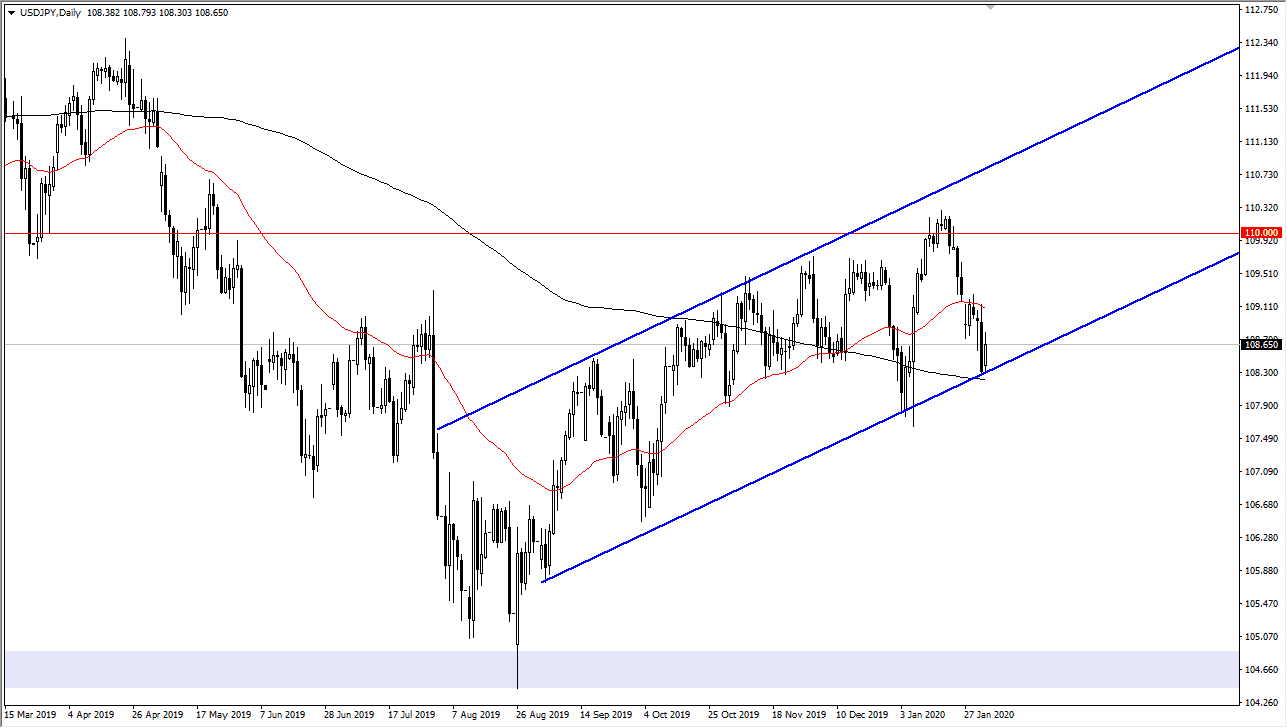

The US dollar has bounced a bit during the trading session on Monday to open up the week, using the 200 day EMA and the uptrend line to offer support. That being said, there are a lot of “risk off” variables out there that could send the markets lower. Remember, the Japanese yen does tend to be a safety currency that people will flock towards in times of concern, and at this point we certainly have plenty of reasons to be concerned.

The most obvious area to pay attention to is the coronavirus, as it will give plenty of reasons to get nervous, selling off anything that’s risk related. Furthermore, even before this entire situation started, we were starting to see signs of a global slowdown. That of course works against the value of these risk sensitive pair as like the dollar/yen, so that’s also something to pay attention to. That being said though, the technicals don’t look that bad, although we have had a significant selloff recently.

The 200 day EMA is just below, right along with the uptrend line of the up trending channel. It is because of this that the market at the very least should show some type of attempt at recovery, and I believe at this point if we can continue to bounce from here and go looking towards the 50 day EMA, we then would run into the next bit of resistance. Clearing that area could have me buying this pair, but I think that it’s only a matter of time until the ¥110 level comes into play and offer quite a bit of resistance as well.

To the downside, if the market was to break down below the ¥108 level, then it’s likely that we could have a much more significant selloff. Looking at the longer-term charts, the ¥105 level makes quite a bit of sense as a target, but this would obviously be something to do with the global situation deteriorating. That’s entirely possible at this point, so it’s not necessarily the most difficult thing to imagine at this point. I believe that this pair will continue to be very choppy overall, as the market does tend to move on headlines, something that we should have plenty of going forward as coronavirus, global growth, geopolitical tensions, and central bank easing all continue to push and pull markets back and forth. Although it’s been pretty ugly over the last couple of weeks, we are still technically within the up trending channel.