At this year’s World Economic Forum, Ripple announced that it is considering an initial public offering late this year. Demand for the XRP token, controlled by the Ripple Foundation, has expanded in unison with an overwhelmingly bullish start for the cryptocurrency sector as a whole. It is important to understand the difference between blockchain technology and cryptocurrencies. While the XRP/USD is listed as the third-largest cryptocurrency by market capitalization, it is a blockchain company, where an IPO makes sense. A pause in the current breakout sequence is expected to give traders a chance to re-evaluate their portfolios.

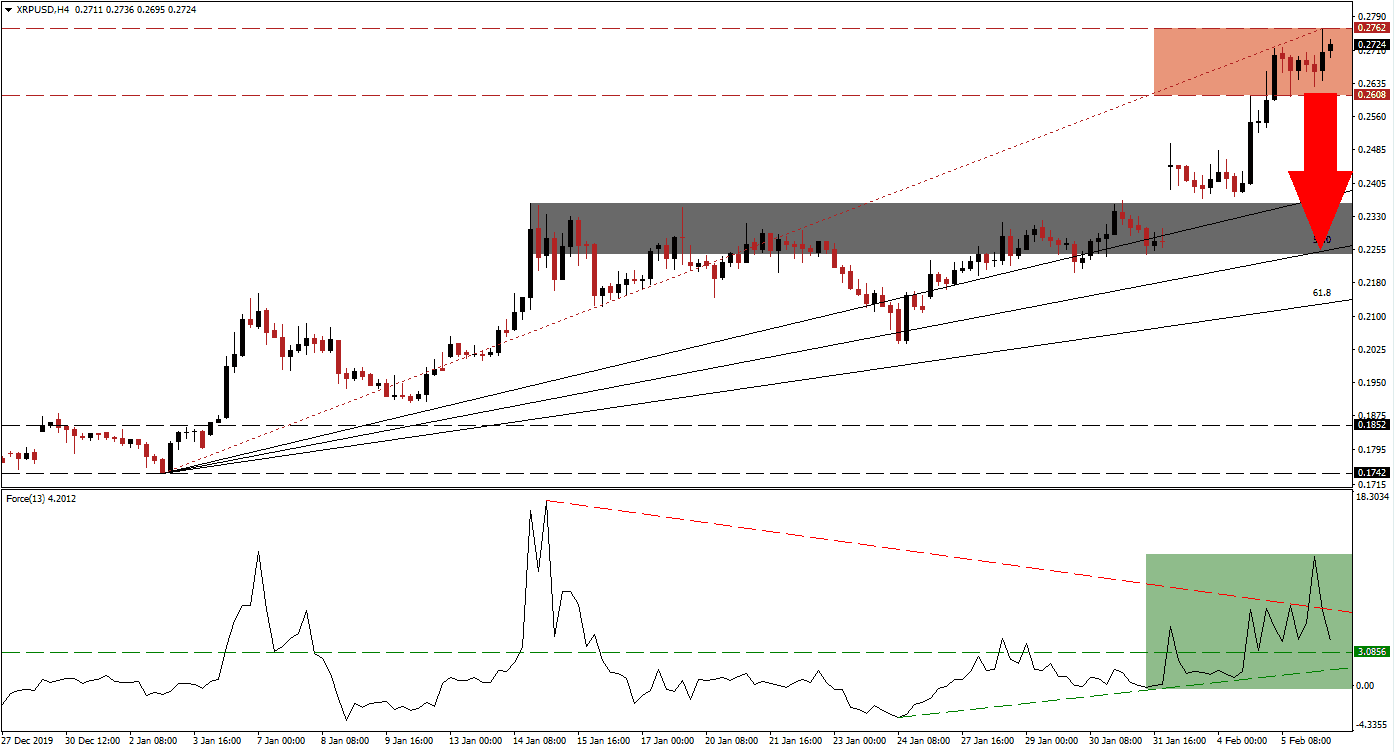

The Force Index, a next-generation technical indicator, offered an early warning that the advance in this token is vulnerable to a corrective phase. While the XRP/USD recorded a multi-month high, the Force Index reached a lower high, allowing for a negative divergence to form. A breakdown below its descending resistance level, acting as temporary support, followed. This technical indicator is now anticipated to move into negative territory, placing bears in control of price action, clearing the path for a push below its ascending support level.

With bearish momentum expanding inside of its resistance zone located between 0.2608 and 0.2762, as marked by the red rectangle, breakdown pressures are on the rise. A profit-taking sell-off is favored to follow, closing the gap between the XRP/USD and its ascending 38.2 Fibonacci Retracement Fan Support Level. The substantial advance across the cryptocurrency sector may find itself in a massive correction before the sector enters bubble territory. You can learn more about the Fibonacci Retracement Fan here.

An IPO for a blockchain company represents a natural step forward, but it goes against the nature of a cryptocurrency. 2020 is likely to see a step towards sector classification in the digital asset space, creating a clear picture of various sub-sectors that have emerged. Price action is expected to enter a corrective phase, keeping the long-term uptrend intact. The XRP/USD will face its next short-term support zone between 0.2243 and 0.2361, as marked by the grey rectangle. This includes the closure of a previous price gap to the upside.

XRP/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.2725

Take Profit @ 0.2275

Stop Loss @ 0.2825

Downside Potential: 450 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 4.50

In the event of a breakout in the Force Index above its descending resistance level followed by a higher high, the XRP/USD is likely to extend its breakout sequence without a much-needed interruption. The long-term fundamental outlook remains bullish, but technical conditions point towards a correction. A breakout will elevate price action into its next resistance zone, located between 0.2986 and 0.3085.

XRP/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.2850

Take Profit @ 0.3085

Stop Loss @ 0.2750

Upside Potential: 235 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 2.35