Gold markets initially fell during the trading session on Friday, perhaps in reduction of risk when it comes to the futures market ahead of the Non-Farm Payroll figures, but ultimately the markets have turned around completely. This makes sense, considering that there are a lot of fears out there when it comes to the coronavirus and China, and the fact that it is really starting to drag upon the world economy.

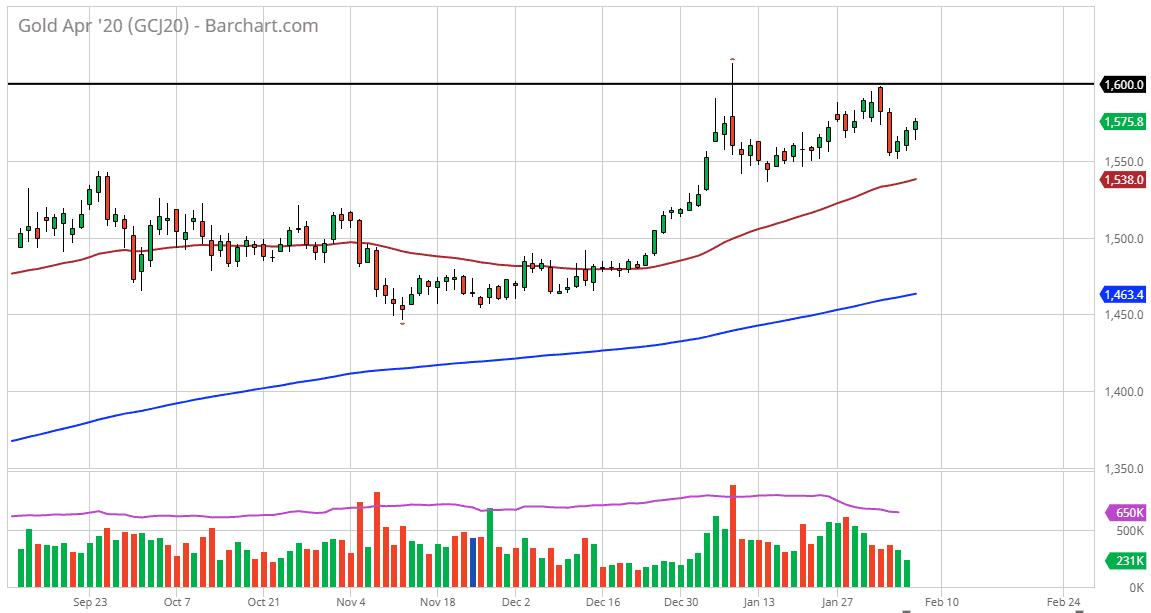

Furthermore, central banks around the world continue their loose monetary policies, and that should of course favor precious metals overall, with gold being the first place put to work by most traders. That being said, we have seen a significant pullback recently, reaching towards the $1550 level before rallying. The action on Friday was an attempt to break this market down but then turned around to show signs of extreme bullishness as well. It does in fact now look as if the market is trying to get to the $1600 level, an area that if we can break through should allow gold to go much higher longer term.

The 50 day EMA is starting to tilt higher again, reaching towards the $1550 level, an area that should offer quite a bit of support. After all, we have bounced from there couple of times so for me I believe that the $1550 level should continue to be a bit of a short-term “floor” in the market. Even if we were to break down through that level, I think that the $1500 level could also come into play. That area is an obvious large, round, psychologically significant figure, and that typically attracts quite a bit of attention. Breaking through that level could change a lot of different things but right now I don’t see that happening unless suddenly there is good news involving the coronavirus.

To the upside, I recognize that the $1600 level has been very difficult to break above, and therefore we should see a ton of resistance in that region. However, if we can get a daily close above the $1600 level, I think it opens up the door to the next leg higher, reaching towards the $1800 level. That is my longer-term target based upon longer-term charts, so that would fall right in line with my expectations. The candlestick for the Friday session was an initial selloff but did show signs of buying, forming a hammer like candlestick.