Gold markets have rallied again during the day on Friday, showing signs of strength yet again. This is a market that continues to find buyers on dips, as there are a plethora of reasons for gold to continue going higher. For example, the central banks around the world continue to keep monetary policy extraordinarily loose, and that by its very essence will drive the value of precious metals and other hard assets higher.

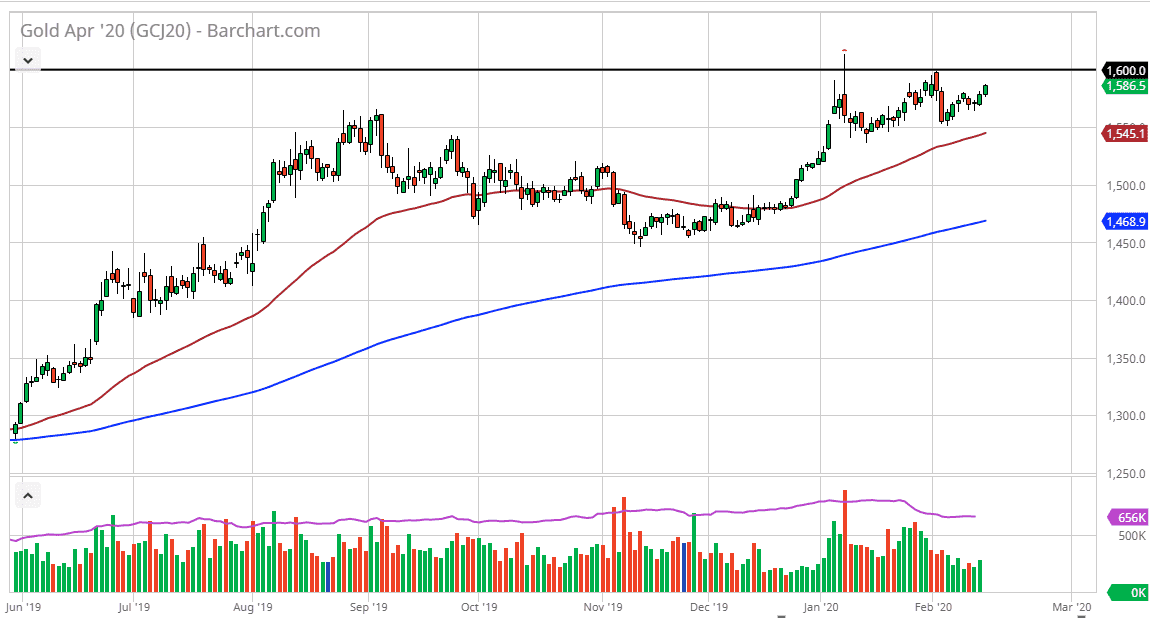

The second major feature of course is the coronavirus and people being scared that the global market is going to slow down drastically. All things being equal though, I do think that’s a transitory issue, but the central bank loosening policy is much more substantial and more of a long-term driver higher. The $1600 level above is a major resistance barrier, so having said that I think that a daily close above that level would signify more buyers coming into the market as it would be a breach of a major resistance barrier. Because of this, it will probably take several attempts to get above there, but I would also point out that there are a confluence of support levels underneath.

The 50 day EMA is starting to reach towards the $1550 level, which is an area that has offered quite a bit of support. Ultimately, even if we do break down below there, I think that the market sees even more support at the $1500 level. The $1500 level is currently attracting the 200 day EMA, so that is something to pay attention to as well. I think that this market will continue to see a lot of buyers looking for value, and as a result you should look it dips as potential buying opportunities. I have no interest in shorting this market until we break down below the $1500 level, perhaps even the $1450 level. I think that a lot of things would have to change for gold to suddenly be a market you should be selling, and I would even go further to suggest that perhaps we are in the midst of an ascending triangle which of course is a very bullish sign as well. That being the case, the market should continue to offer plenty of opportunity as the headlines will continue to throw the market back and forth, but longer-term directionality is most certainly to the upside.