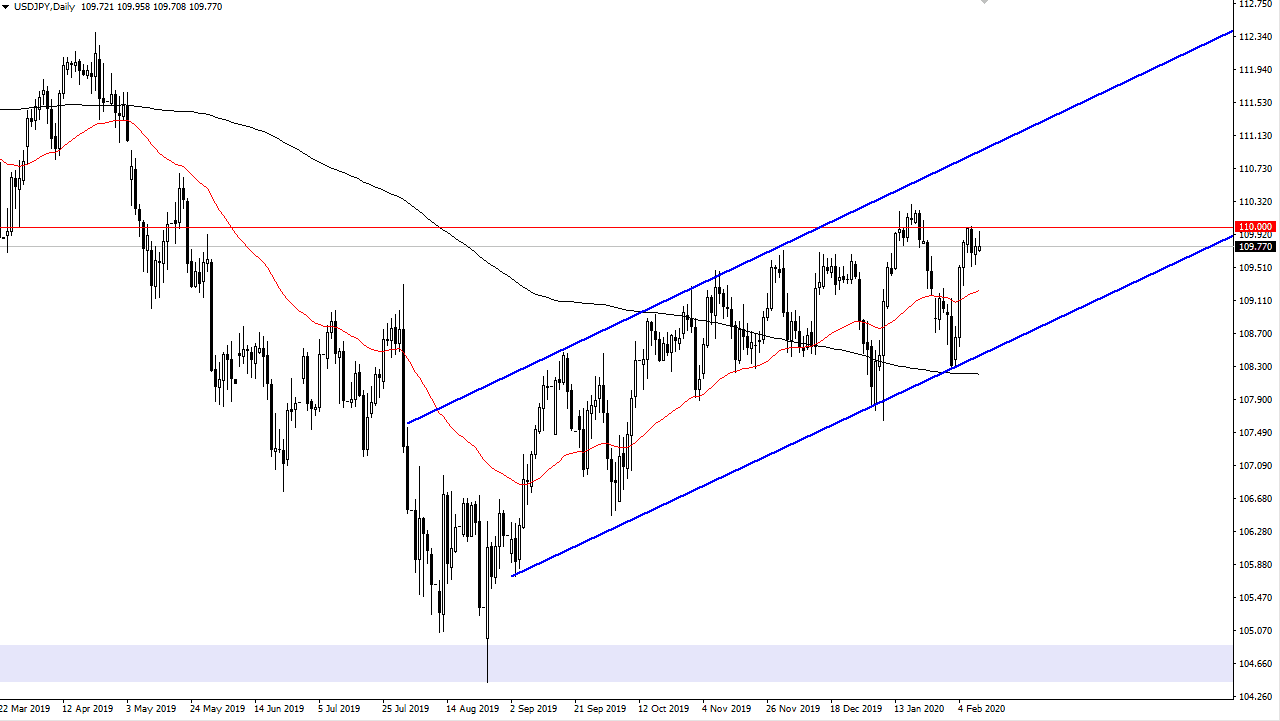

The US dollar has rallied a bit during the trading session on Tuesday, slaving into the ¥110 level, an area that has been resistance more than once. By doing so, the market looks as if it is ready to roll over, and it’s interesting to see whether or not the market will continue to show signs of strength or weakness. The ¥110 level of course is interesting, because it is the middle of the longer-term consolidation that I see on monthly charts going from ¥105 on the bottom and ¥115 on the top. In other words, it’s essentially “fair value”, meaning that both buyers and sellers seem to be okay with it being there.

Looking at the chart, the market has continued to see a lot of resistance in this area, and I think that it’s not until we break to a fresh, new high that we would be buyers and going towards the ¥111 level, and then eventually the 112.33 and level. On the other hand, if we were to rollover from here and break down below the hammer from the Monday session, then it’s likely that the 50 day EMA which is painted in red will get tested. The uptrend line of the channel of course offers a lot of support as well, so if the market was to break down below there it would change a lot of things. At that point I would anticipate a move down towards the ¥105 level based upon longer-term work. That being said though, it’s not that either one of these moves would be quick, but it is a longer-term call. At this point, this is a lot of choppiness just waiting to happen and keep in mind that this pair is highly sensitive to risk appetite in general as the Japanese yen is considered to be one of the “safest currencies” out there. Looking at this choppiness, I think that we will continue to see a lot of short-term opportunities in both directions, but at this point it looks as if the sellers are starting to step up yet again. All things being equal though, it’s probably best to look at this from more of an hourly timeframe or something like that.