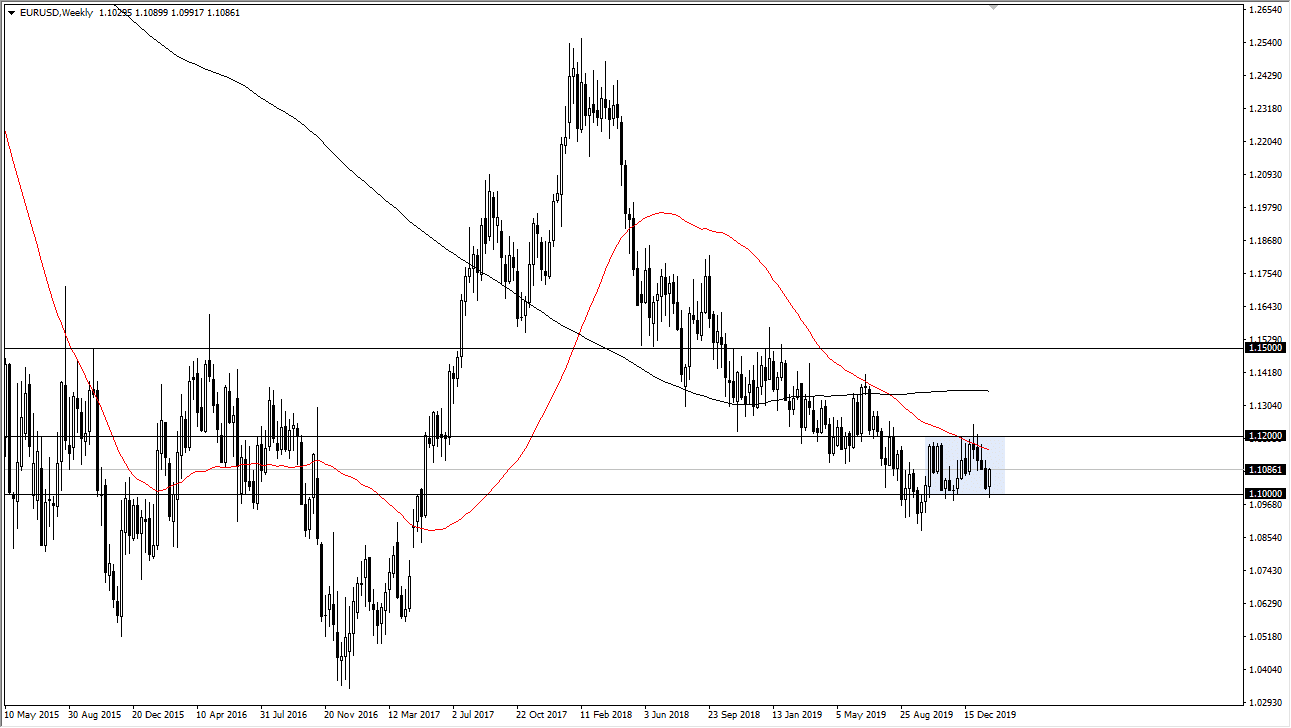

EUR/USD

The Euro has gone back and forth during the week, but quite frankly it looks as if we are going to get more of the same. The 1.10 level is massive support, just as the 1.12 level above is massive resistance. It looks as if we are ready to continue going back and forth in this area, with not much changing anytime soon. Both central banks are very dovish and therefore it’s not a huge surprise to see that we can’t make any headway in one direction or the other. I think that the next couple weeks will remain back and forth in this 200 PIP range.

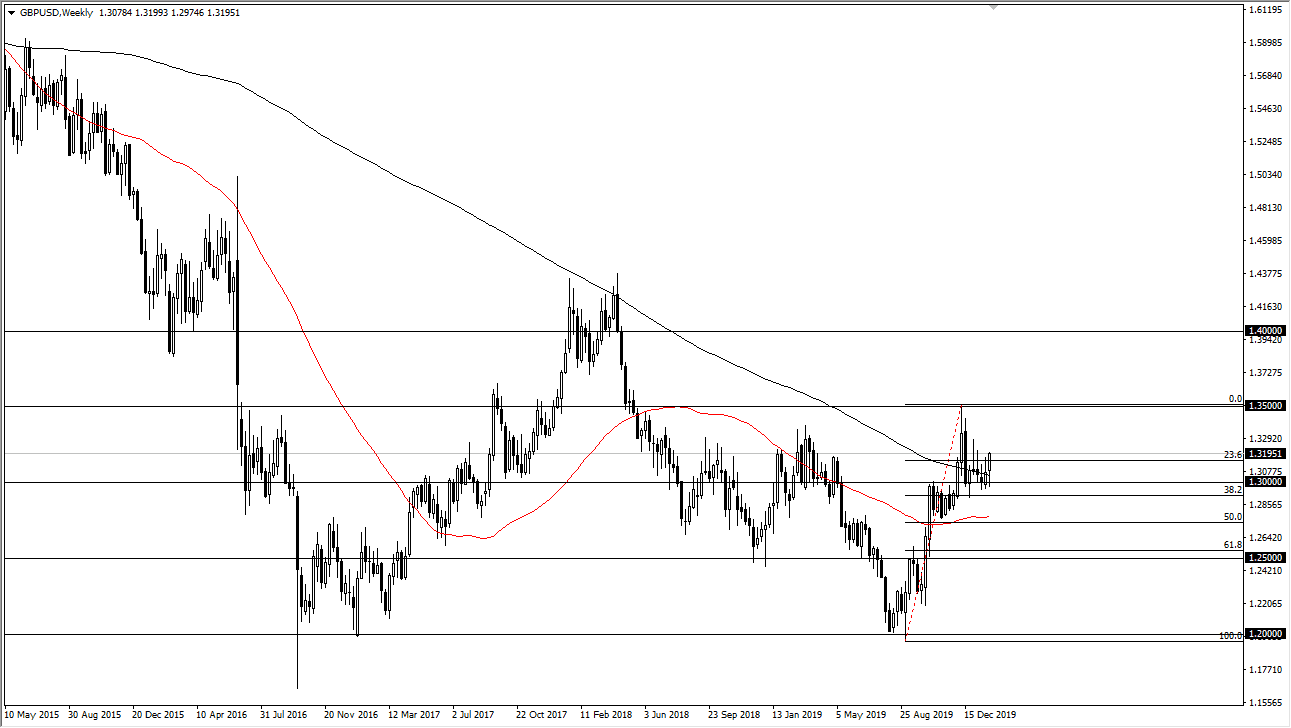

GBP/USD

The British pound had a good week, after the Bank of England chose not to cut interest rates. That being said, we still have several wicks from the previous candlestick on the weekly chart that shows just how much trouble there is above. At this point, it’s likely that the market will continue to be a “buy on the dips” type of scenario. Having said that, if the market was to break down below the 1.30 level, then a certain amount of rethink would have to come into the equation. I still like the British pound longer-term, but it’s going to be a bit of a fight higher.

AUD/USD

The Australian dollar got hammered this week, and I suspect that we are going to have further weakness ahead of us. The market breaking below the 0.67 level is the next sign that we are going to reenter the previous consolidation area that had been so important during the financial crisis. By doing so, it’s likely that the market will trade between 0.67 and 0.64 going forward. It is not until we get good news about the coronavirus that the Australian dollar looks set to recover. That being said, we are at extraordinarily low levels so a longer-term “buy-and-hold” scenario may present itself eventually.

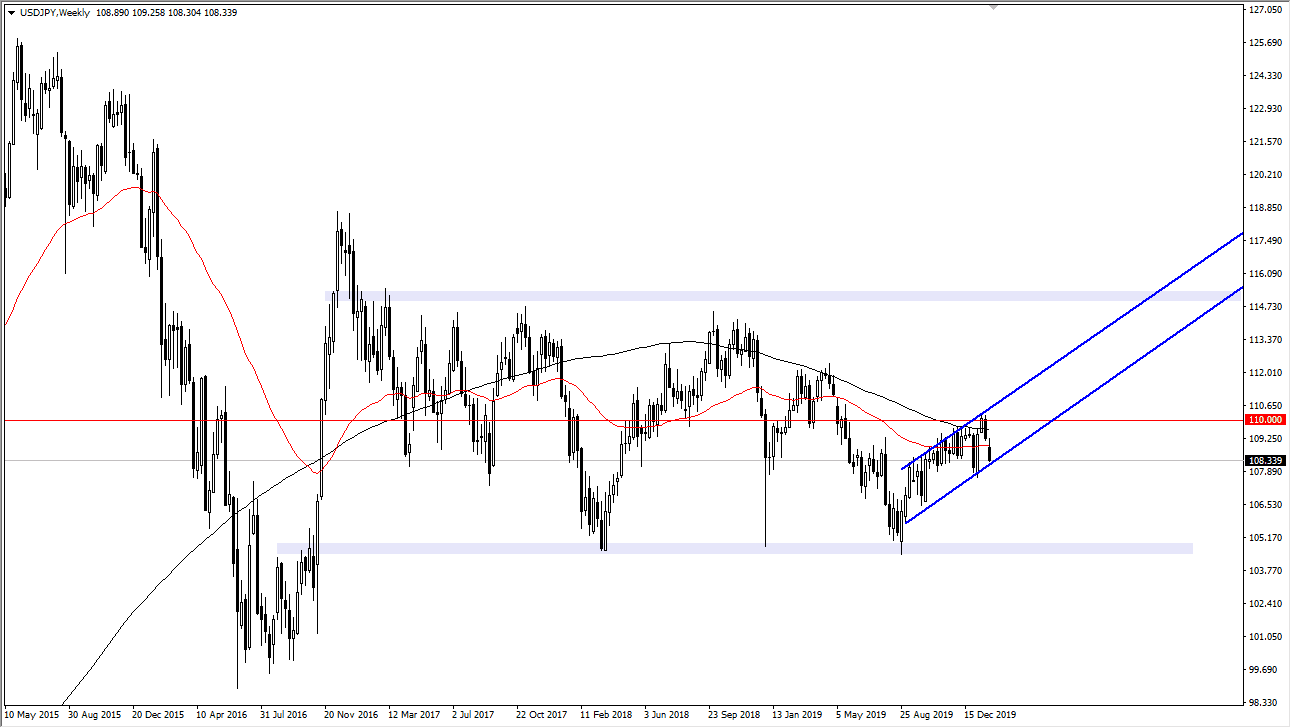

USD/JPY

The US dollar has fallen hard against the Japanese yen to reach towards the ¥108.30 level. The ¥108 level should be supportive, but if we were to break down below the uptrend line that I have marked on the chart, it could open up a move down to the 160 and level, followed by the ¥105 level. When you look at the totality of the market, we have been bouncing around between ¥105 on the bottom and ¥115 on the top with the ¥110 level being the “fair value” level. At this point, it looks like we are susceptible to a bit of a rollover, but that will of course come down to risk appetite.