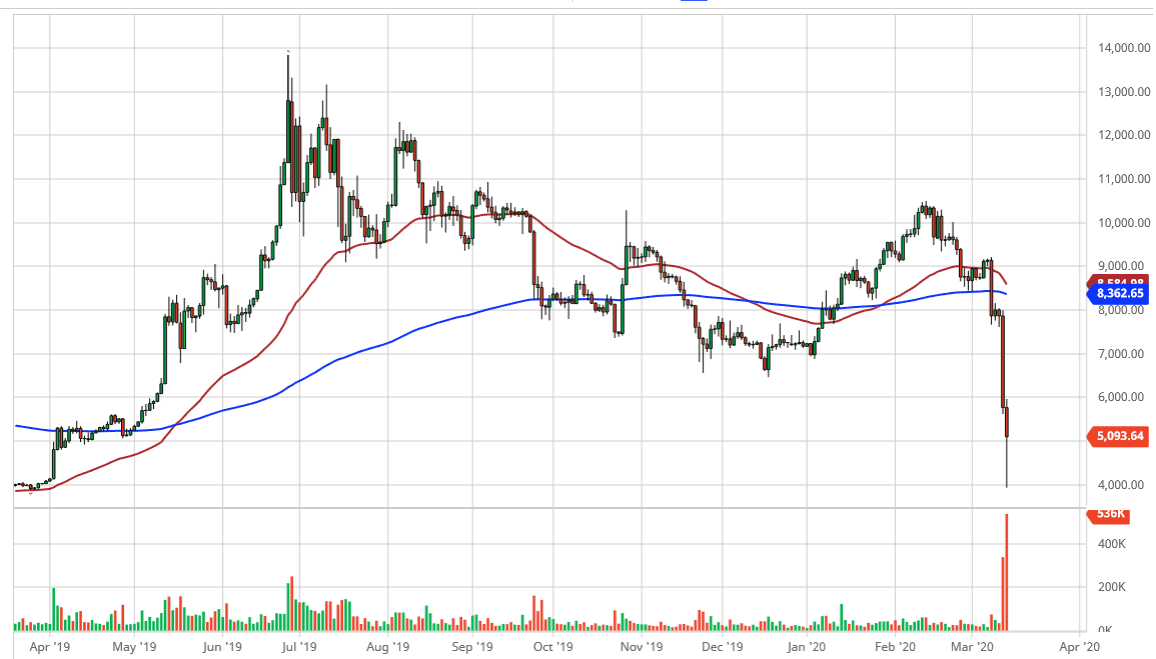

The Bitcoin market broke down significantly during the trading session on Friday, dropping another $2000 in the blink of an eye. Bitcoin has collapsed and it’s very likely that we are going to continue to see sellers come in because a lot of people that have taken this face punch are still in the market. Behavioral finance suggests that as markets rally from here, some traders will be more than willing to sell the closer they get to the entry price. In other words, the market is frightening for those who have gotten and recently, thinking that it was a “value.” That being said, the fact that we did bounce over $1000 at the end of the session is somewhat bullish, and it’s possible that the market could rally in the short term. After all, when an asset loses 50% and 48 hours, it is overdone by just about any metric.

I believe that a bounce from here could lead to the $6000 level, or perhaps even the $7000 level. That being said though, I am not going to be a buyer of Bitcoin in that scenario, but I’m looking to sell at the first signs of exhaustion above. Either one of those round figures would work in general. However, if the market was to break down below the $4000 level, he would lead to a complete collapse in the Bitcoin market.

If bitcoin cannot function is a safe haven in the environment that we have seen, that eliminates yet another reason for the idea of Bitcoin. At this point, the only reasoning for Bitcoin that I have seen work out has been getting money out of authoritarian regimes such as China or Venezuela. In that scenario, yes, Bitcoin does function quite well. However, as a financial asset it has been an absolute disaster. The argument that you almost always here is “Well, there are people out there that bought Bitcoin at $10.” That might be true, but that isn’t going to be you. Furthermore, not many people can buy something at $10, watch it rally all the way to $20,000, collapse a couple of times, and then simply hold onto it. I would be absolutely stunned if the amount of Bitcoin traders that have done that is more than 0.5% of the total market. As a retail market, Bitcoin has done an unimaginable amount of destruction to accounts. I think at this point it’s likely to see rallies faded again, so if you do feel the need to trade this asset, sell it at one of the large figures above.