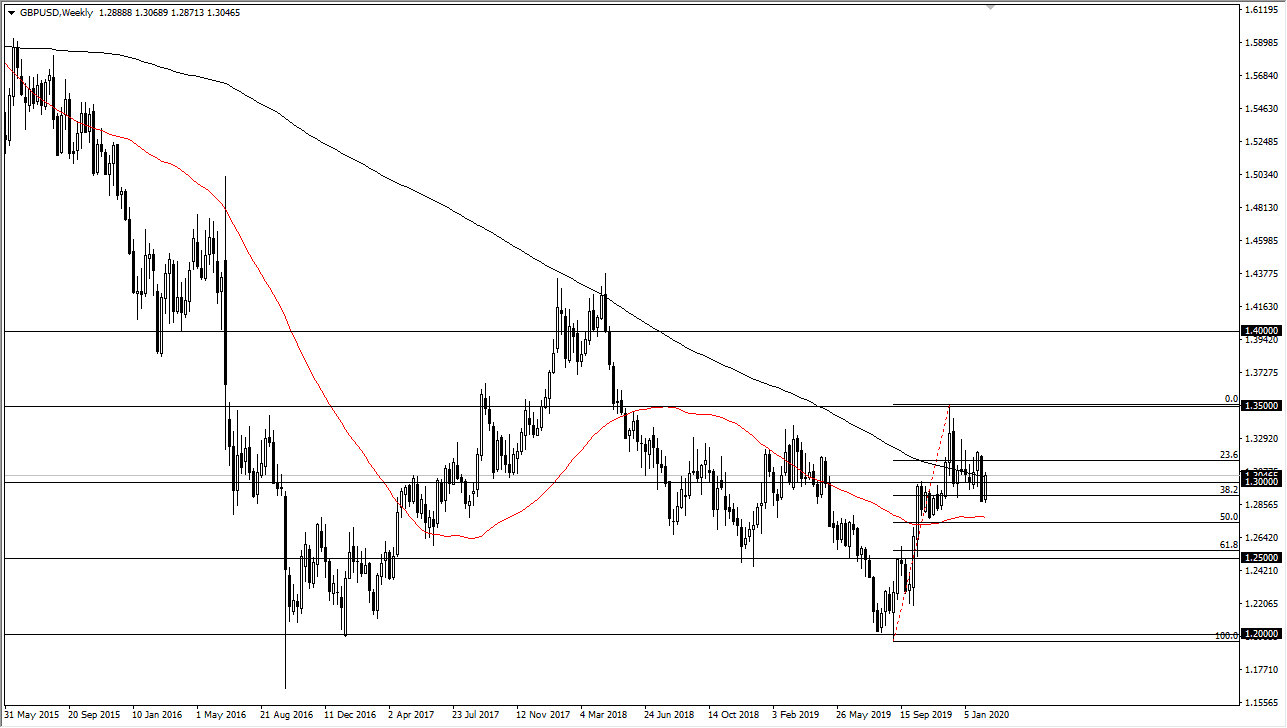

GBP/USD

The British pound has rallied during the previous week, but recently we have seen a lot of choppiness in this market and I think we are trying to form some type of floor here. Going forward, the best trade will be buying on the dips, with a special attention paid to the 1.30 level. Furthermore though, there are plenty of areas underneath that I am interested in including the 1.2875 level. I have no interest in shorting the British pound, although I also recognize that it is going to continue to be very volatile and therefore it’s crucial that you keep your position size reasonable.

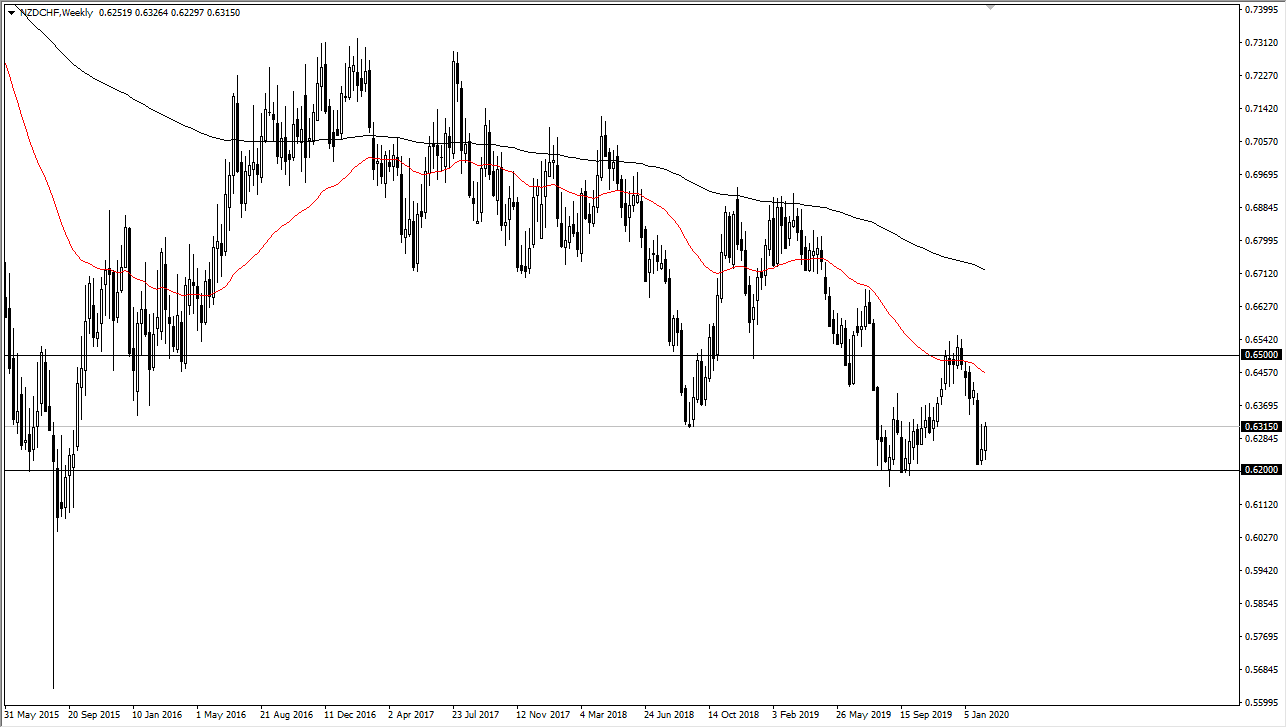

NZD/CHF

The New Zealand dollar has rallied significantly during the week, especially against the Swiss franc as it is testing a major area of resistance. If we can break above the highs of this past week, I believe that the New Zealand dollar will continue to go towards the 0.65 handle. Otherwise, I would anticipate a range bound market and I do see the 0.62 level as an area that will continue to be massive support. If we drop towards that area you may find some value in that region to start buying again, as the market has shown this area to be very important.

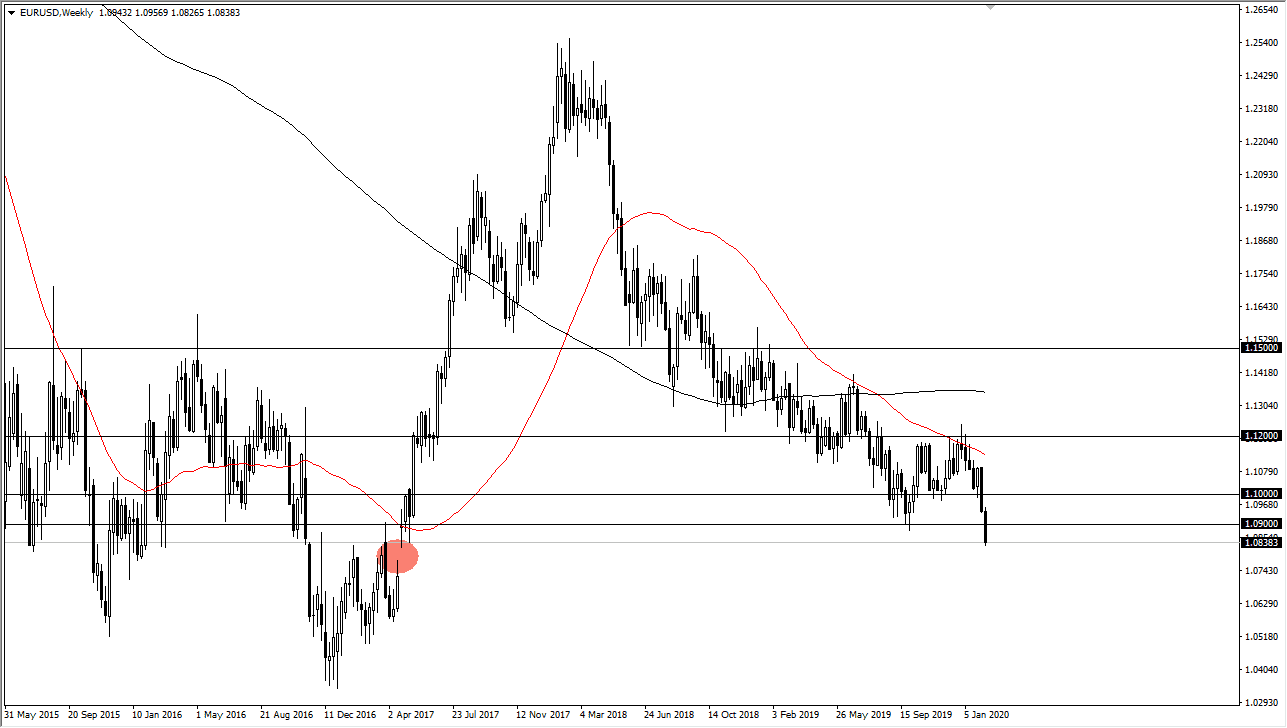

EUR/USD

The Euro never ceases to amaze me. It will do nothing for months on end and then suddenly take off. That’s what we’ve seen over the last couple of weeks, as we have sliced through the 1.09 level. As you can see on the longer-term chart, there is a gap that I have highlighted closer to the 1.0750 level, and I think that’s where we are going. Short-term rally should continue to be sold into, just as you can say over the last couple of years. Nothing has changed and it looks as if the German economy is getting worse, not better. With this, the Euro will continue to be a currency you should be selling.

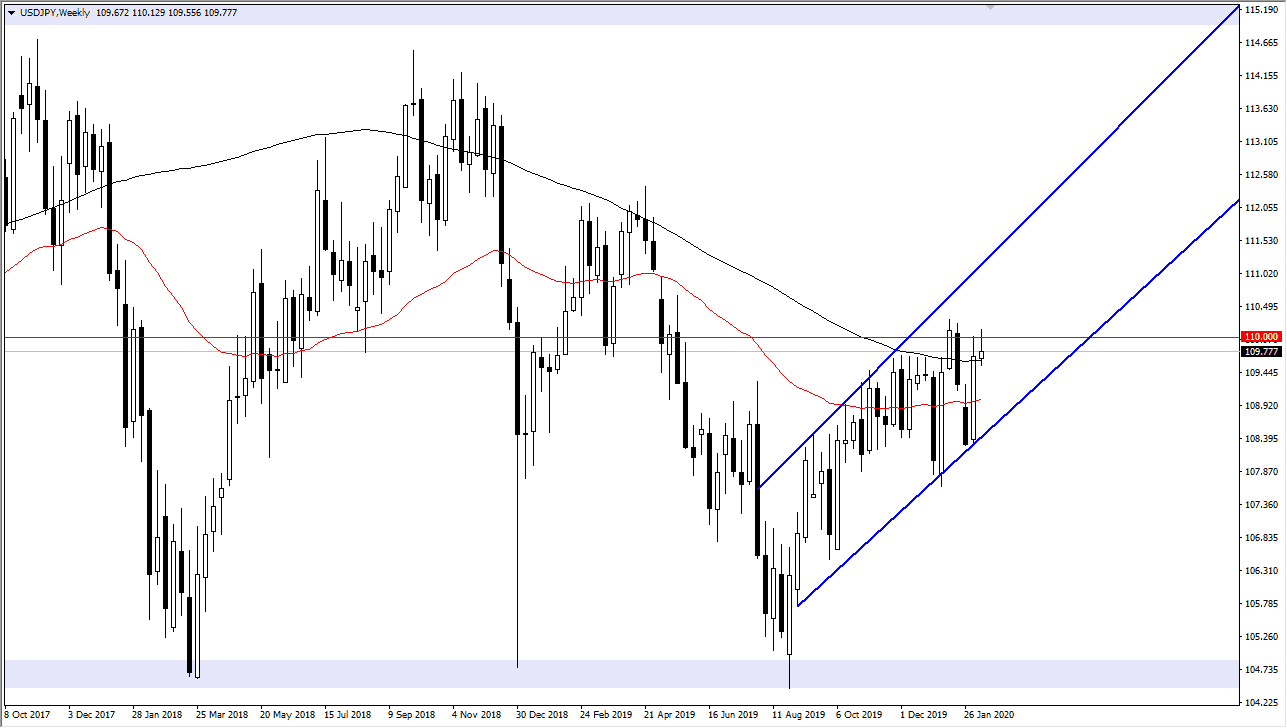

USD/JPY

The US dollar had rallied most of the week, but then gave back quite a bit of the gains. It ended up forming a shooting star and I find that interesting considering that we are sitting at the ¥110 level. That is essentially the middle of the overall consolidation range between ¥105 on the bottom and ¥115 on the top. In other words, it is “fair value.” That means that there will be a lot of noise here so I fully anticipate that this market will probably pull back this week, but I’m not looking for some type of meltdown quite yet. The alternate scenario is that we break above the ¥110.35 level, which opens up the move towards the ¥111 level.