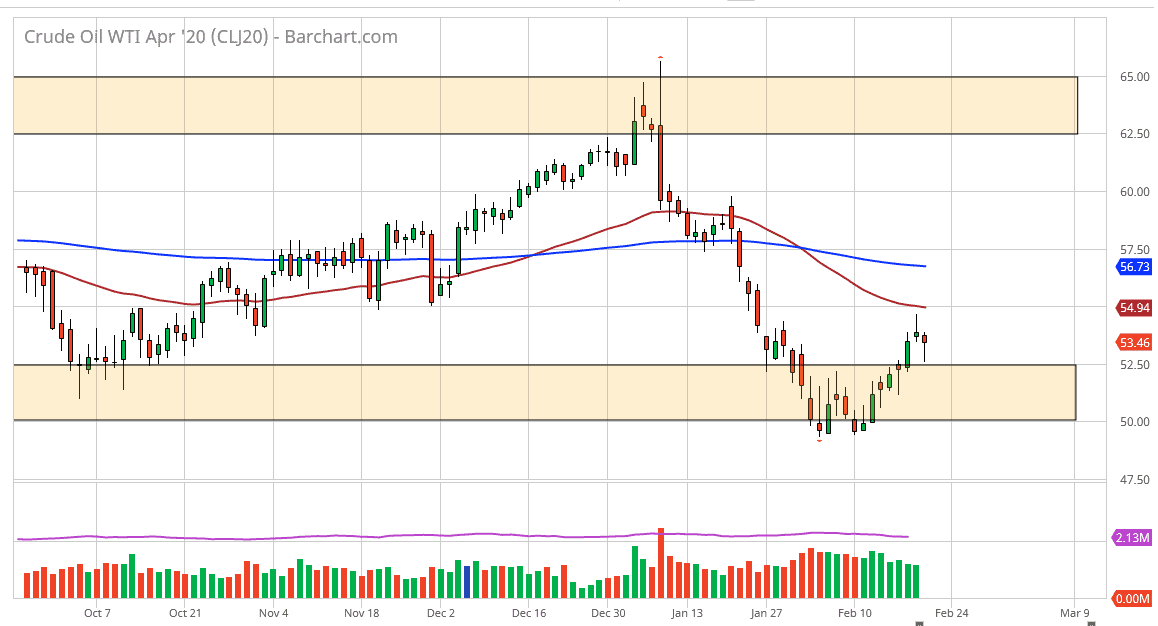

West Texas Intermediate Crude Oil markets fell initially during the trading session on Friday but found support near the $52.50 level to bounce a bit. Ultimately, this is a market that should continue to see a lot of choppiness and volatility, especially considering that the headlines out of China throw the markets around so drastically. After all, the markets look very likely to continue to try to bounce from here, but I think the shooting star that formed on Thursday shows just how difficult it’s going to be. When you get conflicting candlesticks like this, it’s quite often that you will see markets go back and forth in that area as it shows conflicting pressures.

The market has fallen rather hard over the last couple of weeks, and the recovery makes quite a bit of sense as people are starting to bank on the idea of the Chinese showing less infections, but the reality is that we still have a lot to chew through, and there are a lot of concerns about re-infections. Beyond that, the coronavirus is starting to show up outside of China, and that of course is going to do no favors for the price of crude oil and the idea of demand either. With that in mind, I believe that although it looks like we are trying to stand our ground down here, it is going to be very difficult. However, if we were to break above the $55 level is likely that the market should continue to go higher, perhaps reaching towards the $57.50 level, possibly even the $60.00 level.

If we do break down below the hammer from the trading session on Friday, then it probably shows that the market is going to go down into that $2.50 level between the $52.50 level and the $50.00 level. Ultimately, this is a market that continues to show a lot of back-and-forth, but it should be noted that as soon as the fears of coronavirus aside, it’s very likely that crude oil will rally. The market breaking down below the lows that were recently made would be a very negative sign, probably based upon an acceleration of the concerns around the world. This is a market that is highly sensitive to China as we have recently seen estimates that demand coming out of China would drop at least 20% in the short term, possibly even further if this doesn’t subside.