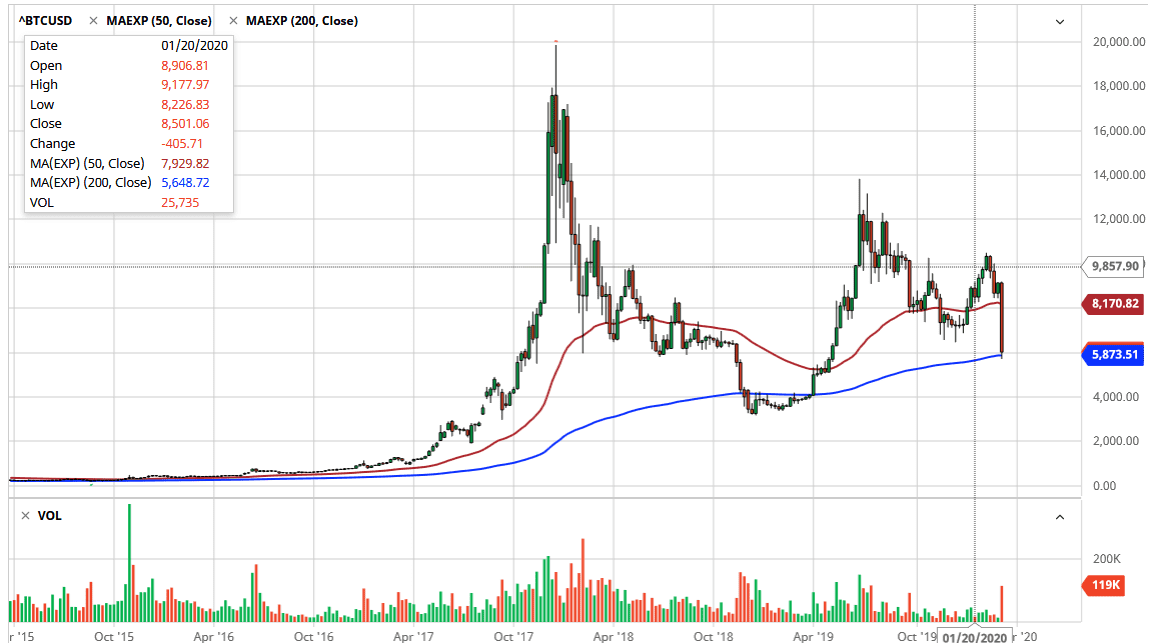

Bitcoin markets got absolutely slaughtered during the trading session on Thursday, basically falling as soon as the day started. As I recorded the video, we were basically 25% down, testing the 200 week EMA. The market breaking below the $6000 level is rather important, and even though we have held as I record this, it’s very unlikely that we hold for much longer. The fact that the $6000 level might had held the market would be somewhat impressive if we hadn’t slice through several other big figures on the way there in the same session. This is simple exhaustion as far as selling is concerned.

Bitcoin got a big boost from people trying to get money out of China before the coronavirus got out of control, and of course the idea of the halving in May. However, the market has clearly dislocated from that concept, because quite frankly everything is selling at the moment. However, Bitcoin is much more vulnerable to these major downdrafts, because it is a much thinner market. Furthermore, one thing that should be noted is that the volume is roughly 6 times what it had been, so this is a selling position with a bit of conviction. Don’t get me wrong, I think that we are going to continue to see selling pressure, but it obviously will be less brutal than it has been during Thursday’s session. Having said that, don’t be surprised at all to see some type of relief rally but I believe that people will be looking to fade this rally, even those who hold Bitcoin because they will want to mitigate some of their losses.

On the other hand, if we did break down below the candlestick for the trading session on Thursday, this opens up the door to the $5000 level rather quickly. A break down below there opens up the door to the $4000 level. At this point, I think it’s becoming more and more obvious that institutional money will probably leave this market again, and we may get a repeat of what we had seen early last year when only the diehards were interested. In a scenario where Bitcoin lost money while the US dollar lost value, and then fell even harder as the US dollar gained, this shows that there is no real hope for Bitcoin to rally from a longer-term standpoint.