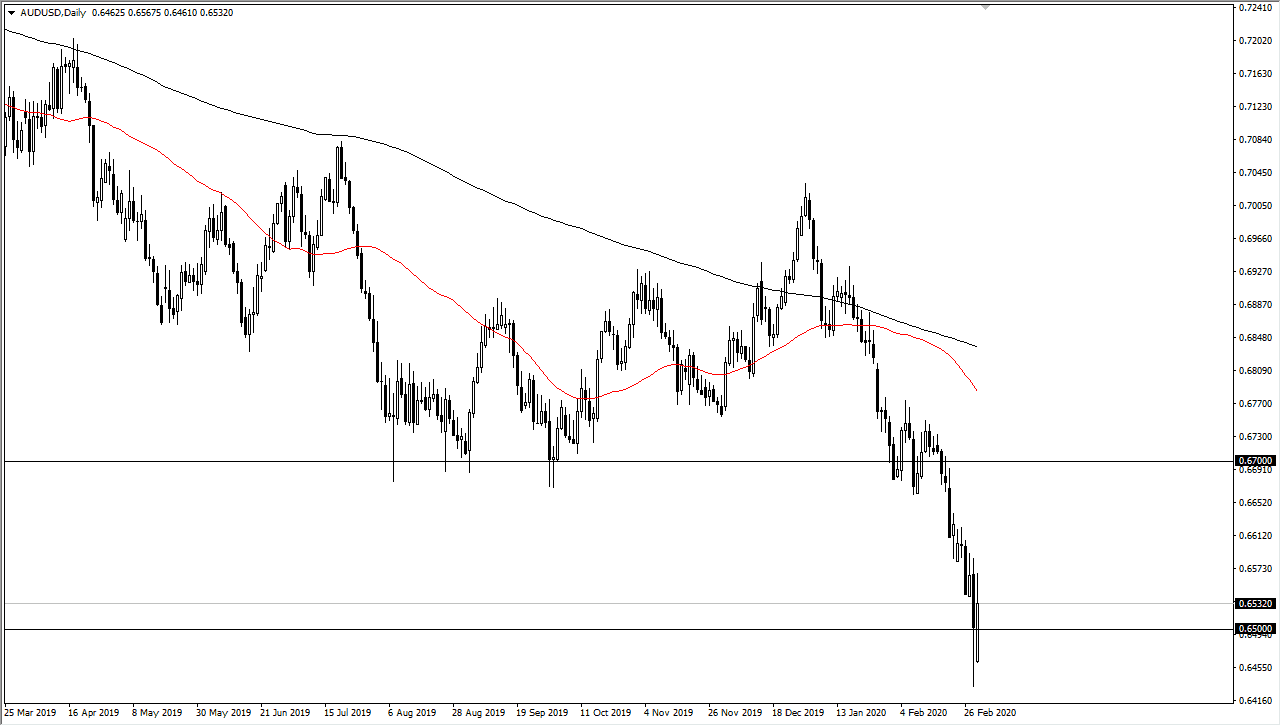

The Australian dollar has rallied a bit during the trading session on Monday after initially gapping lower. Ultimately, this is a market that was a bit oversold, so a bounce should not be a huge surprise, especially considering that the market has been hanging around the 0.65 handle. That is an area that should obviously cause a bit of a psychological bounce, mainly because these big figures always attract attention. That being said, the US dollar has also gotten hit in general, as there are a lot of people out there anticipating a 75 basis point cut. That is a stretch and I believe that it’s very unlikely that we get it. Having said that, it certainly looks is that the Federal Reserve will do something, and that should be paid attention to.

The Australians have an interest rate announcement coming out early during the trading session on Tuesday so that should be paid attention to. With this, the market will more than likely react accordingly, and it is expected that the Reserve Bank of Australia will possibly cut rates. The question now is whether or not they will be aggressive about it and whether or not the statement will be overly hawkish or dovish. With this, the next 24 hours could be rather important, so pay attention to how the US dollar acts in general. It has been sold off quite drastically, but that could change very rapidly if the market gets wind of the Federal Reserve not cutting as aggressively as people are expecting. If that’s going to be the case, it’s likely that the next couple of weeks could be very difficult, which should be obvious by now anyway. Ultimately, caution will be of the utmost necessity, but it still looks to me as if we are likely to see rally sold into. I believe that the 0.67 level will be the “ceiling” in the market given enough time, I think that the 0.63 level could be targeted, as it is the bottom of the overall consolidation from the financial crisis and therefore it makes quite a bit of sense that we could see the market test that area again. If the market was to break down below there, then it’s likely that we could go down to the 0.60 level after that. Ultimately though, if we were to turn around a break above the 0.67 handle, then we could go looking towards the 0.70 level, and then perhaps even further.