Bitcoin went back and forth during the trading session again on Tuesday as Bitcoin traders simply have no idea what to do with the global economic situation. This makes quite a bit of sense because other markets are seeing the same thing, mass confusion as coronavirus continues to rip through various nations. Bitcoin is not immune from external forces, despite the fact that most Bitcoin traders like to think that they don’t trade with the rest of the world. The reality is that the US dollar has a massive influence on this market due to the fact that it is the “anti-fiat market” and of course the quote currency is the greenback.

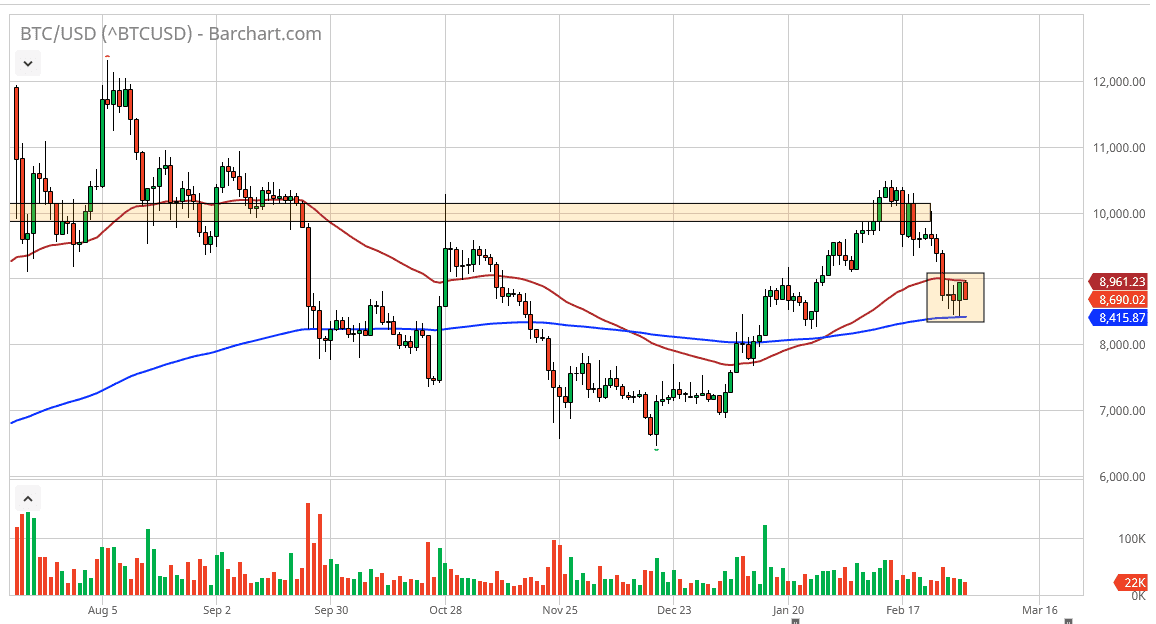

Currently, Bitcoin is just above the 200 day EMA and it looks as if it is going to continue to see a bit of support in this area, just as it is starting to see resistance at the 50 day EMA. The one thing that Bitcoin seems to pay quite a bit of attention to is the technical aspect of the charts. At this point, Bitcoin is still heavily influenced by retail traders, which seem to be more drawn towards technical analysis. The reality is that Bitcoin is being used for a multitude of reasons, and depending on the week, you may read that it is “digital gold”, or the next week it could be a “store of value.” After that, you may hear something to the effect of it is a way to get away from fiat currencies, and then perhaps even a way to send money across borders from places such as China.

Ultimately, this is a market that is starting to bounce back and forth in this general vicinity, and therefore if we do see this market break out or break down with a significant impulsive candle, that could be thought of as a signal to buy or sell, as the market continues to move on the latest headlines. The May halving is considered to be the next major driver of Bitcoin, but the reality is that scarcity doesn’t really matter when we are talking digits. The market at this point does look as if it has a lot of support, so as long as the states above the 50 day EMA I am more inclined to think that we break higher, but I would wait until we break out of this little box in order to put any money to work. To the upside, the market is likely to go looking towards the $9500 level, while a breakdown below the 200 day EMA opens up a move to the $8000 level.