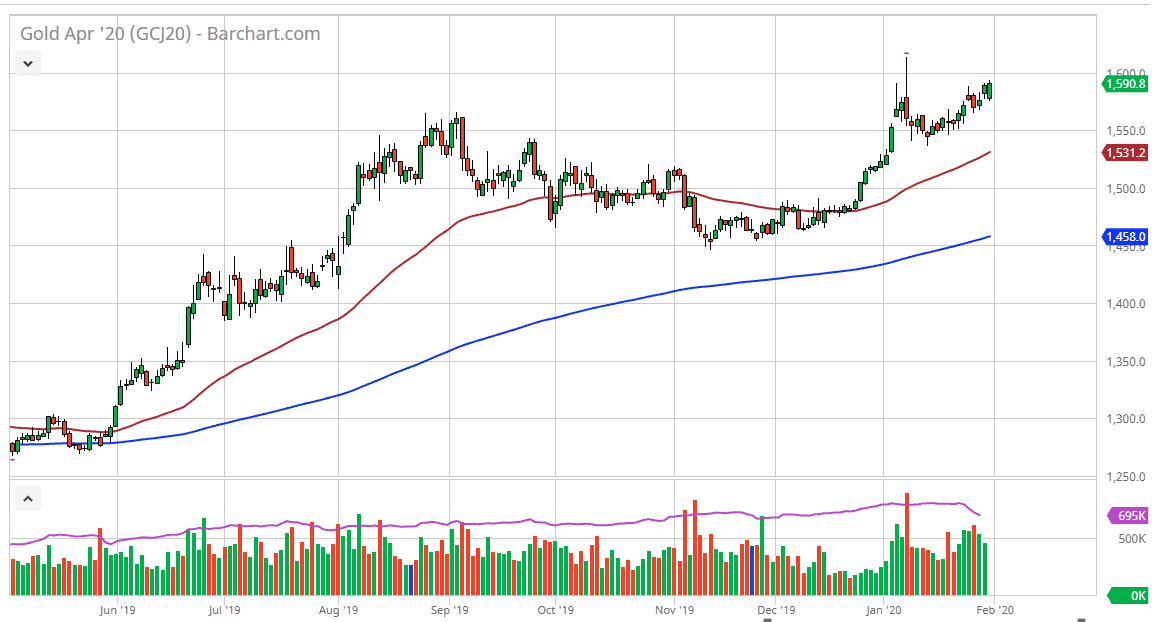

Gold markets have gapped lower to kick off the trading session on Friday, filled the gap from the Thursday session, only to turn around and go to the upside. Ultimately, this is a market that is in an uptrend anyway and it does look like it is trying to attack the $1600 barrier. That is a level that of course will attract a certain amount of attention because it is a large, round, psychologically significant figure, and an area where the sellers had returned previously. That being said, several banks around the world continue to loosen monetary policy as seen at the Federal Reserve, the European Central Bank, and the Bank of England. They all remain loose, so therefore quantitative easing, or whatever it is they are calling it this week, drives up demand for gold as fiat currencies lose their value.

All things being equal, I think there is plenty of support below and I do like the idea of buying pullbacks. The $1550 level underneath is massive support, and now that the 50 day EMA is racing towards that level, it could be very likely to see buyers in this general vicinity, and therefore value hunters taking over again. Even if we break down below the 50 day EMA I think it’s only a matter of time before the market goes down to the $1500 level. The $1500 level course is a large, round, psychologically significant figure as well, so that is also something to pay attention to as the 200 day EMA reaches towards it.

Pay attention to the US dollar as well, but don’t forget that gold and the US dollar can rise at the same time. This is especially true when it is more or less a “safety trade”, and not necessarily something to abate greenback losses. I think that not only gold can rally, but the greenback will probably rally right along with it against quite a few currencies. I anticipate that the market will continue to see a lot of back and forth, but that pullback that happens occasionally should be thought of as a buying opportunity as it offers value in the commodity that is obviously very highly demanded right now. I believe based upon longer-term analysis, the gold markets will more than likely go looking towards the $1800 level, but it may take several weeks if not months to get there.