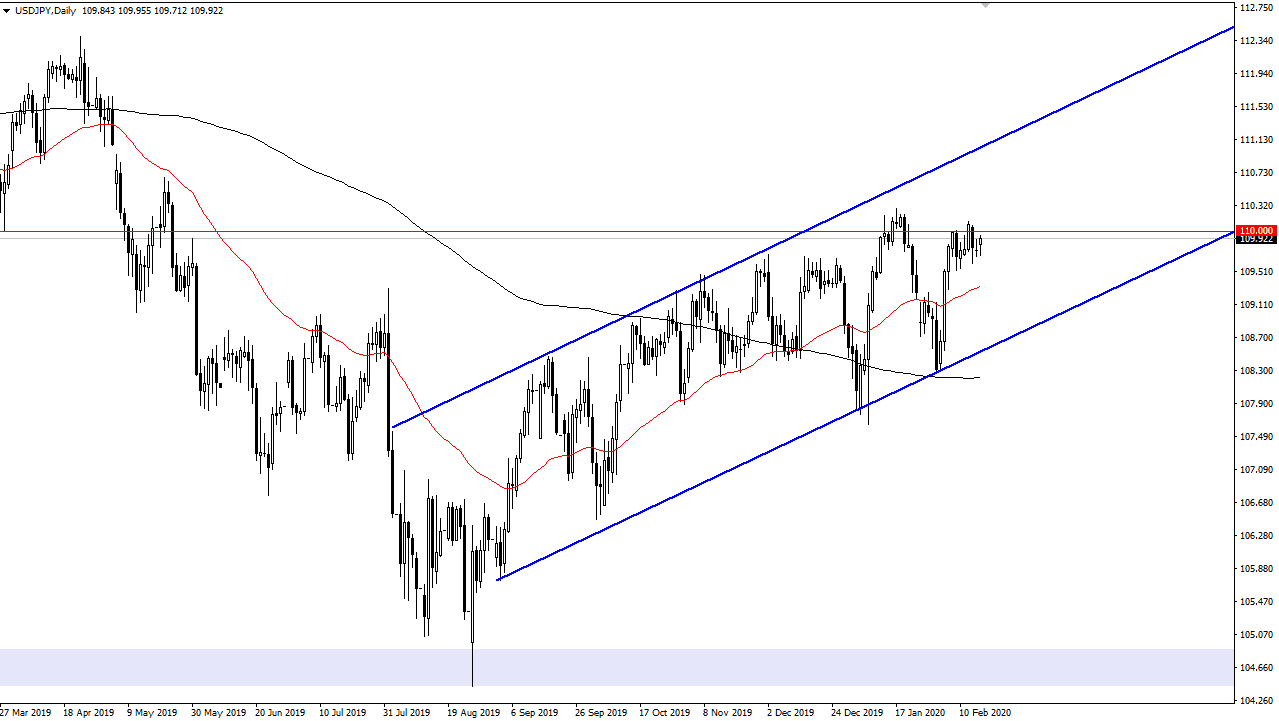

Pullbacks at this point should see plenty of support near the 50 day EMA, which is painted in red on the chart. Furthermore, there is a significant amount of support at the uptrend line, so it’s likely that area should attract a lot of pressure as well. If we were to break down below the uptrend line though, then I think the market probably drugs towards the ¥105 level. To the upside, if the market was to break to a fresh, new high, then the market probably goes looking towards the ¥111 level, followed by the ¥112.33 level.

You can see clearly that the market has been very choppy as of late and I don’t think that changes anytime soon because although the S&P 500 continues to rally, the noise coming out of China will continue to cause major issues. Another thing that makes this interesting is that the Japanese economy is on the verge of a technical recession, so that has been working against the value of the yen anyway. Ultimately, I do think that we are about to make some type of longer-term decision as the ¥110 level is essentially the middle of the overall consolidation between the ¥105 level on the bottom and the ¥115 level on the top. It makes it essentially “fair value”, and therefore markets will feel relatively comfortable in this area. However, the market forming some type of impulsive candlestick could give us a “heads up” as to the next bigger move. Being patient will be crucial trading this market.