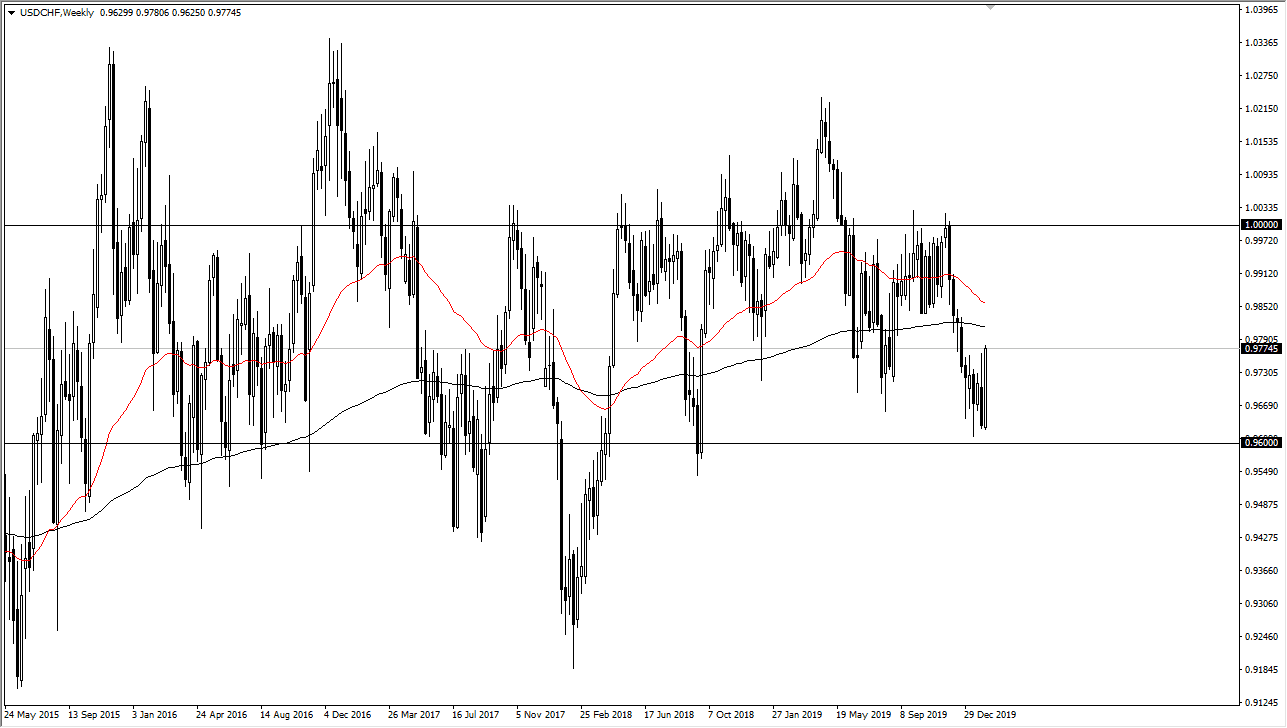

USD/CHF

The US dollar has exploded to the upside against the Swiss franc, and it now looks as if it is ready to continue going higher. It has cleared resistance from several weeks in a row, and I believe at this point if the market pulls back a bit, it should end up being a nice buying opportunity as the US dollar is favored over the Swiss franc as it is a representative of a growing economy, something Switzerland is not. Furthermore, it is also a safety currency, so it has the best of both worlds in the current environment. I believe that the market will work its way towards the parity level again, but that doesn’t mean that it’s going to be easy, short-term pullback should offer short-term buying opportunities going forward.

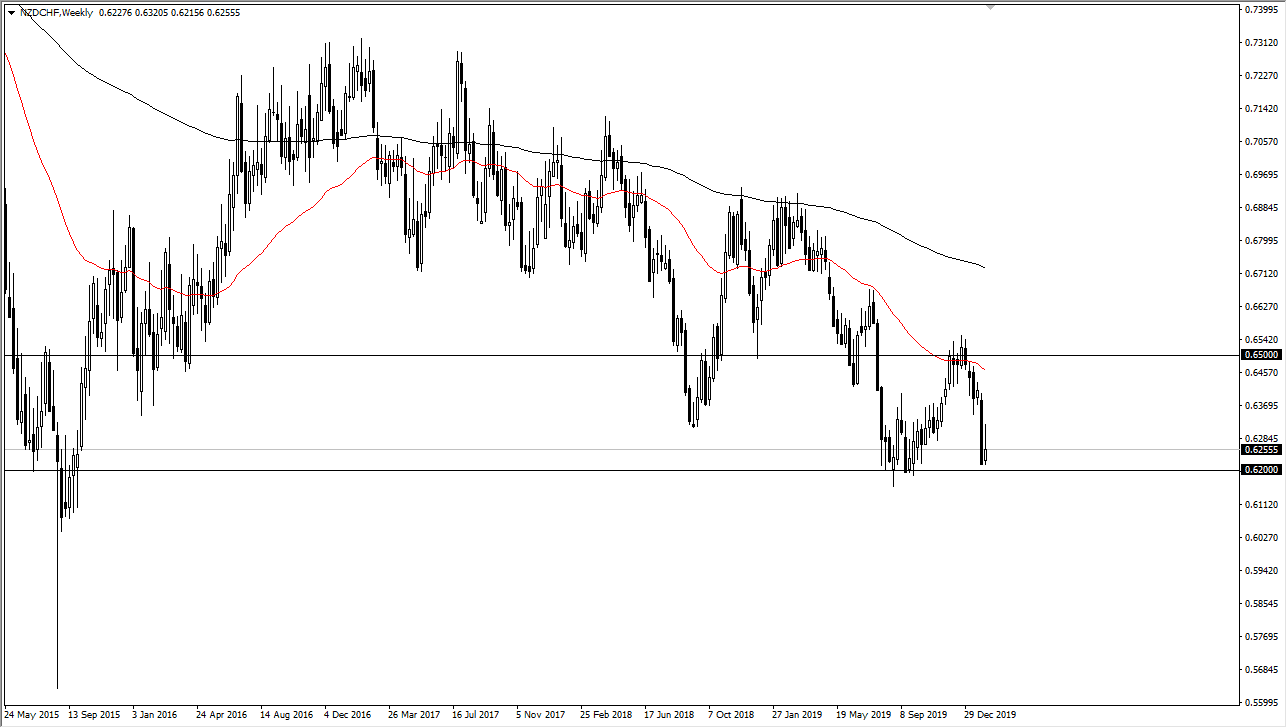

NZD/CHF

The New Zealand dollar has rallied during most of the week but gave back a significant amount of the gains. That being said, the market has formed a bit of an inverted hammer, and if the market was to break down below the 0.62 level, then it’s possible that the market breaks down towards the 0.60 level. At this point, I think rally should be sold in this market. In reference to going long the Swiss franc here in shorting it against the US dollar, you can bypass both of these pairs if you simply want to short the New Zealand dollar against the US dollar. (It’s the same thing as taking both of these trades but involves half of the risk.) However, if you wish to take one of these trades over the other, just make sure that you only take one of them.

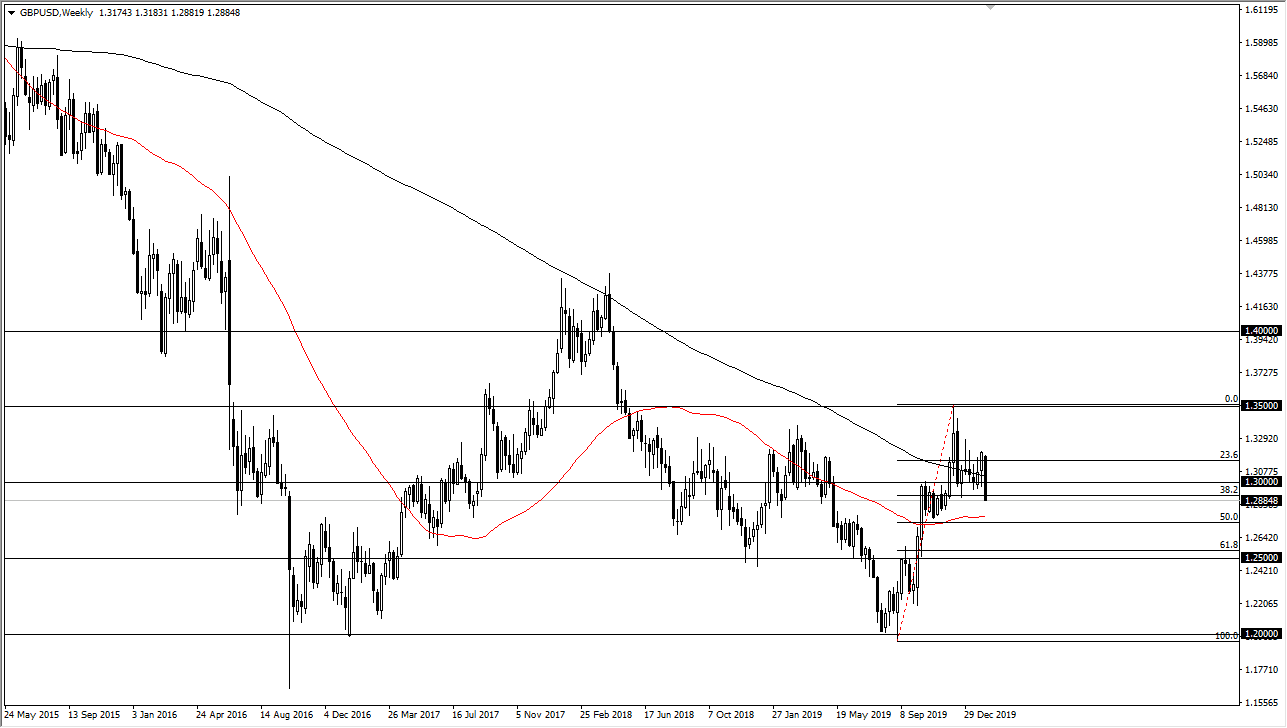

GBP/USD

The British pound has been hammered during the week against the US dollar, and it does look as if it is trying to get down towards the bottom of the bullish flag underneath. With that being the case, we are more than likely looking at a move towards 1.2750 level. As the British and the Europeans continue to bicker, it simply makes owning the US dollar little easier than the British pound. I’m not looking for any type of collapse, just simply a continuation of a little bit of negativity.

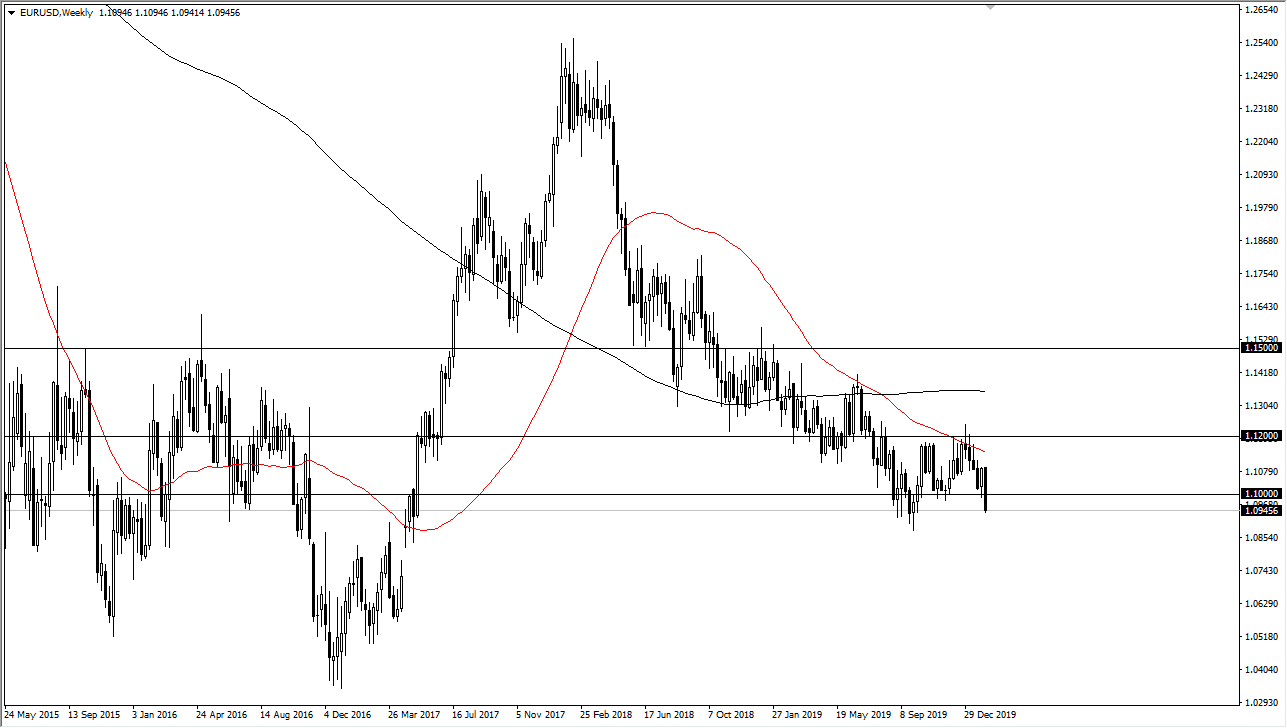

EUR/USD

The Euro broke below the 1.10 level this week, which of course is very negative. At this point, it’s very likely that short-term rally should continue to offer selling opportunities with an eye on the 1.09 level. If the market breaks down below there, it’s very likely that the 1.08 level would be targeted next. I have no interest in buying the Euro with the weak fundamentals that the EU has.