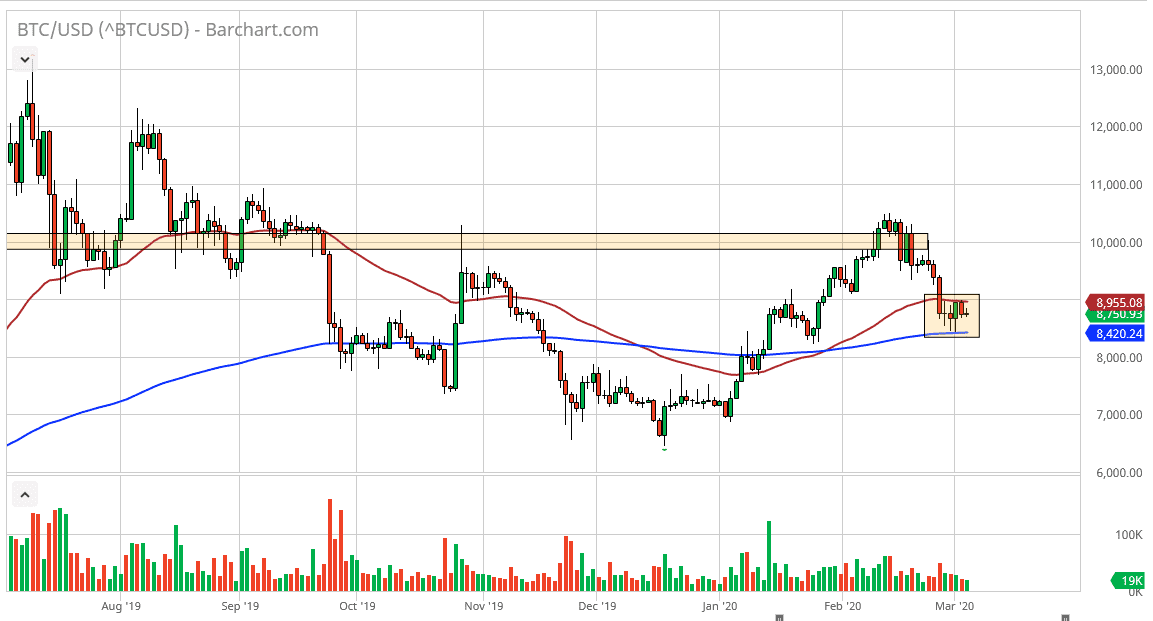

The Bitcoin market did very little during trading on Wednesday, as markets continue to consolidate after a violent thrashing in both directions from a global standpoint. The Bitcoin market is currently trading between the 200 day EMA and the 50 day EMA on the daily chart, which suggests that there are lot of pressures in both directions, a bit of an analogy to the global markets in general. There have been a lot of disruptions out there, not the least of course is the coronavirus. Keep in mind that Bitcoin received a nice bounce due to money flowing out of China, which seems to have calmed down. Nonetheless, the technical analysis still suggest that there is a chance for Bitcoin to continue the upward movement.

After all, we had reached well above the $10,000 level before pulling back. That was a significant move and moves like that don’t happen in a vacuum. It does make sense that a lot of traders out there are looking to get involved after seeing that, and Bitcoin is without a doubt one of those market that attracts the most traders went something like that happens. With this in mind, a break above the $9000 level would signal that the market is ready to go much higher.

Hourly chart suggests more basing

Looking at the hourly chart, the 200 EMA is offering a little bit of dynamic resistance but quite frankly I think that is neither here nor there, as the market participants continue to see a lot of noise in global markets overall, which of course has its effect over here for at least a psychological move. The $9000 level looks to be significant resistance based upon the most prominent peaks of the sideways action that we are seeing, so this point I do think it is only a matter of time before traders have to make some type of decision and I anticipate that this could end up being a bit of a “inverted head and shoulders pattern” which is rather bullish. To the downside, if the market gives up the $8400 level, that would of course be negative, and it certainly not impossible but with the Federal Reserve cutting interest rates it boosts the idea of Bitcoin being no way to get away from fiat currency which should continue to lose value in general. A simple matter of patience or building up a position slowly is probably the best way to trade currently.